Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2017

Canada PMI rounds off strong third quarter, but also points to price pressures

The latest PMI survey data indicate that the Canadian economy enjoyed strong growth in September, sending an encouraging signal for third quarter GDP. However, the upturn was accompanied by intensifying price pressures, suggesting that inflation could continue to rise in coming months.

At 55.0 in September, the seasonally adjusted IHS Markit PMI rose from 54.6 in August, comfortably above the 50.0 no-change threshold and indicating a slight acceleration in the rate of improvement of business conditions.

The September reading rounded off a third quarter which saw an average PMI reading of 55.0, just below the second quarter's six-and-a-half year high of 55.2.

The PMI survey is conducted by IHS Markit and covers a representative sample of 400 manufacturing companies operating in Canada. The headline PMI is a composite index based on five survey questions covering output, new orders, inventories, supplier performance and employment. It is intended to act as a barometer of business conditions.

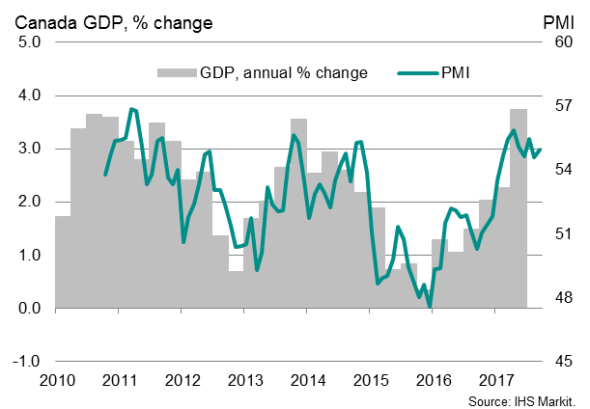

However, as manufacturing acts as a bellwether of the wider economy, the PMI also provides an advance guide to gross domestic product. The PMI has the advantage of being available monthly and far sooner than official GDP estimates. Since the survey data were first available in late-2010, the IHS Markit PMI has exhibited a correlation of 78% with the annual rate of change of GDP but is available some two months before the official data are published.

IHS Markit Canada PMI v GDP trend

Solid third quarter GDP signalled

The sustained elevated PMI readings therefore bode well for third quarter GDP. Earlier this year, the strong surge in the PMI numbers had accurately anticipated the upturn in GDP growth, which hit 3.7% in the second quarter compared to a year ago, up 1.1% compared to the first quarter.

The third quarter PMI data are consistent with only a slight moderation in the annual rate of GDP expansion to around 3.0%, with a solid quarterly gain of approximately 1.0% signalled.

Manufacturing upswing

The survey also provides an advance guide to official manufacturing output data, and the recent results bodes well for the third quarter. The output index from the PMI surveys, which measures month-on-month changes in factory production, exhibits a correlation of 60% with the official annual rate of change in production. More importantly, the survey has accurately foretold all major turning points in the official data, exhibiting a lower noise-to-signal ratio than the official data.

The IHS Markit data have also provided a far clearer and more reliable indication of manufacturing trends than the competing IVEY survey, which has a correlation of just 13% with official data.

The recent IHS Markit Output Index numbers suggest that production is growing at an annual rate of 3-4%, with a slight uptick in growth momentum in September.

Stretched capacity

Signs are also appearing of capacity constraints driving up prices. Other PMI survey indices showed new order inflows rising at a faster rate in September, leading to an increase in backlogs of work for the fifth time in the past six months as capacity continued to be stretched.

However, the clearest indication of capacity constraints appeared in supplier delivery times, which lengthened to the greatest extent for over six years in September. Capacity constraints and longer delivery times often mean demand is outstripping supply, which in turn usually ends up in higher prices. Not surprisingly, the PMI survey's supplier delivery times index exhibits a 73% correlation with consumer price inflation with delivery times acting with a lead of two months.

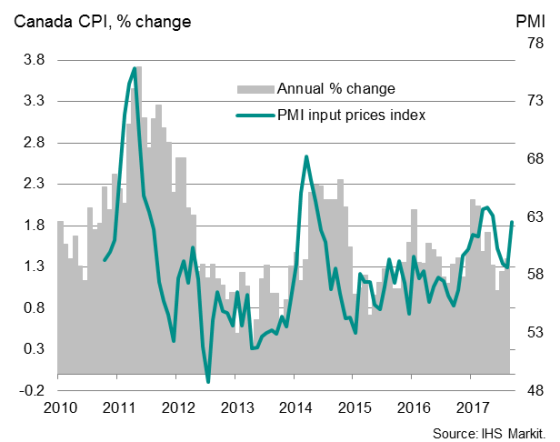

Rising prices

Manufacturing input costs and inflation

Survey indicators of factory input costs and selling prices also point to rising inflationary pressures. Input price inflation re-accelerated in September to approach the three-year highs seen earlier in the year, and prices charged for goods showed the largest monthly increase since March 2014.

A composite index based on both suppliers' delivery times and firms' input costs acts as a useful overall guide to price pressures in the economy, and enjoys a 76% correlation with consumer price inflation, with the survey data acting with a lead of three months.

The survey data suggest there is a strong risk that consumer price inflation will continue to accelerate in coming months from the 1.4% rate seen in August.

Jobs boom

Finally, the survey index of employment pointed to sustained strong hiring in September as firms boosted capacity to meet rising demand. Although the rate of job creation cooled slightly in September, the survey results so far in 2017 have indicated the strongest manufacturing employment growth since data were first collected in 2010.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-economics-canada-pmi-rounds-off-strong-third-quarter-but-also-points-to-price-pressures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-economics-canada-pmi-rounds-off-strong-third-quarter-but-also-points-to-price-pressures.html&text=Canada+PMI+rounds+off+strong+third+quarter%2c+but+also+points+to+price+pressures","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-economics-canada-pmi-rounds-off-strong-third-quarter-but-also-points-to-price-pressures.html","enabled":true},{"name":"email","url":"?subject=Canada PMI rounds off strong third quarter, but also points to price pressures&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-economics-canada-pmi-rounds-off-strong-third-quarter-but-also-points-to-price-pressures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Canada+PMI+rounds+off+strong+third+quarter%2c+but+also+points+to+price+pressures http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-economics-canada-pmi-rounds-off-strong-third-quarter-but-also-points-to-price-pressures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}