Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 03, 2016

UK PMI suffers biggest fall for 4' years as weakness spreads to services

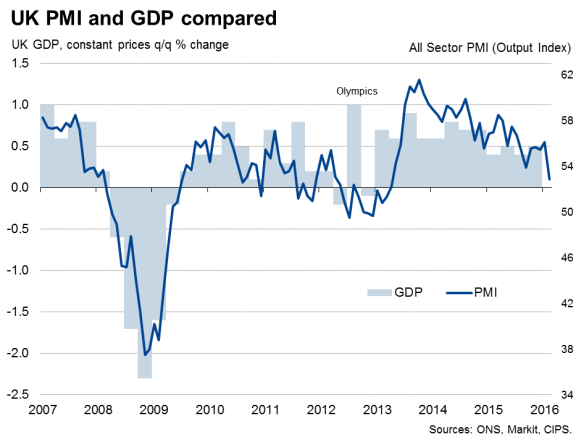

UK economic growth slowed to its weakest for almost three years in February, according to the latest Markit/CIPS 'all-sector' PMI data. At 52.9, down from 56.1 in January, the headline index measuring growth of business activity fell to its lowest since April 2013. The 3.2 index-point slump in the PMI was the largest since August 2011.

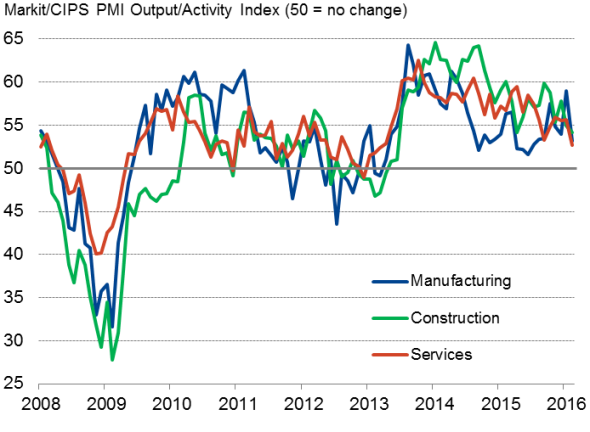

Growth slowed across the board in February, with survey gauges falling in manufacturing, services and construction. However, the slowdown in services was arguably the most worrying, as the sector has provided an important support to UK economic growth in recent years, not least due to its sheer size. Service sector business activity showed the smallest monthly increase since March 2013. Expansions meanwhile hit ten- and seven-month lows respectively in construction and manufacturing, the former suffering from a housing market slowdown and the latter wounded by falling exports.

The slowdown in February leaves the PMI suggesting that economic growth could slow to 0.3% in the first quarter, down from 0.5% in the final quarter of last year, but there are downside risks to even this modest expansion.

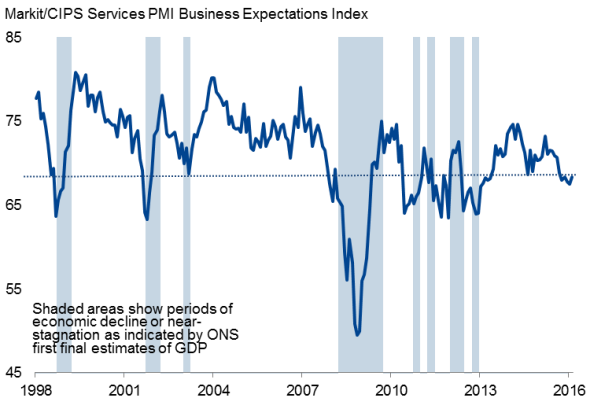

The February PMI alone is consistent with just a 0.2% quarterly rate of GDP growth, and there may be worse to come. Despite rising slightly compared with January's three-year low, business confidence in the service sector remained at a level which has historically presaged an imminent slowing in the economy to near-stagnation or worse in coming months (see chart).

Broad-based slowdown

Future expectations

Worries mount

Survey responses reveal that firms are worried about signs of faltering demand (inflows of new orders across the three sectors combined registered the smallest monthly increase since April 2013), but boardrooms have also become unsettled by concerns regarding the increased risk of 'Brexit', financial market volatility and weak economic growth at home and abroad.

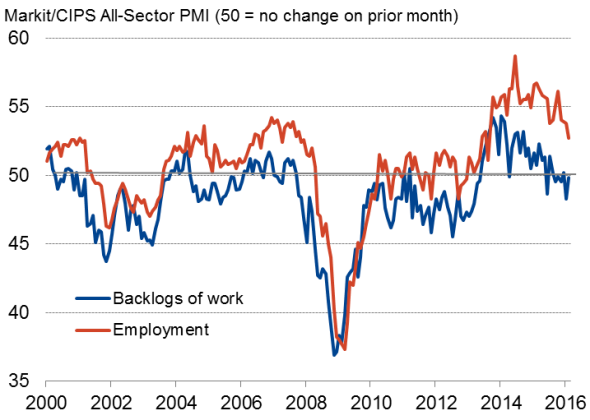

Not surprisingly, the slowdown in order book growth and the recent drop in optimism have taken a toll on hiring, resulting in the smallest monthly increase in employment since August 2013 in February. Slower rates of job creation in services and construction accompanied a second successive monthly drop in factory payrolls.

Inflationary pressures meanwhile remained subdued. Average prices charged for goods and services once again barely rose, while average input prices showed one of the smallest increases seen this side of the 2008-9 recession.

While some of the weakness of inflation continues to reflect low global commodity prices, companies also report that price competition remains fierce amid softening demand.

Backlogs of work and employment

Policy toolbox

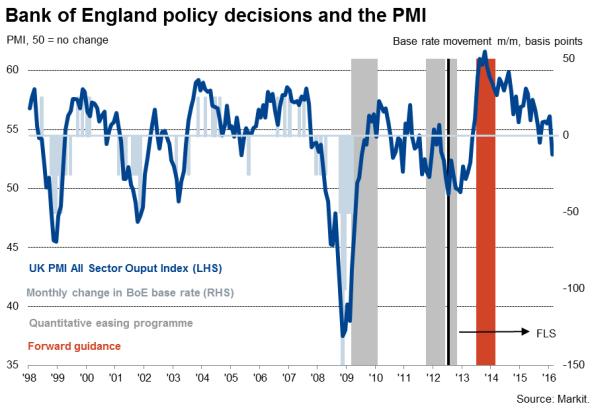

The extent of the slowdown will be a shock to policymakers and surely puts to bed any talk of the Bank of England raising interest rates. The focus will instead increasingly shift to whether policymakers may soon need to dig deeper into their toolbox to introduce new measures to shore-up the economy with additional stimulus, and what tools might be used. History shows that the PMI has now moved down into territory normally consistent with the central bank cutting interest rates rather than hiking.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-Economics-UK-PMI-suffers-biggest-fall-for-4-years-as-weakness-spreads-to-services.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-Economics-UK-PMI-suffers-biggest-fall-for-4-years-as-weakness-spreads-to-services.html&text=UK+PMI+suffers+biggest+fall+for+4%27+years+as+weakness+spreads+to+services","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-Economics-UK-PMI-suffers-biggest-fall-for-4-years-as-weakness-spreads-to-services.html","enabled":true},{"name":"email","url":"?subject=UK PMI suffers biggest fall for 4' years as weakness spreads to services&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-Economics-UK-PMI-suffers-biggest-fall-for-4-years-as-weakness-spreads-to-services.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+suffers+biggest+fall+for+4%27+years+as+weakness+spreads+to+services http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-Economics-UK-PMI-suffers-biggest-fall-for-4-years-as-weakness-spreads-to-services.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}