Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 03, 2014

US jobs growth rebounds and jobless rate plunges, but wage growth disappoints

Buoyant labour market data, plus signs that the US economy is growing strongly despite slower growth elsewhere in many countries, adds to the likelihood of the Fed being the first major central bank to hike interest rates.

Further robust data in coming months will fuel expectations that the first rate hike could occur early next year, earlier than current expectation of a mid-year hike, though policymakers will want to see wage growth revive before being comfortable with raising households' borrowing costs.

Revival in hiring

Non-farm payrolls rose by 248,000 in September, according to the Bureau of Labor Statistics, surprising analysts who were on average expecting a 215,000 rise. Job creation in prior months was also revised up. July's increase was revised from 212,000 to 243,000 and August's lame figure of 142,000 has been boosted to a more respectable-looking 180,000.

Payrolls have shown an average monthly rise of 224,000 in the third quarter, down from 266,000 in the second quarter but above the 190,000 average seen in the first three months of the year. The third quarter perhaps provides the best indication of the underlying hiring trend: while the weakness in the first quarter reflected extreme weather disruptions, the second quarter was buoyed by the subsequent rebound.

Resilient economic growth in Q3

The increased rate of job creation in the third quarter accompanies data which show the economy continuing to boom in recent months. Markit's PMI surveys suggest the economy is set to have grown at a minimum 3% annualised rate again in the third quarter,with business activity surging in factories and service sector companies alike (note that final Services PMI data for September are published later today).

Importantly, the PMI surveys also suggest that the US is showing resilience in the face weakening economic conditions in many other countries, including those in the eurozone and many emerging markets. This "decoupling' means, however, that the US is likely to be the first major developed economy to hike interest rates, which will put further upward pressure on the dollar.

Jobless rate lowest since 2008

The prospect of higher interest rates is also brought further into focus by the upturn in job creation helping bring the unemployment rate down from 6.1% to 5.9%, its lowest since July 2008 and markedly below the 7.2% seen a year ago.

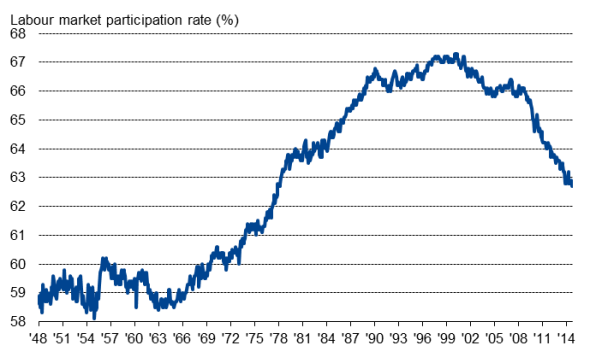

However, the drop in the jobless rate was in part due to the participation rate edging down to 62.7%, its lowest since 1978. This raises concerns among policymakers as to why people who may be eligible for work are simple leaving the job market, giving up on the hunt for suitable work. It also suggest there may be plenty of slack left in the labour market, meaning the economy can grow without stoking inflation if these discouraged workers choose to re-enter the job market.

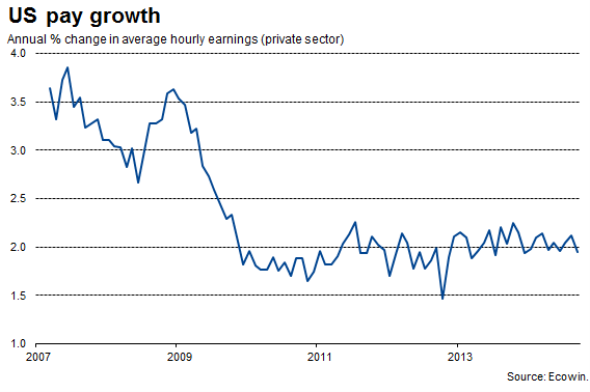

Policymakers will certainly be worried by the lack of wage growth. Average hourly earnings increased by just 2.0% on a year ago in September. Without substantially higher wage growth, the fear is that households will pull back on consumption if interest rates and borrowing costs start rising, snuffing out the wider economic recovery.

In the detail of the jobs report, service sector companies added 207,000 to their payrolls in September, the largest rise for three months, while construction companies added 16,000 but manufacturers reported a mere 4,000 rise. Government positions increased by 12,000; the largest rise since April.

Labour market participation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-US-jobs-growth-rebounds-and-jobless-rate-plunges-but-wage-growth-disappoints.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-US-jobs-growth-rebounds-and-jobless-rate-plunges-but-wage-growth-disappoints.html&text=US+jobs+growth+rebounds+and+jobless+rate+plunges%2c+but+wage+growth+disappoints","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-US-jobs-growth-rebounds-and-jobless-rate-plunges-but-wage-growth-disappoints.html","enabled":true},{"name":"email","url":"?subject=US jobs growth rebounds and jobless rate plunges, but wage growth disappoints&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-US-jobs-growth-rebounds-and-jobless-rate-plunges-but-wage-growth-disappoints.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+jobs+growth+rebounds+and+jobless+rate+plunges%2c+but+wage+growth+disappoints http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-US-jobs-growth-rebounds-and-jobless-rate-plunges-but-wage-growth-disappoints.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}