Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 04, 2016

Bank of England announces new stimulus package to avert recession

The Bank of England has announced aggressive action to shore up the economy and avert a slide into recession. The action is designed to illustrate that the Bank is willing and able to act quickly in response to the economic shock created by the surprise 'Brexit' vote, and is accompanied by assurances that policymakers are "ready to take whatever action is needed" if the bank's revised gloomy forecasts turn out to be correct.

The Monetary Policy Committee not only voted to cut interest rates to a record low of 0.25% but also decided to increase its quantitative easing programme, buying more government and corporate bonds, as well as announcing a new scheme to encourage more bank lending. The majority of policymakers also stand ready to delivery more stimulus later this year if required.

Recession risk

There was a clear need for the Bank to take action and the measures will help reduce borrowing costs, encourage more lending, shore up confidence and of course push the pound down further, benefitting exporters.

As noted by governor Mark Carney in the press conference following the decision: "We are seeing risks manifest in a wide variety of indicators -- indicators which in many cases are better indicators of what is actually happening in the economy, rather than what we call hard data -- so there is a clear case for stimulus, and stimulus now, in order to have an effect when the economy really needs it."

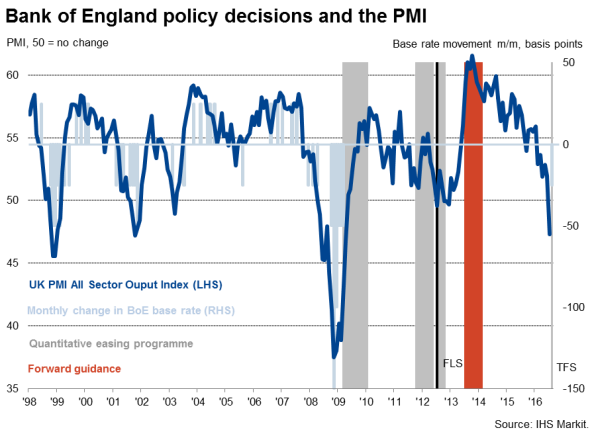

Deputy governor Ben Broadbent added in reference to a chart displaying PMI data: "This is one of the more reliable indicators of activity, the CIPS [PMI] surveys. We've weighted the sectors here into one single series, or rather two - one for output, one for expectations. These are the steepest falls in both those series we've ever had and they're both of them at levels we haven't seen since early 2009. They are reliable indicators, these and a few other surveys, and I would point out that if you took them at face value, they would suggest that the economy is actually contracting."

The major concern has therefore been a record slide in the Markit/CIPS PMI survey data to the lowest since April 2009. The July surveys indicated a steep drop in both business activity and business sentiment regarding the outlook for the year ahead, pointing to an increased risk of recession. The July numbers are consistent with GDP falling at a quarterly rate of 0.4% in the third quarter.

The surveys indicate that activity has slumped since the 23rd June referendum, with intensifying political and economic uncertainty caused by the prospect of 'Brexit' resulting in an immediate and broad-based downturn in demand across the construction, manufacturing and service sectors.

Gloomy forecasts, but no recession

The Bank has consequently slashed its projections for economic growth in response to the downturn seen in the aftermath of the UK's vote to leave the EU. The economy is still expected to grow 2.0% this year, but to eke out a mere 0.8% expansion next year, down from a prior expectation of 2.3% growth. Growth in 2018 is now expected to reach a modest 1.8%.

Importantly, the Bank sees almost no growth in the second half of 2016, though does not see a recession as its central forecast, averted in part thanks to the aggressive action announced today.

However, unemployment is set to rise to 5.6% in two years' time, up from a projection of 4.9% made in May.

Inflation is meanwhile expected to rise to 2.4% in two years' time, largely on the back of higher import prices resulting from the depreciation of sterling since the EU referendum. It's clear, though, that the Bank is prepared to 'look through' what it expects to be a temporary hike in inflation, preferring instead to try to limit the risk of recession.

Aggressive action

The 25 basis points rate cut is the first since 2009 and was widely expected. The nine-member Monetary Policy Committee voted unanimously to reduce the main policy rate, and the minutes from the meeting showed most were prepared to cut further towards zero later this year if the economy continued to show signs of deteriorating in line with the bank's updated forecasts.

To facilitate the feed-though of lower interest rates to the economy, all members voted to launch a Term Funding Scheme whereby banks get preferential rates on up to "100bn of lending, conditional on how much each bank lends.

There was less unanimity on quantitative easing. Only six of the nine members voted to increase the Bank's government bond purchases from "375bn to "435bn. From mid-September, the Bank will also start buying "10bn of investment-grade corporate bonds, a move voted for by all but one MPC member.

However, more action may well be needed, and not just from the Bank of England.

While all of the measures announced are likely to help support the economy, there are huge question marks over the effectiveness of each measure. Lower interest rates benefit borrowers but, at such low levels, hurt savers, who could in turn cut back on spending. With gilt yields already at historic lows, the impact of additional quantitative easing is also in doubt. There are also concerns that the corporate bond purchase programme may be constrained by the limited number of companies for which sufficient quantities of bonds can be bought that will have a direct link to the domestic economy.

The overriding concern is that the Bank can reduce the cost of credit and encourage more lending, but it can do little to boost the demand for lending and spur spending if business and households are worried about the outlook.

The focus therefore now shifts to the Chancellor's Autumn Statement, which will outline the extent to which fiscal policy will be used to provide additional support to the economy.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-bank-of-england-announces-new-stimulus-package-to-avert-recession.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-bank-of-england-announces-new-stimulus-package-to-avert-recession.html&text=Bank+of+England+announces+new+stimulus+package+to+avert+recession","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-bank-of-england-announces-new-stimulus-package-to-avert-recession.html","enabled":true},{"name":"email","url":"?subject=Bank of England announces new stimulus package to avert recession&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-bank-of-england-announces-new-stimulus-package-to-avert-recession.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+announces+new+stimulus+package+to+avert+recession http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-bank-of-england-announces-new-stimulus-package-to-avert-recession.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}