Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 02, 2016

Bond ETFs bears surge over November

November's bond market selloff has led to a wave of short selling in fixed income ETFs on both sides of the Atlantic

- The aggregate demand to borrow ETFs has jumped by a third over November

- Shorts are most active in high yield, emerging market and long dated ETFs

- European ETFs make up four of the 10 most shorted funds

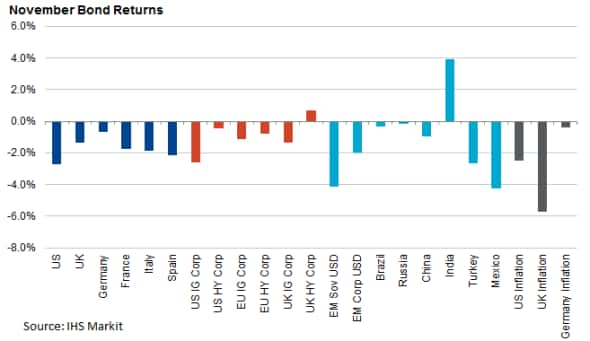

November has been a unanimously tough month for fixed income investors as the growing consensus around a US interest rate hike and the creeping specter of inflation has sent global benchmark rates spiking to the highest levels in over a year. Every major asset class, save for Indian rupee denominated bonds and high yield sterling bonds, posted negative total returns for the month.

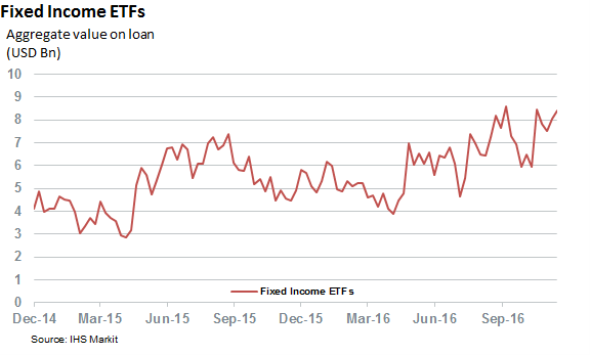

Investors have been rushing to hedge themselves from this across the board selloff as the demand to borrow fixed income ETFs in the securities lending market has jumped by a third over November. This surge in shorting activity takes the aggregate demand to borrow the asset class over the $7.2bn mark which puts in within $200m of the recent highs registered in the closing weeks of last September.

It's worth noting that the high registered over September coincided with the quarterly options expiry, which arguably drove demand to borrow from option market making hedging activity. The current surge in demand is much more likely to be driven by pure market forces owing to the fact that we are currently outside of option expiry period.

High yield and long dated bonds favored

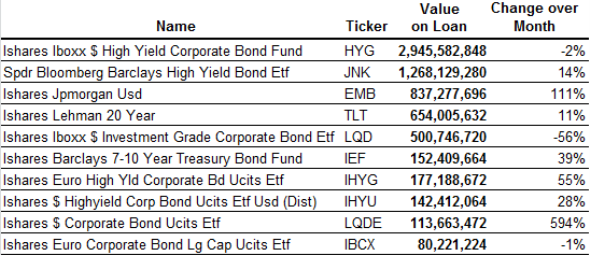

Not surprisingly, short sellers have been gravitating to the riskiest and historically volatile end of the bonds market as products that invest in high yield, emerging market and long dated bonds currently see the greatest demand to borrow.

High yield bonds are by far and away the most in demand from short sellers as the two largest US listed funds that invest in the asset class, the iShares iBoxx $ High Yield Corporate Bond Fund and the Spdr Bloomberg Barclays High Yield Bond ETF make up half the aggregate bond ETF borrow with $2.9bn and $1.3bn of these funds now out on loan respectively. The recent volatility hasn't spurred much additional borrow demand for these funds however as both their value on loan have been relatively flat over the last month.

The same can't be said for the third most borrowed ETF, The iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB). Short sellers have more than doubled their aggregate positions in this fund by over the last month with roughly $840m of its shares now out on loan. The surging EMB short interest now stands at 10% of its AUM, the first time short sellers have been this active since Q1's emerging market wobble.

Highly volatile long dated bonds round out the three most popular ETF short strategies and the iShares 20+ Year Treasury Bond ETF has been the tool of choice to express bearish sentiment as gauged by the $650m of borrow seen in the fund as of latest count.

Europeans also ride trend

European short sellers have also been actively expressing two way bond market views through ETFs and as four European listed funds feature among the 10 most borrowed ETFs. European short sellers demand has been mostly focused on euro and dollar denominated corporate bonds on both sides of the investment grade divide.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-equities-bond-etfs-bears-surge-over-november.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-equities-bond-etfs-bears-surge-over-november.html&text=Bond+ETFs+bears+surge+over+November","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-equities-bond-etfs-bears-surge-over-november.html","enabled":true},{"name":"email","url":"?subject=Bond ETFs bears surge over November&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-equities-bond-etfs-bears-surge-over-november.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond+ETFs+bears+surge+over+November http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-equities-bond-etfs-bears-surge-over-november.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}