Increase your efficiency in responding to due diligence questionnaires

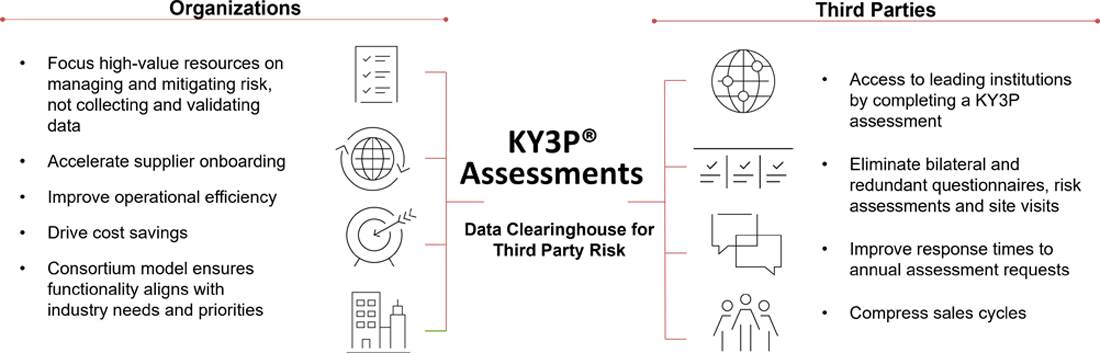

Effectively managing operational risk is now a mission-critical area in financial services. Regulatory pressures require firms to proactively manage suppliers, leading to an increase in due diligence questionnaires (DDQ). This creates an increased burden on you and your firm to respond to these requests and share information in a timely manner. Multiple DDQs and the lack of standardization collecting and distributing the data can lead to duplicated efforts, costly errors and delayed responses. Our KY3P® for Third Parties services enable you to respond to due diligence requests from your entire client base. Driven by insights from diverse banks, customers, and S&P Global cross-industry experience, the KY3P blended framework consists of control objectives critical to business. We offer three different use cases depending on your need. Download KY3P® Risk Assessment Overview for Third PartiesVariety of Use Cases to Suit Your Needs

Respond to requests for attestations made through KY3P. Our extensive database makes the process extremely efficient.

Proactively share responses when any customer requests this information.

For clients that require more than self-attestation responses, we partner with industry leading consultants to develop a detailed independent risk assessment that can be shared with your customers.