Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 03, 2015

Eurozone's manufacturers show resilience despite record slump in Greece

The eurozone manufacturing economy showed encouraging resilience in the face of the Greek debt crisis in July. At 52.4, the Markit Eurozone Manufacturing PMI held close to its June level of 52.5 - which had been the highest for over a year - coming in ahead of the earlier 52.2 flash estimate largely on the back of stronger than previously recorded growth in Germany.

The survey's output index in fact was unchanged on the June level, and employment growth ticked higher. The key area of weakness was a slowing in the rate of growth of new orders, but even here the survey only pointed to a very modest easing in the pace of expansion of new business.

Record slump in Greece

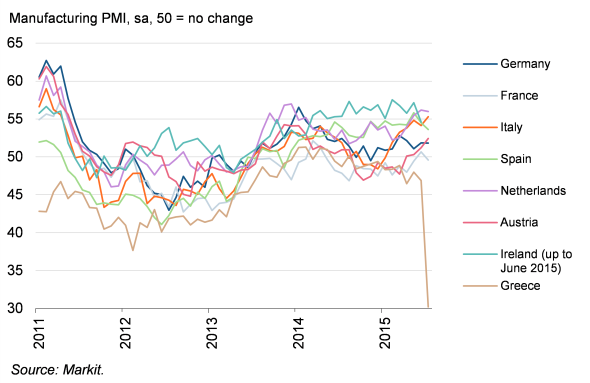

The solid regional PMI readings were especially impressive given the striking - though not surprising - impact that the Greek crisis, and in particular the bank closures, had on that country's economy, with the Greek PMI (at 30.2, down from 46.9 in June) signalling the steepest downturn ever seen in the survey's 16-year history. It is clear that Greece's recession will have deepened significantly in the second quarter, which will have a knock-on effect in terms of worsening the country's fiscal position due to the squeeze on tax revenues.

Core worries

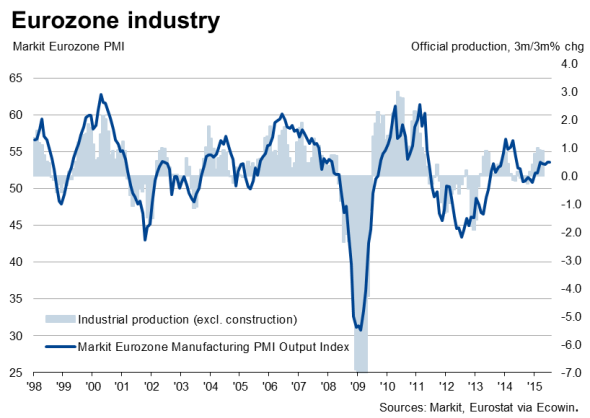

However, despite holding up well on prior months, the overall rate of growth in the region as a whole remains only modest, pointing to industrial production growing at an annualised rate of around 2%.

Manufacturing by country

The manufacturing performance of the so-called "core' remains a concern. France slipped back into contraction with a PMI reading of 49.6 (unchanged on the flash reading), making it the only country besides Greece to see worsening business conditions in July.

Only lacklustre growth was again seen in Germany, with a PMI of 51.8 (down from 51.9 in June but above the flash reading of 51.5) suggesting the euro area's largest member state continued to act as a brake on the overall region, suffering a fall in export orders for the first time since January.

The most impressive growth rates are being seen in the Netherlands, Spain and Italy, the latter being notable in enjoying its strongest growth for over four years in July with a PMI of 55.3. It was the Netherlands that topped the rankings, however, with a PMI of 56.0, down from 56.2 in June but signalling the country's strongest growth spell for one-and-a-half years.

Reassured policymakers

Policymakers will be reassured by the robust growth rates seen in these countries and the resilience of the region's manufacturing sector as a whole outside of Greece, especially as growth is likely to pick up again now that Greece has jumped its latest hurdle in the ongoing debt crisis.

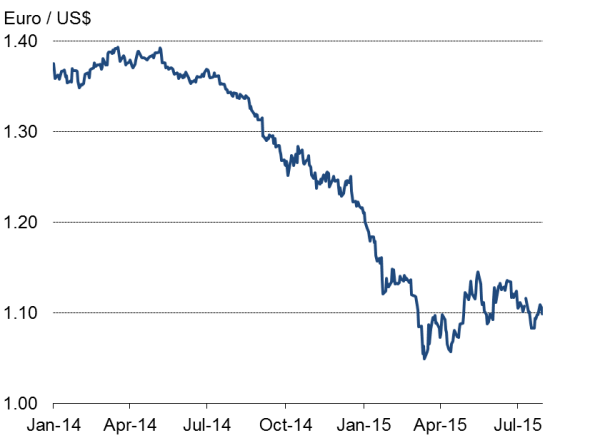

There is also some encouragement on the inflation front, with average prices charged by manufacturers rising for a second successive month. Although only modest, the rise in charges contrasts with falling prices earlier in the year and therefore marks a step in the right direction towards raising inflation from its current 0.2%. The upturn in prices to a large extent reflected rising costs, in turn often linked to the weakened euro. The currency is down approximately one-fifth from roughly $1.35 a year ago to around $1.10 in recent sessions as the ECB's €60bn per month asset purchases contrasts with growing belief that the US Fed will start hiking interest rates later this year.

The ECB is likely to express the view that the region's recovery remains "on track" and that the manufacturing sector should help delivery economic growth of approximately 1.5% in 2015.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-economics-eurozone-s-manufacturers-show-resilience-despite-record-slump-in-greece.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-economics-eurozone-s-manufacturers-show-resilience-despite-record-slump-in-greece.html&text=Eurozone%27s+manufacturers+show+resilience+despite+record+slump+in+Greece","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-economics-eurozone-s-manufacturers-show-resilience-despite-record-slump-in-greece.html","enabled":true},{"name":"email","url":"?subject=Eurozone's manufacturers show resilience despite record slump in Greece&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-economics-eurozone-s-manufacturers-show-resilience-despite-record-slump-in-greece.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone%27s+manufacturers+show+resilience+despite+record+slump+in+Greece http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-economics-eurozone-s-manufacturers-show-resilience-despite-record-slump-in-greece.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}