Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 02, 2015

Nigeria's bonds rise; US treasuries down

Credit markets show confidence in new Nigerian leader, while in the US mixed macro data sends send treasuries down

- Nigerian bonds rallied by over 5% since the election

- US ten year treasuries fall below 2% again after disappointing manufacturing data

- Mongolia sees bearish bond sentiment as the copper slump slows growth

Nigerian elections welcomed

Markets reacted positively to news that opposition leader Mahammadu Buhari beat incumbent Prime Minister Goodluck Jonathan in Nigeria's general election this week. It was the first time an opposition party won an election in Nigeria since Jonathan's People's Democratic Party came to power in 1999. The victory also marked the first peaceful ousting of an incumbent candidate; hailed as step forward for the continent's largest economy.

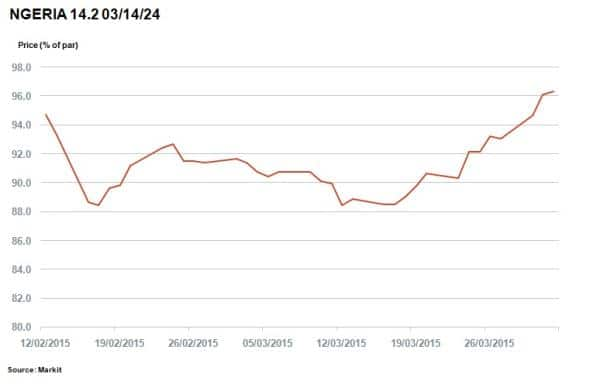

March has been a good month for Nigerian bond investors as the 14.2% 2024 naira denominated government bond in rose 5pts to 96.35pts (as a percentage to par) on the back the opposition's momentum leading up to the election. US dollar denominated debt also found buyers as the 6.75% 2021 notes gained 2.25pts post-election.

The election result was a welcome relief for holders of Nigerian debt who had been hit hard over the last several months. Nigeria relies on oil for the majority of government revenue and the falling price of oil and strong US dollar have presented a challenging environment.

Nigeria still has numerous problems to address including terrorism, oil dependence, corruption and economic inefficiencies. But a peaceful democratic transition of power may mark the first step forward towards greater prosperity.

Two handle treasury

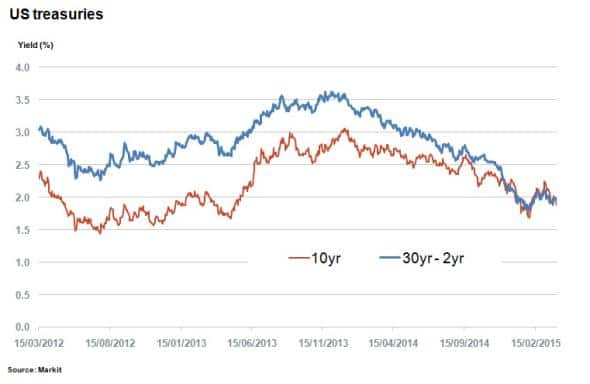

In the US, contradicting macroeconomic data over the last few weeks has seen volatility in US treasuries. While last Friday's positive flash PMI data signalled momentum, weak manufacturing data and disappointing ADP jobs data released this week proved less optimistic which sent the ten year yield back under 2% to 1.87%.

This yield had reached 2.24% just one month ago as investors started to speculate about an imminent rate rise. Recent mixed signals on the health of the US economy, however, have made this prospect less likely.

This negative sentiment is also reflected by the fact that the US yield curve has started to flatten again. The yield difference between two and 30 year treasuries decreased from 3.5% in December 2013 to 1.8% in January 2015 and has since fluctuated around 2%. Yield curve flattening is usually a sign of an oncoming downturn in the economy as inflation is repressed.

All eyes will be on Friday's non-farm payrolls, a key indicator of economic health.

Mongolia struggles with growth

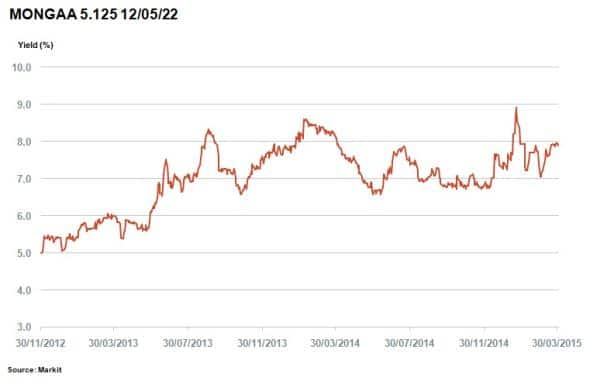

The central Asian country, which experienced its own copper driven economic boom over the last few years, has seen its growth in GDP halve in the last four years to 7.8% last year. This decline was largely driven by the slump in copper price, which is responsible for one third of Mongolia's economic output.

The falling copper price hit the country's bonds, with the 5.125% US dollar denominated issue rising above 8%; sparking fears of a potential downgrade. This figure still remains well above the yields of 6% seen two years ago.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-Credit-Nigeria-s-bonds-rise-US-treasuries-down.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-Credit-Nigeria-s-bonds-rise-US-treasuries-down.html&text=Nigeria%27s+bonds+rise%3b+US+treasuries+down","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-Credit-Nigeria-s-bonds-rise-US-treasuries-down.html","enabled":true},{"name":"email","url":"?subject=Nigeria's bonds rise; US treasuries down&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-Credit-Nigeria-s-bonds-rise-US-treasuries-down.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nigeria%27s+bonds+rise%3b+US+treasuries+down http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-Credit-Nigeria-s-bonds-rise-US-treasuries-down.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}