Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 01, 2014

Shorting poultry amid the chicken run

Poultry producers around the world have delivered solid returns over the last twelve months due to pricing power and increased demand for the protein, but short interest in certain poultry stocks is building.

- US production is set to rise to a record in 2014 of 17.8 million metric tons

- South Americans continue to leverage vertical integration and remain the largest exporters

- Short interest in broiler* and egg producers has increased dramatically throughout the year

Record production forecast

According to the U.S. Department of Agriculture the country is set for a record year of broiler production growing by 3% due to increased slaughter, heavier weights and overall demand for poultry as the meat's price competitiveness has increased compared to red meat.

Despite delivering substantial returns over the past few quarters, certain poultry stocks are attracting significant interest from short sellers.

In an environment where input costs have come down but selling prices have increased. This could indicate investors are anticipating an increase in supply and associated pricing pressure after a recovery in supplier pricing power.

If prices are expected to drop, the cyclical industry will live up to its character as the quarters of relative undersupply and subsequent pricing power looks set to reverse. his scenario could be devastating for marginal producers and may be behind the recent shorting activity.

US producers in the spotlight

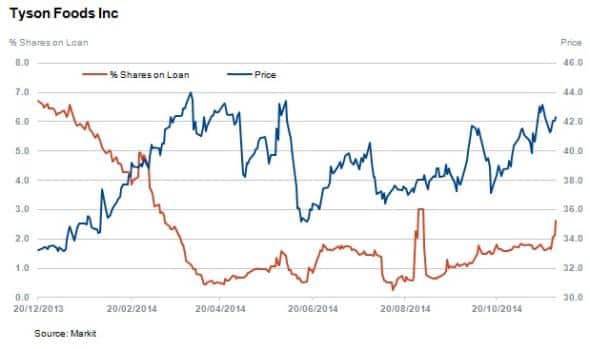

Tyson Foods, the largest poultry meat supplier in the US with approximately 20% market share has 2.6% of shares outstanding on loan.

Although this represents an increase in short interest compared to the preceding quarter, on an annual basis short sellers have actually covered positions from highs of 7% reached earlier in the year.

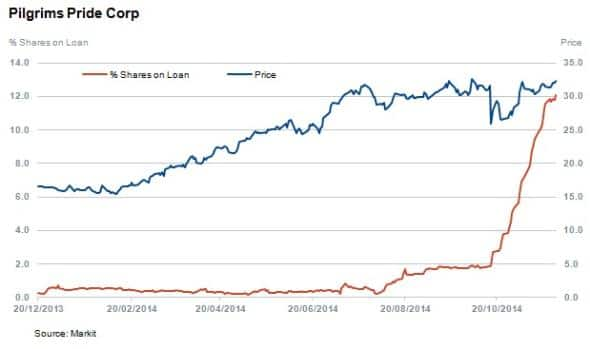

Pilgrim's Pride occupies third position in terms of global production volume with 1.7bn birds and is majority owned by Brazilian producer JBS. The firm has seen significant short interest since July as shares outstanding on loan have increased to 12.1%.

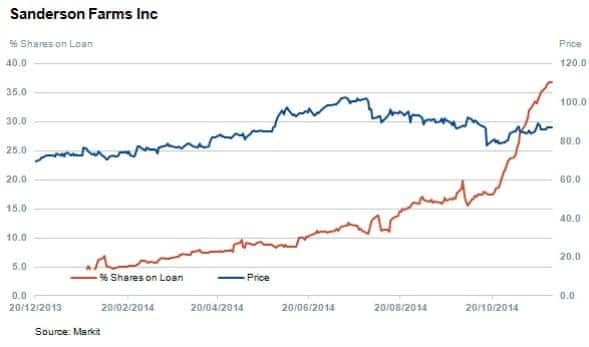

Looking further down the ranking US firm Sanderson Farms, the twelfth largest producer in the world, is by far and away the most shorted of this relatively small flock with 36.7% of shares outstanding on loan. The share price is up 20% year to date but recent momentum has seen the share price decrease 15% from highs midyear, adding to shorting activity.

Short the chicken, short the egg

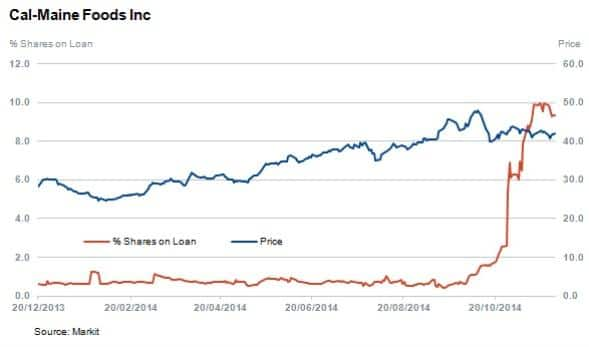

All aspects of the poultry market are under scrutiny as Cal-main, the largest producer and distributor fresh eggs in the US with 20% market share, has also witnessed a marked increase in short selling in the last quarter of 2014. Short interest in the stock has increased from 0.6% in September to 9.3%.

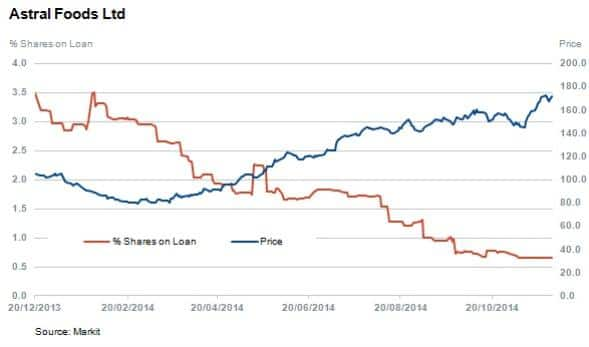

Bucking the trend in increased short interest (but not increased prices) is comparatively smaller South African producer Astral (200m birds). The stock has sent short sellers covering from highs of 3.5% at the beginning of year as the stock has increased 65% year to date.

Brazilian counterparts attract less shorting activity in their home capital markets but their business fundamentals are driven by the same global pricing factors in broilers and feed.

The largest company by volume in the world producing almost 1.9bn birds annually is Brf SA. Similarly to its global peers, the firm has posted a solid recent performance as the stock is up 35% year to date.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Equities-Shorting-poultry-amid-the-chicken-run.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Equities-Shorting-poultry-amid-the-chicken-run.html&text=Shorting+poultry+amid+the+chicken+run","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Equities-Shorting-poultry-amid-the-chicken-run.html","enabled":true},{"name":"email","url":"?subject=Shorting poultry amid the chicken run&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Equities-Shorting-poultry-amid-the-chicken-run.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorting+poultry+amid+the+chicken+run http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Equities-Shorting-poultry-amid-the-chicken-run.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}