Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 03, 2014

Europe's top shorts deliver

October's turbulent markets have played into the hands of European short sellers as the shares which they were willing to pay the most for have underperformed the market by the widest margin in over six months.

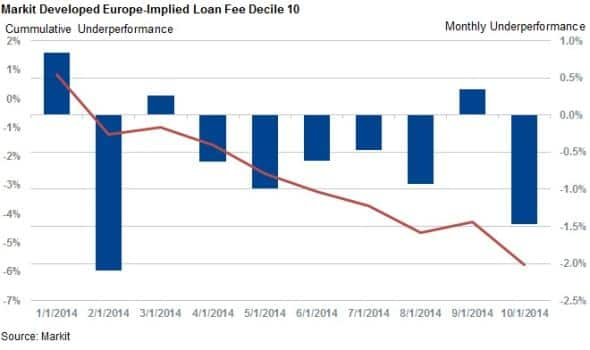

- The 10% of shares which cost the most to short in Europe have underperformed the market by 1.5% in October; the worst underperformance in eight months

- The "top' or most expensive shorts (the tenth decile) have underperformed their peers by a cumulative 5.7%

- This contrast with the least expensive to borrow shares which have delivered cumulative relative outperformances of 4.3% year to date

- Technology software and services make up the some of the most successful shorts of the last four weeks, with recent IPOs King Digital and Mobileye targeted

October will be remembered by market commentators as a tale of two halves for European investors. The first two weeks of the month saw the Stoxx lose more than 10% of its value, pushing it on the way to new yearly lows. Despite talks of a possible long term correction, better than expected macroeconomic news from abroad and the fact that the great majority of the region's banks passed regulator-imposed stress tests saw confidence return to the markets. As a result, we have seen the index climb back to roughly where it started out the month.

Despite the recent volatility and the fact that the markets have traded flat for the month, short sellers look to have managed to eke out a profit as the most expensive to borrow shares in the region have underperformed the market by a wide margin.

Most shorted underperform

Shorts have managed to continue to perform relatively well in Europe, with the 10% of shares commanding the highest fee in the securities lending market (a gauge of how committed short sellers are in a name) underperformed the rest of their peers by a significant 1.5%. The shares with the highest fee among the Markit Developed Europe universe have returned 0.6% over the month of August, nearly 1% lower than the returns posted by the wider universe.

The recent underperformance has seen European shares underperform the market by the widest margin since February. This strong underperformance, added to the fact that the most expensive to short shares have lagged behind the market for six of the previous nine months, sees these shares trail the market by 5.7% since the start of the year.

Software and services underperform

Software and services firms feature prominently in this month's short sellers' shopping baskets, with 11 firms among this the most expensive to borrow shares. This includes King Digital which was August's best performing in Europe. The company continues to earn the most bearish score in the fee factor, despite the fact that its shares look to have bottomed out in recent weeks.

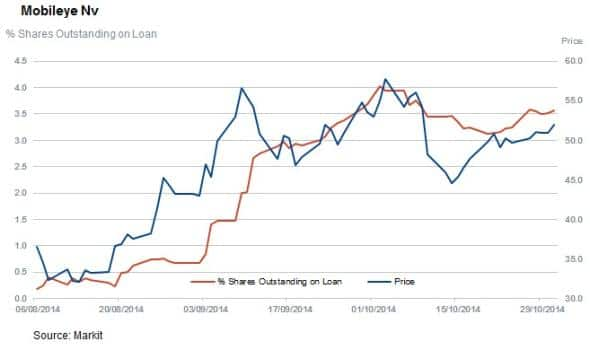

Another stock earning a bearish rank is Mobileye, an Israel-based company which develops software for detecting potential automotive collisions. here are currently only 3.5% of shares out on loan with the share price down 4% over the past month. The stock is up 42.5% since listing in August, but short sellers seem undeterred by the recent price surge as they have continued to add to their positions.

Dutch sim card maker Gemalto has seen increased short selling, with 22.4% of shares out on loan after Apple revealed their own sim card for handsets. Gemalto is currently in the top 2% of most expensive shorts in Europe and demand is peaking as we have seen the company's share price decline 15.2% over the last 30 days.

Other highlights

CGG takes the title of the best performing short of the last month. The geosciences firm serves the oil and gas industry and takes the top spot with a 33% decline in price over the last month with 10% of shares currently out on loan. This recent tumble takes the stocks fall to over 60% since the start of the year.

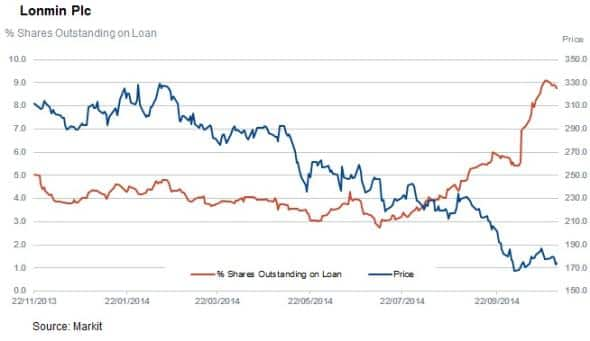

Another company to see surging short interest is South African platinum miner Lonmin whose short interest has increased to 8.8% of shares outstanding. With shares down 44.4% year to date, short interest has risen significantly over the last few weeks. The company has only recently ramped up to full production post another strike season and tough labour negotiations. fourth quarter results for the company are due on November 10th.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-equities-europe-s-top-shorts-deliver.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-equities-europe-s-top-shorts-deliver.html&text=Europe%27s+top+shorts+deliver","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-equities-europe-s-top-shorts-deliver.html","enabled":true},{"name":"email","url":"?subject=Europe's top shorts deliver&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-equities-europe-s-top-shorts-deliver.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Europe%27s+top+shorts+deliver http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112014-equities-europe-s-top-shorts-deliver.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}