Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 02, 2014

US oil firms line short sellers' pockets

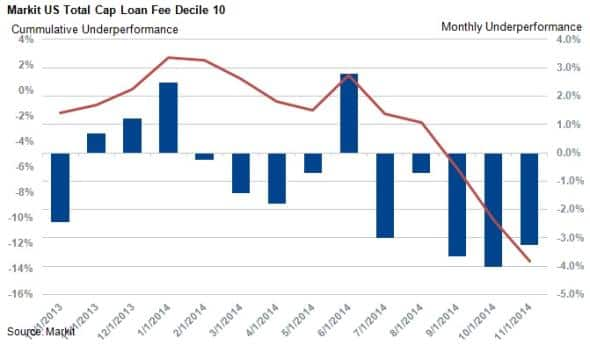

The last three months have been very positive for short sellers as evident by the fact that the top 10% of the most expensive shares to borrow in the US have underperformed the market by nearly 11%. We review the stocks driving this trend.

- This is the first time the most popular shorts have underperformed by over 3% for three consecutive months

- The top 10% of shares ranked by cost to borrow have underperformed the rest of the universe by a cumulative 10.9%

- This contrasts with the least expensive shorts which have delivered a 2.3% cumulative return over the last three months

Best performing shorts in the US

The past three months have brought positive returns for short sellers. The most popular shorts gauged by stock loan rate, the cost paid by short sellers to carry their position, in the US Total Cap Universe have underperformed the rest of the market for three consecutive months by more than 3% for the first time since 2006.

This represents a cumulative underperformance of 10.9%, delivered from the 10th decile or the most expensive shorts. October was specifically a particularly good month for shorts posting a 4.0% underperformance.

The average share price decline of the best performing twenty shorts in the universe was 68% over the past three months, with average short interest ending at 13%.

One of the most significant factors that has been moving markets in the past three months has been the determined decline in oil prices. Brent crude breached $70 in the period and alternative, such as fracking, or higher cost producers are feeling the pain. But energy companies were beaten to the top short spot by a component supplier who lost a contract with the world's largest ever publicly listed entity.

GT Advanced Technologies was the best performing short (in terms of absolute price decline) of the past three months with the stock price down 97%. The company is a potential component supplier into the electronics industry, manufacturing advanced and innovative materials including crystal growth equipment for displays. The company filed for chapter 11 bankruptcy in October 2014 after supply arrangements with Apple for sapphire glass to be used in the recently launched iPhone 6 collapsed.

Oil producer shorts exposed as low price tide continues

Unsurprisingly, US energy companies make up a large proportion of the best shorts as oil prices hit five year lows amid continued stable supply from Opec and slowing factory activity reported in China. A total 11 of 20 of the worst performing shares in the US over the last three months are energy related companies.

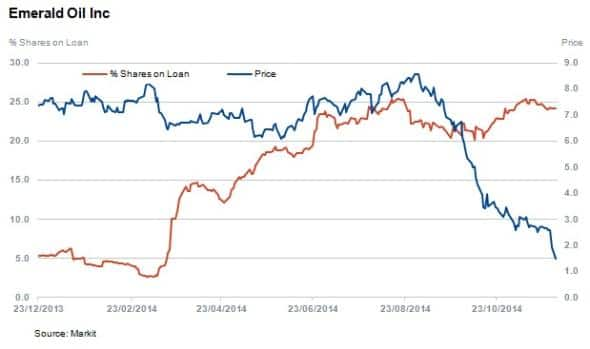

Emerald Oil was the "best' oil short as the company and others are facing oil price war of sorts as the firm admittedly was struggling at $80 a barrel levels and recently announced plans to cancel new rig expansion in 2015.

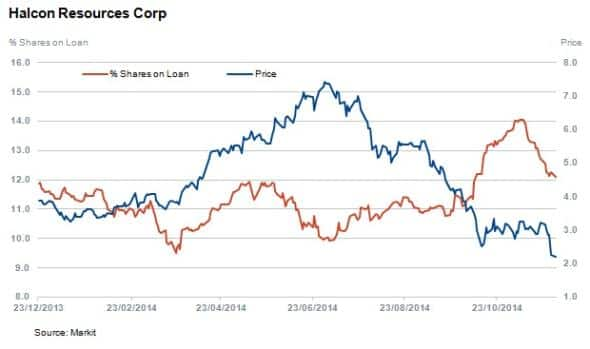

The biggest company by market capitalisation in the in the top twenty shorts, at position 20, is Halcon Resources. The share price is down 55% over the last three months. Management recently scaled back spending plans for 2015 and stated that "the precipitous drop in crude prices calls for conservatism".

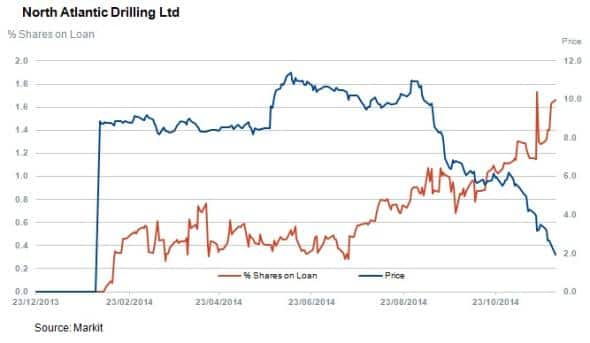

In third place is Seadrill subsidiary North Atlantic Drilling who is suffering both from sanctions over projects in Russia and the lowest oil price in five years. The share price has been in free fall losing 80% in three months.

Continuing weakness in the Baltic Dry Index sees dry bulk player Knigtsbridge Shipping joining the best performing shorts. The stock is down 63% over the past three months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-equities-us-oil-firms-line-short-sellers-pockets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-equities-us-oil-firms-line-short-sellers-pockets.html&text=US+oil+firms+line+short+sellers%27+pockets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-equities-us-oil-firms-line-short-sellers-pockets.html","enabled":true},{"name":"email","url":"?subject=US oil firms line short sellers' pockets&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-equities-us-oil-firms-line-short-sellers-pockets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+oil+firms+line+short+sellers%27+pockets http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-equities-us-oil-firms-line-short-sellers-pockets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}