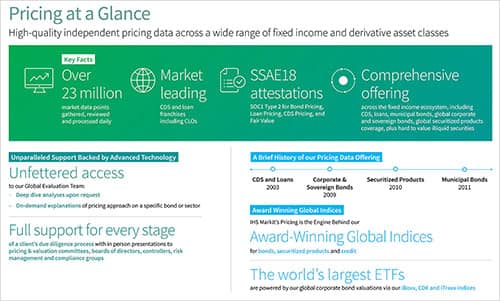

Formulate your trading and investment positions with high-quality, independent pricing data.

Optimize trades, make more informed investment decisions and mitigate risk with our next-generation pricing and reference data services. Get high-quality, independent pricing data that spans a wide range of fixed income and derivative asset classes, including market-leading credit default swaps (CDS) and loan franchises, plus CLOs and bonds in the municipal, corporate and global securitized sectors, including coverage of hard to value illiquid securities. Our sophisticated technology engine powers our data services. We built our innovative tools with an emphasis on transparent methodology and flexible delivery, alongside a team of leading fixed income experts who deliver unique cross-asset insight. Our offering includes detailed liquidity metrics and transparent information about pricing sources and methodologies, with flexible delivery options tailored to your needs. Download Sector Curve factsheet