Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 03, 2017

Casino stocks fail to come up trumps

Despite having a former operator in the White House, most US casino stocks have missed out on the post-election rally, however short sellers are largely sitting on the sidelines.

- US casino stocks have seen short sellers cover positions to a two year low since the election

- Covering comes despite significant underperformance in the sector since the election

- Non-US casino shares have also see a reduction in bearish bets

The Trump presidency has so far proved a double edged sword for US gaming stocks. While having a former casino operator in the White House is arguably an asset for the industry, his divisive rhetoric has the potential to scare off overseas visitors which account for a significant portion of gamblers in Las Vegas, the largest US gambling destination. While it's still too early to tell what impact, if any, the new administration will have on foreign visitors, large tourist destinations such as New York City are already bracing for a fall in overseas visitors.

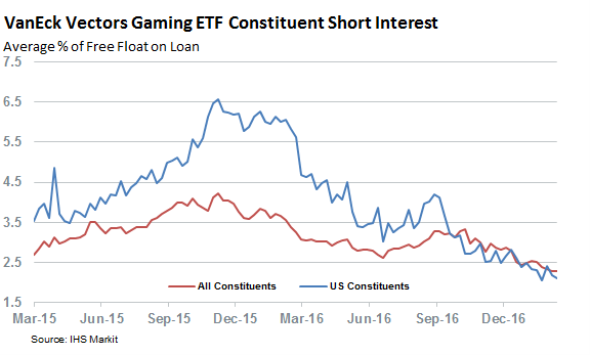

While losing a portion of their high spending overseas visitors is potential a risk for the industry, investors don't seem to worry as US casino stocks haven't experienced any significant bearish activity since the US election back in November. In fact the opposite has occurred as the eight US constituents of the VanEck Vectors Gaming ETF (BJK), which tracks global casino and gambling stocks, have seen the demand to borrow their shares fall to the lowest level in two over years. This sustained covering means that the sector sees roughly a third of the demand to borrow its shares than it had 12 months ago.

This lack of appetite to short comes despite the fact that US casino stocks have by and large underperformed the wider US market since the election, as the US constituents of the BJK ETF have returned 5% by since the election which is only a third of the 15% advance registered by the S&P 500 over the same period.

Recent earnings reports have fueled this underperformance as the three largest US operators, Las Vegas Sands, MGM Resorts and Wynn Resorts, all posted relatively downbeat profit figures which saw all three firms fall short of analyst forecasted EPS estimates. The former two of the three were particularly affected by poor earnings as their shares fell by 5% and 8% respectively on the day they announced earnings. Short sellers seem to be taking the cue from analysts, who are forecasting all three firms to brush aside recent earnings setbacks, as all three operators currently have a lower proportion of their shares out on loan than on the eve of the election.

Wynn resorts, which used to be the most shorted US casino stock, has led this covering after demand to borrow its shares shrank by over a third over the last three and a half months.

A global trend?

Short covering among global casino shares isn't limited to US traded firms as the average demand to borrow non-US constituents of the BJK ETF has shrank by a similar margin in the last three months. US operators again played a role in this trend as their Asian listed operations, Sands China, Wynn Macau and MGM China, have led the covering.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Equities-Casino-stocks-fail-to-come-up-trumps.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Equities-Casino-stocks-fail-to-come-up-trumps.html&text=Casino+stocks+fail+to+come+up+trumps","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Equities-Casino-stocks-fail-to-come-up-trumps.html","enabled":true},{"name":"email","url":"?subject=Casino stocks fail to come up trumps&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Equities-Casino-stocks-fail-to-come-up-trumps.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Casino+stocks+fail+to+come+up+trumps http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Equities-Casino-stocks-fail-to-come-up-trumps.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}