Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 02, 2015

Fed to remain cautious as hiring remains impressive but wage growth disappoints

Yet another month of impressive job creation pushes the Fed closer to hiking interest rates later this year, albeit with the Fed likely to remain in a cautious mood.

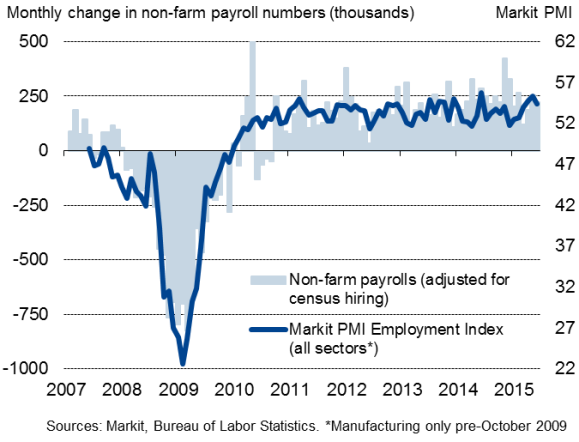

Non-farm payrolls increased by 223,000 in June, just shy of expectations of a 233,000 rise and in line with Markit's PMI survey data, which pointed to a 220,000 increase.

Although behind expectations, and accompanied by news that April and May had collectively seen 60,000 fewer new jobs added than previously thought (a downward revision that was also signalled by the PMI), the latest upturn suggests that the encouragingly strong run of job creation seen in recent years shows few signs of stalling.

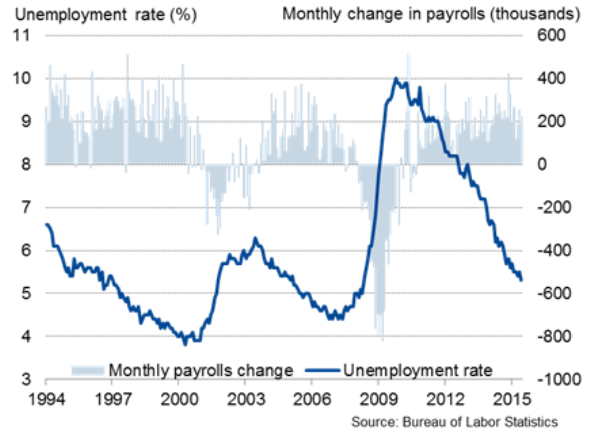

The additional hiring helped push the unemployment rate down to a seven-year low of 5.3% from 5.5% (albeit aided by a drop in the participation rate), edging closer to the 5.0-5.2% range which is widely seen as indicative of full employment and beating expectations of a dip to 5.4%.

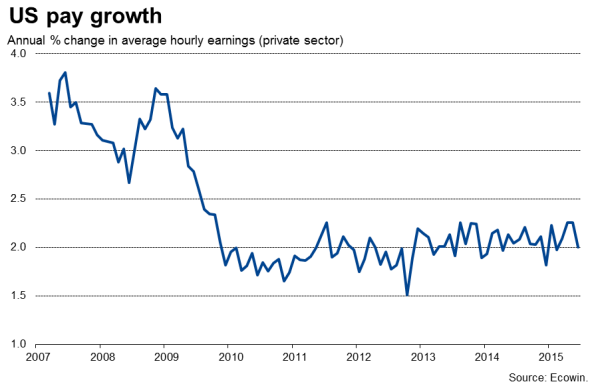

Wage growth - widely viewed as a critical indicator of when policymakers will feel comfortable that the economy can withstand higher borrowing costs - failed to impress, remaining a bothersome fly in the ointment of the recovery story. Average hourly earnings were unchanged, meaning wages are up just 2.0% over the past year, missing expectations of a 2.3% rise.

Non-farm payrolls and the PMI

Fed to edge towards September rate hike

The employment report therefore fits in with recent central bank rhetoric that the economy continues to grow at a reasonable pace, but that there is some way to go before policymakers will feel comfortable enough to start hiking interest rates. Although the markets are currently pricing in a 36% chance of the first rate rise taking place in September, the Fed will want to see strong job creation sustained in coming months and signs that wage growth is starting to lift higher.

US labour market

Such positive news is by no means assured. The employment report follows other signs of the economic upturn losing momentum. Notably, Markit's flash PMI survey data signalled a marked slowing in the rate of economic growth in June. The survey data suggest that, although the economy looks to have rebounded in the second quarter, growing at a 2.5% annualised rate compared to a 0.2% decline in the first quarter, the pace of expansion looks set to weaken again in the third quarter.

The recent strength of the dollar is partly to blame for the slowdown, meaning policymakers will be especially conscious of hiking interest rates if it means the Greenback could see further upward pressure.

The debt crisis in Europe, and the growing possibility that Greece could leave the eurozone, adds further uncertainty to the global economic outlook. The Fed will want to see signs that the crisis will be resolved smoothly before adding further uncertainty to global financial markets by hiking interest rates.

However, as yet, the data flow merely points to a modest slowing in the economy and, given the desire for policy making to be as transparent as possible, we are likely to see the Fed continue to prepare the ground for an initial rate hike later this year. However, the Fed will stress that policy will be very much dependent on economic conditions remaining supportive in coming months. Moreover, the pill will be sweetened by strong reassurances that a benign inflation outlook means the path of further rate rises will be gently sloping and carefully measured, rather than steep and aggressive.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Economics-Fed-to-remain-cautious-as-hiring-remains-impressive-but-wage-growth-disappoints.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Economics-Fed-to-remain-cautious-as-hiring-remains-impressive-but-wage-growth-disappoints.html&text=Fed+to+remain+cautious+as+hiring+remains+impressive+but+wage+growth+disappoints","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Economics-Fed-to-remain-cautious-as-hiring-remains-impressive-but-wage-growth-disappoints.html","enabled":true},{"name":"email","url":"?subject=Fed to remain cautious as hiring remains impressive but wage growth disappoints&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Economics-Fed-to-remain-cautious-as-hiring-remains-impressive-but-wage-growth-disappoints.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+to+remain+cautious+as+hiring+remains+impressive+but+wage+growth+disappoints http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Economics-Fed-to-remain-cautious-as-hiring-remains-impressive-but-wage-growth-disappoints.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}