Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2015

Solid PMI results support ECB view of eurozone recovery "on track'

The ECB kept its foot firmly on the stimulus pedal at its June policy meeting, dismissing suggestions that a revival in economic growth, signs of resurgent inflation and bond market volatility may prompt the central bank to taper or curb its quantitative easing programme.

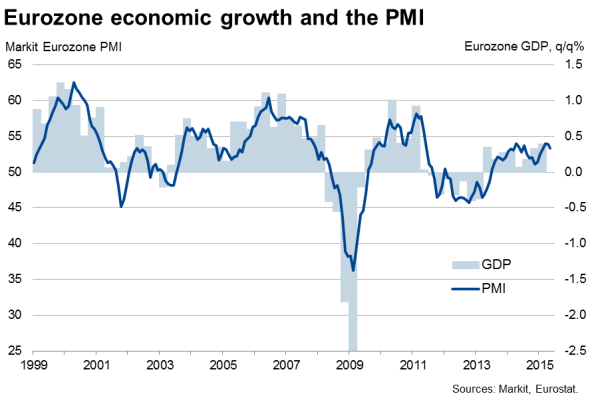

Since the ECB announced its €1.1 trillion asset purchase programme earlier this year, economic growth in the single currency area has surprised on the upside. The positive trend continued in May, with the final Markit Eurozone PMI" posting 53.6 in May, down from 53.9 in April but above the earlier flash estimate of 53.4 and consistent with the region's gross domestic product growing by 0.3-0.4% in the second quarter.

The survey data indicate that a weak euro is boosting manufacturing and households are benefitting from low prices, especially for fuel.

Although the current expansion signalled by the PMI suggests there's a good chance of the euro area beating the ECB's 1.5% growth forecast for 2015, there are significant downside risks. In particular, oil prices need to remain low and any escalation of the Greek crisis could rapidly derail the recovery. ECB President Mario Draghi also cited weaker-than-expected demand in other countries as a concern, something highlighted by disappointing starts to the year in the US and UK and recent weak PMI readings for many countries, especially Asian economies such as China and Japan.

The May dip in the Eurozone PMI is therefore a timely reminder that the recovery is no one-way bet. It's consequently no surprise that Draghi continues to stress the need for QE asset purchases to run their planned course and not be tapered in the light of the growth upturn, the possibility of which has been speculated on due to signs of returning inflation.

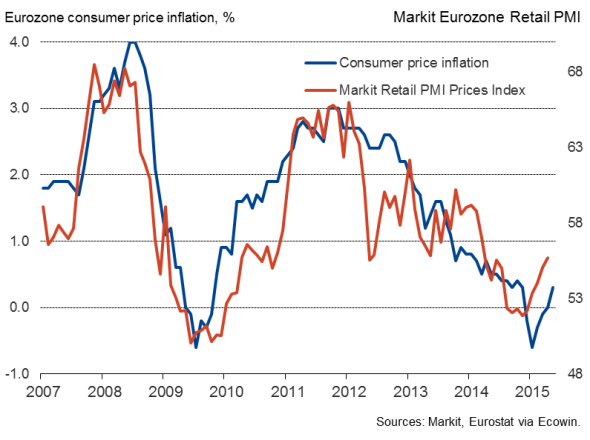

Consumer prices rose at an annual rate of 0.3% in May, in what is a strong turnaround from the 0.6% rate of decline seen at the start of the year. The ECB has consequently raised its 2016 inflation forecast to 1.5%.

Eurozone consumer prices

Worries about the eurozone falling into deflation appear to have been overplayed, and instead low prices have provided a major boost to consumer spending. April's retail PMI data pointed to further upward price pressures building (Retail PMI data for May are released tomorrow).

However, although rising, inflation clearly remains well below the ECB's target of close to 2% and a return to target still looks a long way off.

The central bank also left its main refinancing rate at 0.05% and the overnight deposit rates at -0.20%, meaning banks still need to pay to hoard money at the central bank rather than do something more useful with it, such as lending it to businesses and households. In an encouraging sign of the effectiveness of the policy stance, ECB data show bank lending having risen for the first time in three years in March, though stabilised in April.

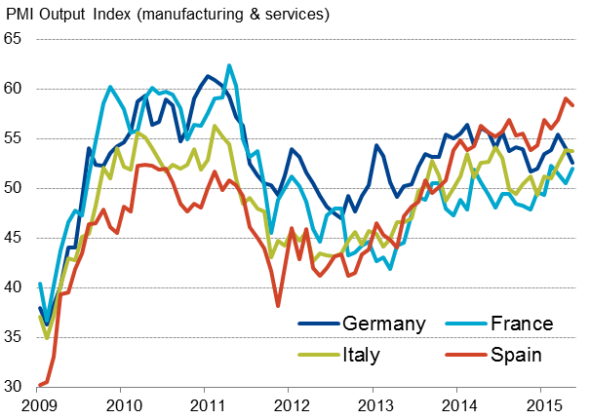

The ECB has also been keen to stress the need for structural reforms in recent communications, which the PMI data suggest have been particular beneficial to boosting competitiveness in Spain, but a missing ingredient to other struggling countries, notably France. The PMI data showed growth booming in Spain but near-stagnant in France.

In many senses, Draghi is therefore right to say that "The recovery is on track exactly according to our projections".

Growth in the four-largest euro states

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-solid-pmi-results-support-ecb-view-of-eurozone-recovery-on-track.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-solid-pmi-results-support-ecb-view-of-eurozone-recovery-on-track.html&text=Solid+PMI+results+support+ECB+view+of+eurozone+recovery+%22on+track%27","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-solid-pmi-results-support-ecb-view-of-eurozone-recovery-on-track.html","enabled":true},{"name":"email","url":"?subject=Solid PMI results support ECB view of eurozone recovery "on track'&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-solid-pmi-results-support-ecb-view-of-eurozone-recovery-on-track.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Solid+PMI+results+support+ECB+view+of+eurozone+recovery+%22on+track%27 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-solid-pmi-results-support-ecb-view-of-eurozone-recovery-on-track.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}