Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 04, 2018

Australia PMI surveys signal a further pick-up in growth and prices during December

The Australian economy ended 2017 with its weakest quarter in over a year, though the latest Commonwealth Bank PMI surveys also suggest that growth may well gather pace in early-2018. Rising inflationary pressures meanwhile add to expectations for tighter monetary policy this year.

Accelerating growth at end of Q4

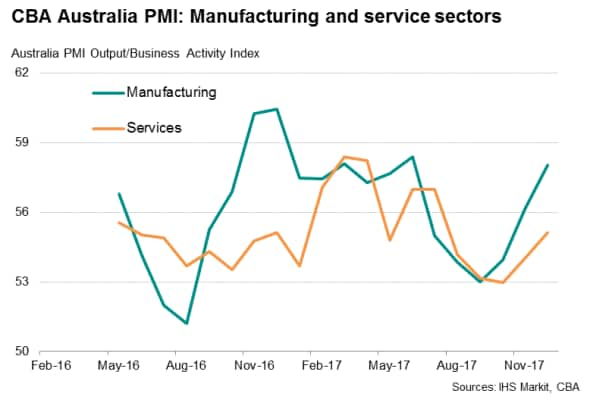

The Commonwealth Bank of Australia Composite PMI™ Output Index rose from 54.3 in November to a five-month high of 55.5 in December. The upturn was driven by faster growth of activity in both the manufacturing and service sectors.

The manufacturing industry continued to lead overall economic expansion as the rate of growth of goods production reached the highest for six months, matched by a similarly marked increase in new orders. Elevated business optimism also saw factories stepping up their input purchases and building up inventories. Notably, backlogs of work rose to the greatest extent since the survey started in May 2016, reflecting stretched operating capacity and portending further output growth.

The service sector showed robust growth, with business activity and new orders both rising at increased rates, albeit below those seen in the goods-producing sector.

Brighter outlook

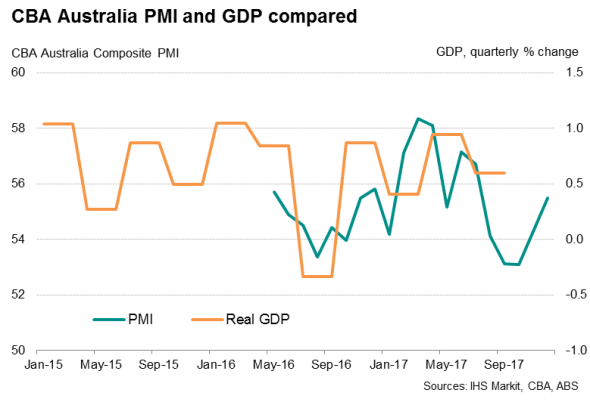

The CBA survey data accurately foretold the slowdown in growth during the third quarter. Official statistics showed the economy expanding 0.6% in the three months ending September, down from a revised 0.9% rise seen in the second quarter. By comparison, the PMI averaged 54.7 in Q3 down from 56.8 in Q2.

With the fourth-quarter average composite PMI reading at 54.3, the lowest since Q3 2016, a further slowing is on the cards for the closing quarter of 2017.

However, a solid start to 2018 is expected after December survey data showed a further pick-up in growth at the end of the fourth quarter. Meanwhile, hiring remains robust, linked to efforts to ameliorate stretched capacity amid robust demand. Employment across both monitored sectors showed solid growth in recent months. Improved job prospects are likely to feed through to higher wages as firms encounter increasing difficulty in finding suitable labour.

Companies' future expectations about business activity levels in a year's time remained elevated despite easing to a seven-month low.

The positive December data therefore add to the view that the economy should gather some momentum in 2018. IHS Markit expects real GDP growth to accelerate from an expected 2.3% in 2017 to 2.6% this year.

Rising prices

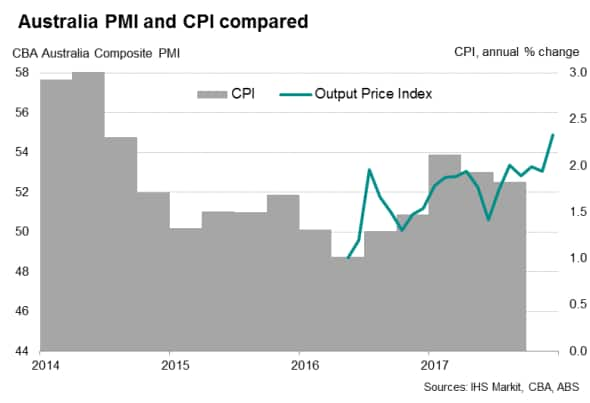

The survey data also indicated a further rise in input costs, with solid rates of increase recorded across the economy. Higher import costs and greater labour expenses were reported. As firms sought to protect margins, they raised average prices charged for goods and services at the steepest rate in the survey history during December.

Higher inflationary pressures will be welcomed by the Reserve Bank of Australia as headline inflation has largely held below the central bank's target range of 2-3% for three years. IHS Markit expects the RBA to raise the policy rate from a record low of 1.5% in the fourth quarter this year.

Global ranking

Global manufacturing had a solid year in 2017, with European economies performing especially well, enjoying one of the best growth rates since the global financial crisis. In contrast, weaker trends are seen in many countries in the Asia Pacific region. Outside of Europe, Australia was the strongest performing manufacturing economy.

The Commonwealth Bank PMI for manufacturing showed the 2017 average at 55.5, placing it in eighth position of the global manufacturing rankings.

Manufacturing PMI rankings over 2017

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-economics-australia-pmi-surveys-signal-a-further-pick-up-in-growth-and-prices-during-december.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-economics-australia-pmi-surveys-signal-a-further-pick-up-in-growth-and-prices-during-december.html&text=Australia+PMI+surveys+signal+a+further+pick-up+in+growth+and+prices+during+December","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-economics-australia-pmi-surveys-signal-a-further-pick-up-in-growth-and-prices-during-december.html","enabled":true},{"name":"email","url":"?subject=Australia PMI surveys signal a further pick-up in growth and prices during December&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-economics-australia-pmi-surveys-signal-a-further-pick-up-in-growth-and-prices-during-december.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+PMI+surveys+signal+a+further+pick-up+in+growth+and+prices+during+December http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-economics-australia-pmi-surveys-signal-a-further-pick-up-in-growth-and-prices-during-december.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}