Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2016

Asian manufacturing downturn extends into May as export trend deteriorates

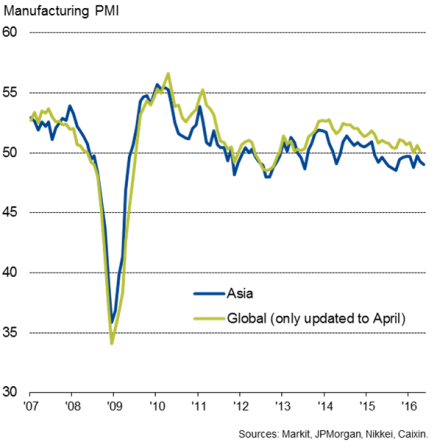

The Asian manufacturing downturn persisted into its fifteenth consecutive month in May, with the rate of decline accelerating slightly to the fastest since February. Markit's manufacturing PMI surveys, compiled on behalf of Caixin in China and Nikkei across seven other Asian economies, recorded a pan-Asian PMI of 49.0 in May, down from 49.2 in April.

The survey data indicate that Asia - and China in particular - continues to act as a drag on global economic growth, a trend that has been persisting over the past three years.

Manufacturing PMI

* Flash PMI data used for May

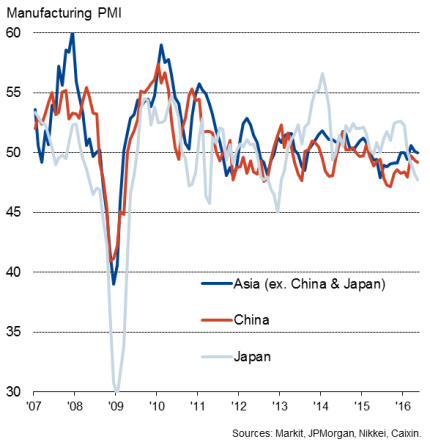

China and Japan worsen

Business conditions worsened at increased rates in both China and Japan during May, with the latter seeing the steeper rate of decline as its PMI slumped to 47.7, the lowest since January 2013. At 49.2, the PMI for China signalled only a moderate downturn, albeit the largest since February.

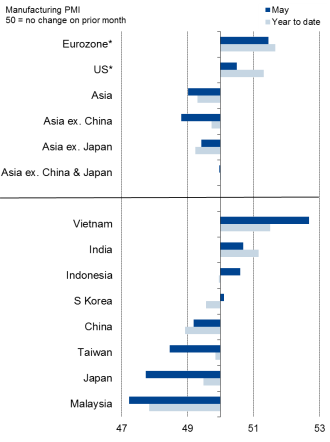

Elsewhere, the Asian PMI excluding China and Japan pointed to stagnation, with the GDP-weighted index coming in at exactly 50.0. However, there were notable growth disparities across the region. Vietnam, India, Indonesia and South Korea all saw improvements in manufacturing business conditions during May, though even in these countries the rate of growth was either modest or, in the case of South Korea, only marginal (albeit the best for five months).

Vietnam leads

Although only moderate overall, Vietnam's expansion in May was nevertheless the strongest seen for a year, meaning it has enjoyed the best manufacturing performance of the Asian economies tracked by the PMI surveys so far this year, followed by India. The steepest manufacturing downturn in both May and the across year to date has been seen in Malaysia, where the recent data showed one of the largest deteriorations in the near four-year history of the survey. Taiwan's renewed downturn meanwhile accelerated to show the largest monthly deterioration in business conditions since last October.

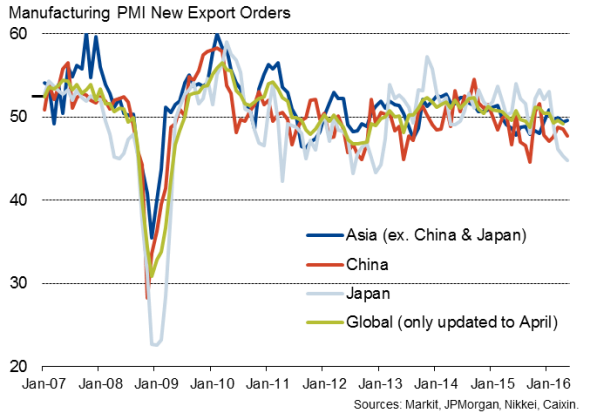

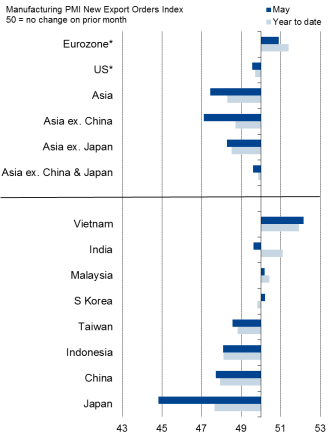

Export downturn gathers pace

The ongoing malaise in Asian manufacturing was once again linked to a downturn in trade flows, in turn broadly the result of weak global demand growth. New export orders fell across Asia at the second-fastest rate seen for just over three-and-a-half years.

Japan saw the steepest fall, suffering the largest monthly decline since January 2013 as the stronger yet hit competitiveness, followed by China, where the downturn was also one of the steepest seen over the past three years. Only Vietnam eked out any noteworthy increase in exports, although both Malaysia and South Korea reported marginal gains.

PMI New Export Orders Indices

* Flash PMI data used for May

Factory employment falls again

Factory employment across Asia meanwhile continued to fall at one of the sharpest rates seen over the past seven years. Jobs losses were once again mainly limited to China, however, where widespread staff shedding reported as firms reduced capacity. All other Asian countries covered by the PMI reported a net increase in employment in May, albeit with only modest overall growth signalled as firms remained cautious in relation to costs.

Prices rise

The survey found better news on prices, with average factory gate prices rising across Asia for a second successive month in May. Although only marginal, these were the first back-to-back monthly rises seen since 2013. Input prices also rose, up for a third successive month in May, with recent months seeing the strongest upward pressures on prices for almost two years, linked in turn mainly to firming commodity prices, notably oil. Only Japan saw falling input costs, where the strong yen reduced import prices.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-Economics-Asian-manufacturing-downturn-extends-into-May-as-export-trend-deteriorates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-Economics-Asian-manufacturing-downturn-extends-into-May-as-export-trend-deteriorates.html&text=Asian+manufacturing+downturn+extends+into+May+as+export+trend+deteriorates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-Economics-Asian-manufacturing-downturn-extends-into-May-as-export-trend-deteriorates.html","enabled":true},{"name":"email","url":"?subject=Asian manufacturing downturn extends into May as export trend deteriorates&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-Economics-Asian-manufacturing-downturn-extends-into-May-as-export-trend-deteriorates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+manufacturing+downturn+extends+into+May+as+export+trend+deteriorates http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-Economics-Asian-manufacturing-downturn-extends-into-May-as-export-trend-deteriorates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}