Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 01, 2015

Japanese credit diverges from Asia

Government stimulus has benefited corporate credit in Japan while US dollar strength has weighed on its regional peers.

- Japan's 5-yr CDS spread has halved since the start of the year

- Basis between iTraxx Japan and iTraxx Asia Ex-Japan is at 52 week high of 53bps

- US dollar indebted Chinese corporates such as Evergrande face headwinds

Two years into Japan's historic "Abenomics" stimulus programme, the country continues its aggressive monetary easing as seeks to reinvigorate the economy and stave off deflation.

The policies have helped the stock market return around 10% this year. Investors have been taking advantage of this accelerating growth as Japanese exposed ETFs' inflows have totalled $8.2bn in the last month alone.

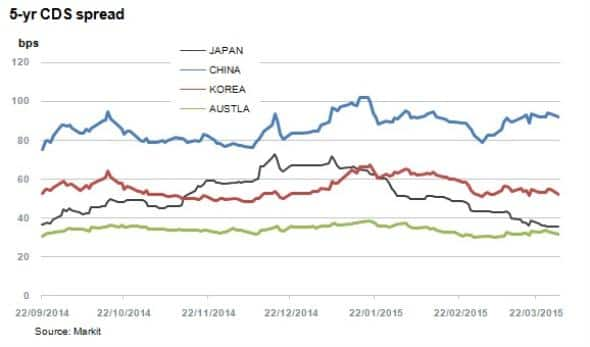

Abe's bid to end Japan's economic problems has entered a more accelerated phase following his re-election in December. The structural reforms, which make up the "third arrow" of his programme, is now top of the agenda. The country's new economic direction has been well received by credit market participants as Japan's 5-yr CDS spread has more than halved since his re-election to 35bps. Compared to its developed Asian peers, Japan has been the standout performer this year, and now ranks second to only Australia as the least risky Asian nation.

Corporate deviation

New initiatives in the corporate sector such as rules around governance have complimented existing reforms around shareholder influence and playouts have also affected corporate credit.

The Markit iTraxx Japan, made up of 50 corporate names, has seen its spread tighten 9bps year to date. This contrasts with the rest of Asia's corporate sector which has seen its spread widen over the same period of time.

For much of the last 12 months, the Markit iTraxx Asia Ex Japan IG had been closely correlated to the Markit iTraxx Japan, but March saw a reversal in the trend. The basis between the two indices rose from 41bps to 53bps as the cost of insuring against Asian corporate credit went up and Japanese corporate credit went down.

Japan's strengthening credit was not only due to policy measures but also the declining price of oil, which is likely to benefit the Japanese economy as it is reliant on energy imports.

The Japanese bond market is much less reliant on external lenders than its Asian peers which have suffered in wake of the 25% spike in the US dollar index. Asian corporations have been prolific issuers in US dollar denominated debt over the last several years and re-servicing these debts is now more costly in local currencies. Talk of an interest rate hike from the US Federal Reserve later this year and subsequent rising rates could spell a double blow to Asian corporates' cost of borrowing.

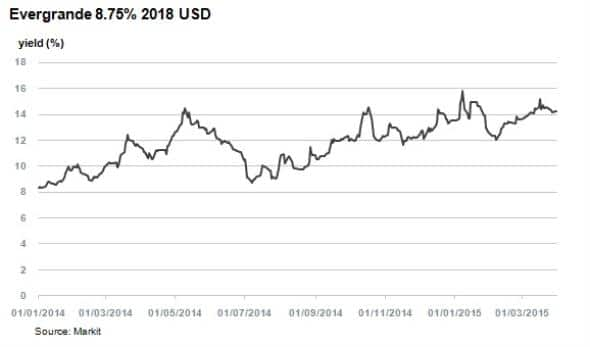

The rising dollar and potential rate rise would be particularly painful for corporations that have a mismatch in the currency they receive earnings in and the currency in which they borrow. Chinese corporates are the most vulnerable, especially property developers which are banned from domestic bank borrowing. Evergrande, China's second largest developer by sales, has seen its dollar bonds slide from yielding 8% last July to over 14% today as investors demand more return for the added risk.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-credit-japanese-credit-diverges-from-asia.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-credit-japanese-credit-diverges-from-asia.html&text=Japanese+credit+diverges+from+Asia","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-credit-japanese-credit-diverges-from-asia.html","enabled":true},{"name":"email","url":"?subject=Japanese credit diverges from Asia&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-credit-japanese-credit-diverges-from-asia.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+credit+diverges+from+Asia http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-credit-japanese-credit-diverges-from-asia.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}