Measure and manage best execution

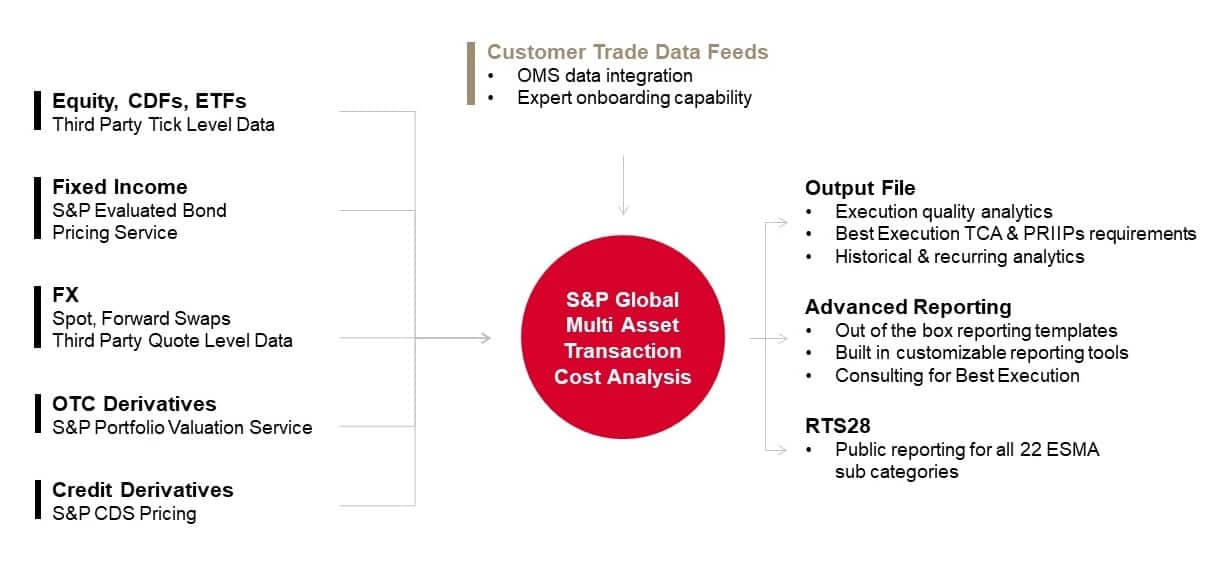

Our multi asset Transaction Cost Analysis (TCA) tool combines your bespoke trade data with our industry leading market data sets to produce the best-in-class TCA metrics, benchmarks and reporting. This solution provides three essential benefits to buy side and sell side firms: Evolving market practices and global regulations such as MiFID II have increased scrutiny over best execution practice. As the concept of best execution has developed from the best available price at a point in time to a more holistic view of the investment process, the need to measure and manage increasingly complex trades and execution processes has grown significantly. For buy-side firms, this advanced trading analysis solution provides the key trading intelligence for verifying execution quality across a range of benchmarks, from “high touch” to direct market access. For sell-side firms, our sophisticated evaluation analytics for algorithms and smart order routers provide for the next generation of execution quality reporting and deliver trading intelligence valued by trading desks.