Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 03, 2014

Russia braced for recession and spiralling prices

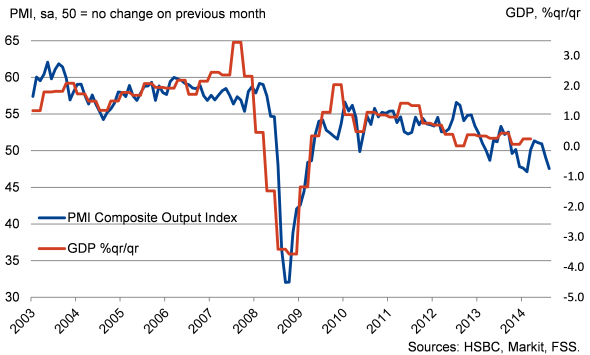

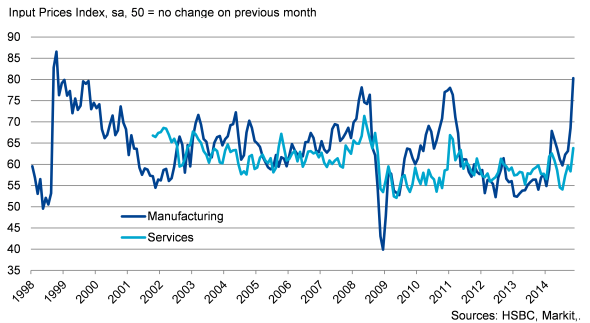

Russian PMI data signalled a steepening downturn in the service sector in November, adding to signs that the wider economy will soon fall into recession. With survey data for manufacturers' input prices meanwhile signalling the fastest rate of inflation since late-1998, Russia faces the unenviable combination of recession and rising inflation.

Russia PMI and GDP

Economy set to contract

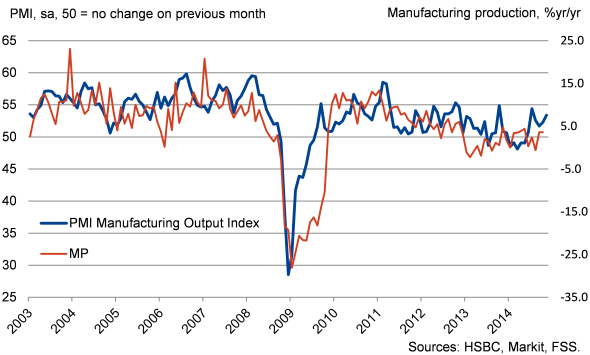

Service sector activity and new business both fell at the fastest rates in five-and-a-half years in November, more than offsetting faster increases in manufacturing output and new orders. The recent manufacturing upturn looks to be driven by the domestic market and import substitution, according to survey respondents. New export business, in contrast, declined for the fifteenth month running.

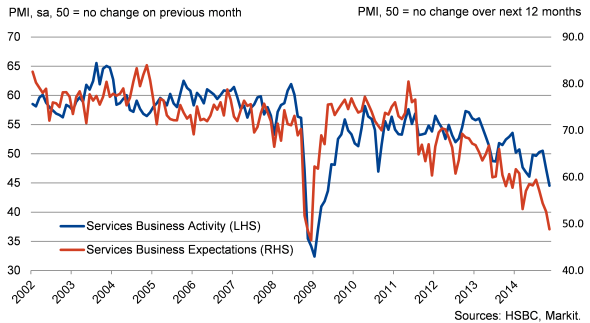

Service sector contracts at faster rate

Manufacturing boosted by domestic demand

Employment and backlogs of work fell across both sectors in November, and the outlook in the service sector sank to the weakest since December 2008.

The PMI data for October and November are so far consistent with a quarterly decline in GDP of around 0.3-0.4% in the fourth quarter.

Meagre growth in Q3

The fourth quarter downturn follows a slowdown in the economy in the third quarter. Official data published on 13 November showed a 0.7% year-on-year rise in GDP in the third quarter of 2014, the third successive quarter of slowing annual growth. It was also the worst reading since the final quarter of 2009, when the economy shrank 2.8% on a year-on-year basis. The first estimate of quarterly GDP does not include a quarter-on-quarter comparison, but PMI data for the three months to September are consistent with a quarterly rise of around 0.2%, similar to the meagre growth recorded in the second quarter.

The Russian Economy Ministry downgraded its 2015 projections on 2 December, expecting the economy to contract by 0.8% next year (following an earlier estimate of 1.2% growth). The latest PMI data suggest that this downturn has already started, and business confidence surveys suggest that companies share the Ministry's pessimism.

Business outlook deteriorates

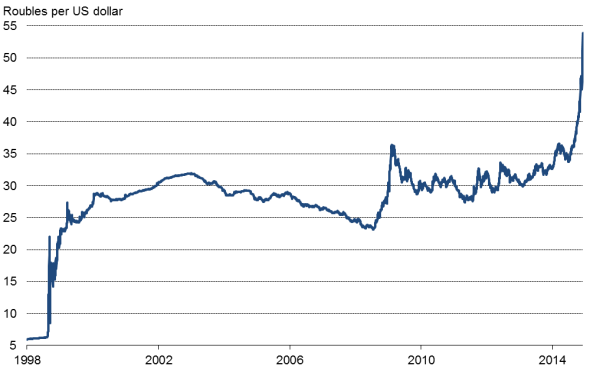

Markit's latest Business Outlook survey, which looks at expectations for the year ahead across the Russian PMI survey panels, indicated that business optimism sank to a record post-global financial crisis low in October. The combined net balance for business activity stood at +10 percent, the lowest since the composite series started in October 2009. It was also the lowest figure among all countries surveyed globally. Firms highlighted a wide range of threats over the next 12 months, including a stagnation of the wider Russian economy, ongoing depreciation of the ruble (leading to higher import prices), falling oil prices, deteriorating relations with the West, economic sanctions, higher interest rates, high taxation and a difficult investment climate.

Ruble dives against dollar

The November Services Business Expectations Index from the PMI survey reinforced the earlier Business Outlook survey findings. For the first time in nearly six years, a higher proportion of firms expect activity at their units to decline over the next 12 months than those forecasting growth. A negative outlook had previously been registered only twice since the survey began in mid-2001, in November and December 2008.

Service sector sentiment close to record low

Inflationary pressures surge as ruble tumbles

The November PMI surveys also highlighted rising inflationary pressures in both manufacturing and services. The goods-producing sector is particularly exposed to the recent collapse in the ruble exchange rate, and input prices for manufacturers rose at the fastest rate in over 16 years in November as import costs jumped higher. Producers raised their own prices at the strongest rate since March 2011 as a result.

Manufacturing input prices surge

Meanwhile, service sector input price inflation showed the second-fastest month-on-month acceleration in the survey history in November, with the rate surging to a 45-month high, and prices charged for services rose at the fastest rate for 40 months.

November PMI survey data were collected 12-26 November.

Forthcoming PMI releases

HSBC Russia Manufacturing PMI: 29 December

HSBC Russia Services PMI: 30 December

Trevor Balchin | Economics Director, IHS Markit

Tel: +44 149 1461065

trevor.balchin@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-Russia.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-Russia.html&text=Russia+braced+for+recession+and+spiralling+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-Russia.html","enabled":true},{"name":"email","url":"?subject=Russia braced for recession and spiralling prices&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-Russia.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russia+braced+for+recession+and+spiralling+prices http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-Russia.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}