Streamlining Section 871(m) Compliance

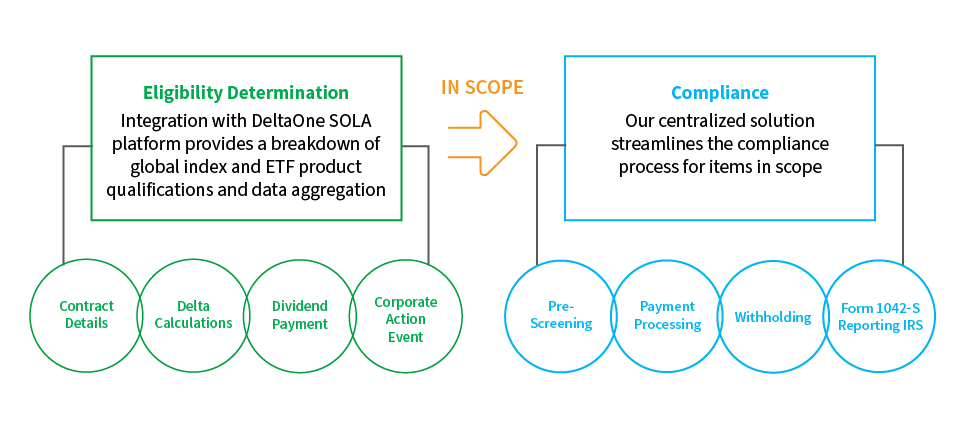

The IRS issued regulation Section 871(m) out of a concern that non-US investors were using US equity derivatives and other linked instruments to avoid US withholding tax on dividends. Section 871(m) re-characterizes some of these payments so they are treated as a US “dividend equivalent amount” (DEA) and are subjected to a withholding tax. Financial institutions trading or servicing these transactions face the challenge of creating new systems and processes to monitor which products fall within the scope of the regulations, and implement withholding and reporting where necessary. S&P Global can help by determining when an equity derivative is in scope/subject to Section 871(m) and calculate the dividend equivalent amounts. Unlike any other service providers, our solution also drills down to the specific US compositions of an Index or ETF and calculates the appropriate DEA through integrating with our DeltaOne SOLA platform. Additionally, by integrating with our Portfolio Valuations solution at S&P Global, clients can directly access our Section 871(m) outputs creating streamlined functionality. Clients will not need to build any additional API feeds, as Tax Solutions will receive transaction data and pull 871(m) results directly from Portfolio Valuations. If you are holding Qualified Derivatives Dealer (QDD) status and looking to identify withholding tax requirements or screen the population of indices and ETFs in the marketplace to identify those lacking QDD status, we can help. Our full service 871(m) offering can cover all your needs from eligibility through compliance: Download Tax Solutions: Section 871 (m) factsheet