Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 01, 2016

Robust US labour market unlikely to sway Fed into imminent rate hike

Another good month of hiring in the US will encourage further chatter in some corners of the Fed moving closer to hiking interest rates again, but signs of weakening economic growth mean policymakers are likely to be cautious and hold off until the global economy is showing greater vigour and the US economy more sparkle.

Non-farm payrolls rose by 215,000 in March, beating expectations of a 205,000 increase. February's hiring spurt was also revised up from 242,000 to 245,000. Wages meanwhile rose 0.3% during the month, up 2.3% on a year ago.

Although the unemployment rate rose to 5.0%, up from an eight-year low of 4.9%, this was in part due to more people entering the labour market. At 63%, the participation rate was the highest since March 2014.

The sustained robust pace of job creation and accelerating wage growth should in theory bolster the Fed's commitment to normalising policy with at least two further rate hikes this year.

However, while the labour market data shout 'rate hike', signs of a worrying weakness in the pace of economic growth at home and abroad caution against the Fed rushing into any further tightening of policy.

Recent Fed rhetoric clearly shows an increased concern about the health of the global economy, a view supported by February's PMI data showing the weakest monthly expansion of global business activity since October 2012.

Meanwhile, the domestic economy is clearly struggling. In the first two months of the year, industrial production was unchanged compared to the fourth quarter, while retail sales were down 0.2% (albeit with core sales rising at a 0.2% annualised rate).

The official data are mirroring disappointing survey indicators. Flash PMI survey data suggest the US economy endured its worst growth spell for three-and-a-half years in the first quarter, with companies reporting that inflows of new work fell to the lowest seen since the recession in March. Collectively, the PMI surveys suggest the economy grew at a meagre 0.7% annualised rate in the first quarter, down from 1.0% in the fourth quarter of last year.

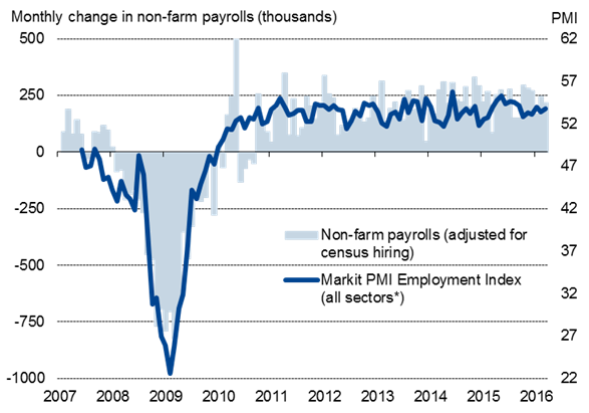

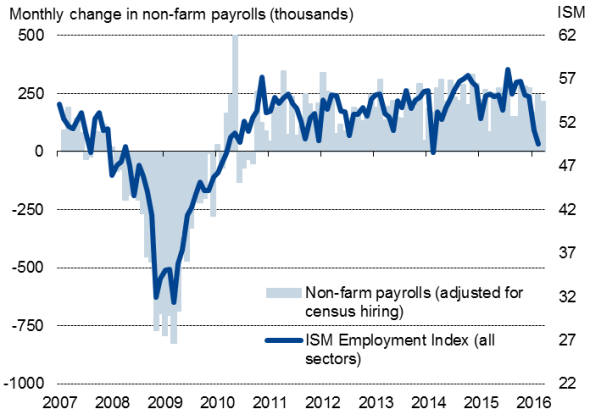

Markit's PMI survey data have also shown resilient hiring in the face of the economic slowdown (contrasting with weak ISM data see charts), suggesting that firms expect the lull in new business growth to be temporary. However, hiring will inevitably slow if demand fails to revive.

A simple regression-based model shows that the flash Markit PMI Employment Index data for March predicted a 201k non-farm payroll gain, broadly in line with the 215k increase. Over the first three months of the year, the PMI has indicated an average 198k monthly rise, which compares with an actual (subject to revision) 209k average increase. The buoyant Markit PMI contrasts with the steep downturn in the employment trend that had been indicated by ISM survey data so far this year.

Markit PMI predicted c200k March employment growth ...

... contrasting with recent weak ISM survey

* Manufacturing only pre-October 2009.

Sources: Markit, ISM, Bureau of Labor Statistics.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Economics-Robust-US-labour-market-unlikely-to-sway-Fed-into-imminent-rate-hike.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Economics-Robust-US-labour-market-unlikely-to-sway-Fed-into-imminent-rate-hike.html&text=Robust+US+labour+market+unlikely+to+sway+Fed+into+imminent+rate+hike","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Economics-Robust-US-labour-market-unlikely-to-sway-Fed-into-imminent-rate-hike.html","enabled":true},{"name":"email","url":"?subject=Robust US labour market unlikely to sway Fed into imminent rate hike&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Economics-Robust-US-labour-market-unlikely-to-sway-Fed-into-imminent-rate-hike.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Robust+US+labour+market+unlikely+to+sway+Fed+into+imminent+rate+hike http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Economics-Robust-US-labour-market-unlikely-to-sway-Fed-into-imminent-rate-hike.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}