Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 01, 2014

Manufacturing PMI casts further gloom on eurozone

September's Markit Eurozone Manufacturing PMI makes for gloomy reading. The euro area's goods-producing sector has lost the growth momentum seen earlier in the year, lurching closer to stagnation. The near-term outlook also looks worrying. Order books are now deteriorating for the first time since June of last year, suggesting output could start to fall as we move into the final quarter of the year.

Not surprisingly, firms are focusing on cost-cutting, resulting in an ongoing lack of job creation and sending a depressing signal of little hope for any reduction in the region's near-record unemployment rate.

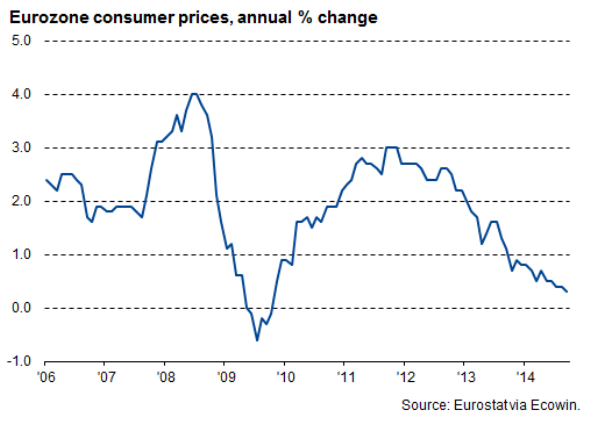

Companies are also cutting prices at the expense of profit margins as they strive to boost sales. In a sign of spreading deflationary pressures, output prices fell in all countries surveyed for the first time in over a year.

In a sign of spreading economic malaise, Germany, Austria and Greece all joined France in reporting manufacturing downturns in September. What's especially perturbing is that Germany's PMI fell into contraction for the first time since June of last year, suggesting the region's northern industrial heartland has succumbed to the various headwinds of weak demand within the euro area, falling business and consumer confidence, waning exports due to the Ukraine crisis and Russian sanctions.

The weakening manufacturing sector, alongside a dip in inflation to just 0.3% in September, will intensify pressure on the ECB to do more to revive the economy and no doubt strengthen calls for full-scale quantitative easing. Many will hope that this week's policy meeting will at least show a determination to address the slowdown with details of an aggressive ABS and covered bond purchase programme.

See the full press release here and read our analysis of the eurozone's second quarter GDP/PMI divergence here.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-economics-manufacturing-pmi-casts-further-gloom-on-eurozone.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-economics-manufacturing-pmi-casts-further-gloom-on-eurozone.html&text=Manufacturing+PMI+casts+further+gloom+on+eurozone","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-economics-manufacturing-pmi-casts-further-gloom-on-eurozone.html","enabled":true},{"name":"email","url":"?subject=Manufacturing PMI casts further gloom on eurozone&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-economics-manufacturing-pmi-casts-further-gloom-on-eurozone.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+PMI+casts+further+gloom+on+eurozone http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-economics-manufacturing-pmi-casts-further-gloom-on-eurozone.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}