Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 02, 2016

Asian manufacturing expansion marred by rising prices

After seeing only marginal growth in the third quarter, business conditions at Asian manufacturers have continued to improve at a modest pace in the fourth quarter. However, there are significant variations in performance across the continent as well as sharply higher input prices.

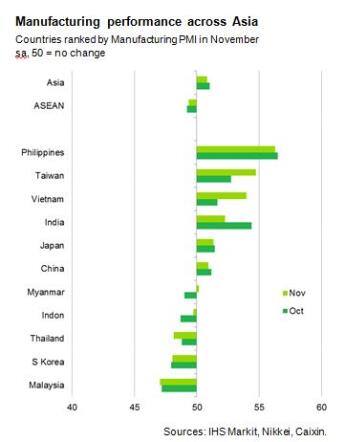

At 50.8 in November, the Asia Manufacturing PMI (an aggregate based on national Nikkei and Caixin PMI results compiled by Markit) was slightly down from 51.0 in October. However this was still the second-strongest growth seen since manufacturing initially moved back into expansion five months ago.

As a whole, the region has shown signs of stronger demand in the first two months of Q4. New orders in Asia's manufacturing economy continued to rise at a quicker rate than the Q3 average. Greater inflows of new business in China and Japan contributed to the latest improvement.

Encouragingly, an upturn in export demand was sustained in the middle of the fourth quarter as sales from abroad increased for the third straight month in November.

Rising material prices

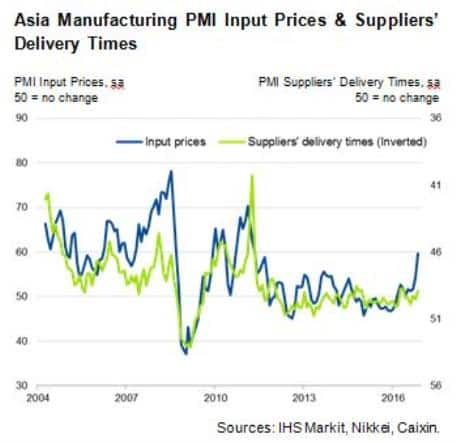

Meanwhile, there were signs of inflationary pressures intensifying over the month. There were concerns over higher costs for raw materials, especially for items such as metals, plus there was a surge in futures prices during the month.

While the Asia Manufacturing PMI Input Prices Index hit a five-and-half-year high, reflecting sharply higher prices for pre-production materials, suppliers were far from overwhelmed, as they can be if demand increases. This suggests that price pressures are being constrained to some extent by a lack of fundamental supply-side drivers.

China accounts for half of Asian manufacturing and its recent improvements have helped lift business activity in the region. The Caixin PMI showed that Chinese manufacturing expanded for the third successive month in November, albeit modestly. With the economic restructuring still underway, large layoffs at traditional industries were seen. However, there are signs that the rate of job shedding is beginning to slow. The Employment Index signalled the slowest rate of decline in 18 months during November.

Meanwhile in Japan, sustained growth was seen in the fourth quarter - the Nikkei PMI was at its second-highest since January. Central to the recent manufacturing upturn has been the weaker yen, resurgent demand in many export markets and normalising supply chains after the earthquakes earlier this year.

After a solid start to the fourth quarter, growth in India's manufacturing sector is showing some loss in momentum, with the PMI down compared to October. Nonetheless, the country registered an eleventh consecutive monthly expansion in manufacturing activity.

The Philippines maintained the lead position in Asia. Strong domestic demand remained key to the robust expansion.

Although South Korea continued to report a deterioration in November, Malaysia remained bottom of the rankings, as the Nikkei PMI sank to a five-month low. A further softening of international demand had affected Malaysian manufacturing conditions.

Overall, the survey results showed that while manufacturing conditions in Asia are improving, the expansion is not broad-based. Strong inflationary pressures signal that manufacturers may face tighter margins if they are unable to pass on higher input costs to customers. A muted global economic outlook suggests that further growth momentum in the region's manufacturing industry is far from guaranteed.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-Economics-Asian-manufacturing-expansion-marred-by-rising-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-Economics-Asian-manufacturing-expansion-marred-by-rising-prices.html&text=Asian+manufacturing+expansion+marred+by+rising+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-Economics-Asian-manufacturing-expansion-marred-by-rising-prices.html","enabled":true},{"name":"email","url":"?subject=Asian manufacturing expansion marred by rising prices&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-Economics-Asian-manufacturing-expansion-marred-by-rising-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+manufacturing+expansion+marred+by+rising+prices http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-Economics-Asian-manufacturing-expansion-marred-by-rising-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}