Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 03, 2017

PMI indicates slowdown in UK GDP growth to 0.4% in first quarter

A further slowdown in UK business activity growth in February adds to evidence that the economy has lost momentum after the impressive expansion seen at the end of last year. Inflationary pressures remained the highest for six years as firms struggled with rising costs associated with the weak pound, but optimism about the year ahead remained elevated by recent standards.

First quarter slowdown

The Markit/CIPS 'all-sector' PMI fell for a second successive month in February, dropping to a five-month low of 53.7 from 55.1 in January. The readings for the first two months of the year so far suggest the economy will grow 0.4% in the first quarter, markedly lower than the 0.7% expansion seen in the fourth quarter of last year.

Other indicators from the survey hint at growth slowing further in March. Growth of new business dipped to a five-month low in February and backlogs of work showed the largest fall for seven months. Optimism about future activity levels also moderated slightly, albeit remaining at one of the most elevated levels seen over the past year-and-a-half.

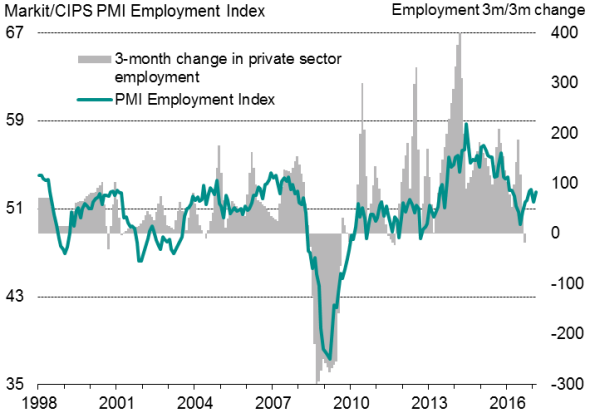

The relatively buoyant degree of optimism sustained in February helped push employment higher. The rate of job creation recovered from January's slowdown yet remained moderate by historical standards. Companies commonly reported that rising costs continued to curb their appetite to hire new staff.

UK employment

Manufacturing-led growth

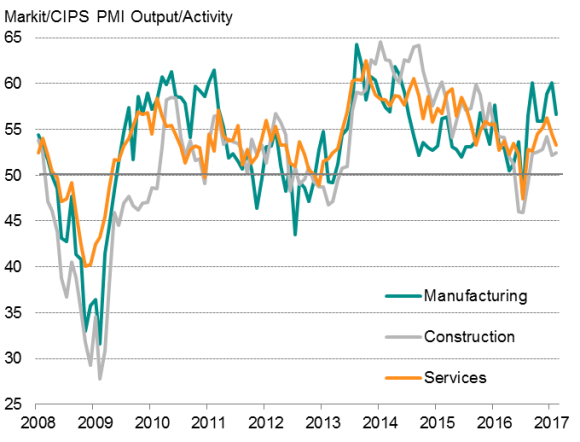

Looking at the data by sector, manufacturing continued to lead the expansion, aided by a revival in export trade. The weaker pound was again reported to have been a key driver of stronger export sales. However, the overall rate of growth of factory production slowed to a three-month low.

The service sector also saw growth wane, down to a five-month low and a rate far weaker than the solid pace seen late last year. The recent service sector slowdown has been most prominent in consumer-oriented sectors.

However, the slowest pace of expansion was recorded in the construction sector, led by the first decline in commercial construction for four months and weaker momentum in housebuilding.

Business optimism meanwhile eased in all three sectors, as did growth of new business, suggesting a broad-based slowdown could be on the cards for March.

Output by sector

Costs increase

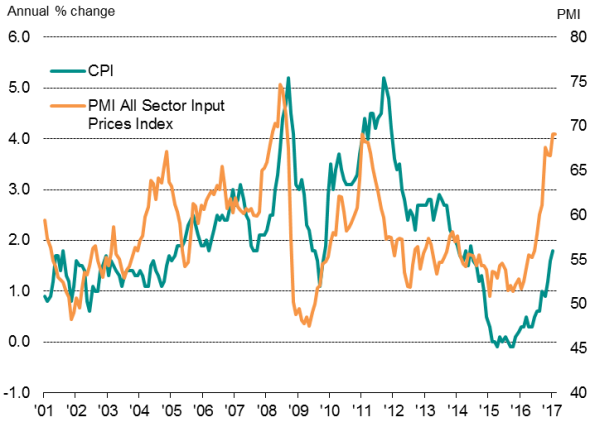

As well as seeing the fastest growth of the three sectors, manufacturing also continued to suffer the steepest rise in input costs. Although moderating compared to January, the rate of increase of factory material costs remained one of the steepest seen on record, commonly linked to rising commodity prices and the increase in import costs resulting from the weak exchange rate. The service sector saw cost inflation hit a post-crisis high, and construction material cost inflation was the second-steepest since 2008.

Measured across all sectors, average input costs rose at a rate identical to January's six-year high. With firms eager to pass higher costs on to customers in order to protect margins, average selling prices for goods and services also rose at a rate unchanged on January's near-six year high.

Policy outlook

The steep upturn in costs suggests that consumer price inflation has significantly further to rise from the 1.8% rate of increase seen in January, adding to our belief that inflation will breach 3% over the course of the next year.

UK inflation

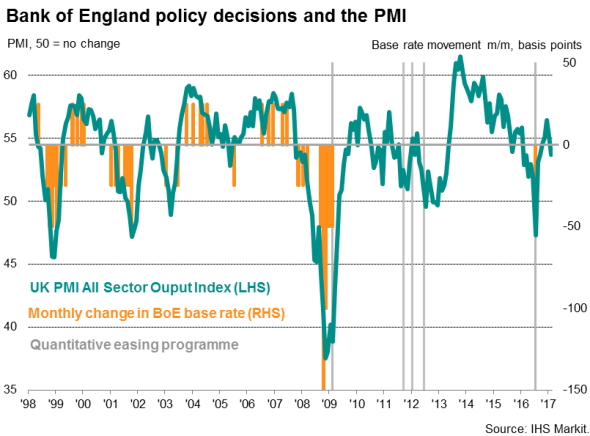

However, the slowdown in the pace of economic growth signalled by the February surveys pushes the PMI back towards territory more indicative of additional policy stimulus from the Bank of England than a tightening.

Policymakers are therefore likely to continue to stress the need to look through any further upturn in inflation and focus instead on the need to keep policy accommodative in the face of a likely further slowing in the pace of economic growth in 2017.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-pmi-indicates-slowdown-in-uk-gdp-growth-to-0-4-in-first-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-pmi-indicates-slowdown-in-uk-gdp-growth-to-0-4-in-first-quarter.html&text=PMI+indicates+slowdown+in+UK+GDP+growth+to+0.4%25+in+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-pmi-indicates-slowdown-in-uk-gdp-growth-to-0-4-in-first-quarter.html","enabled":true},{"name":"email","url":"?subject=PMI indicates slowdown in UK GDP growth to 0.4% in first quarter&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-pmi-indicates-slowdown-in-uk-gdp-growth-to-0-4-in-first-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+indicates+slowdown+in+UK+GDP+growth+to+0.4%25+in+first+quarter http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-pmi-indicates-slowdown-in-uk-gdp-growth-to-0-4-in-first-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}