Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 04, 2017

PMI surveys show UK economy struggling with slow growth and rising prices

The pace of UK economic growth edged down to the joint-lowest for just over a year in September, according to PMI survey data. However, price pressures intensified to suggest that policymakers may continue to talk up rate hike prospects.

Economy on course for modest Q3 growth

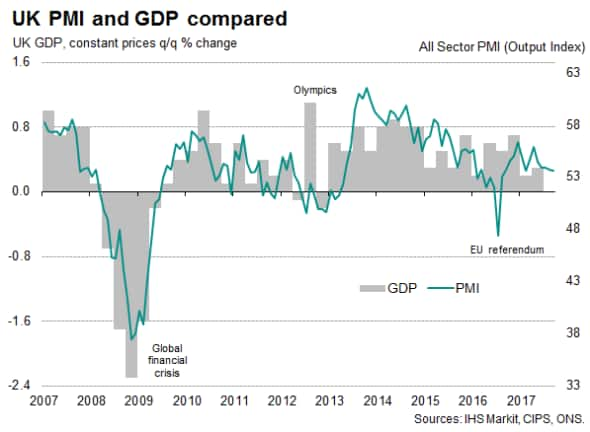

The latest survey data indicated that the economy continued to expand at a modest pace in September, but that growth momentum continued to be gradually eroded. The 'all-sector' IHS Markit/CIPS PMI slipped further from April's recent high, down from 53.7 in August to 53.6 in September. The current reading matched February's recent low to therefore signal the joint-weakest expansion of output since August of last year.

The survey data put the economy on course for another subdued 0.3% expansion in the third quarter, matching the performance seen in the first half of the year, albeit with momentum being gradually lost over the course of the quarter.

With the exception of the slowdown seen in the months surrounding last year's referendum, the third quarter performance was the worst since the first quarter of 2013.

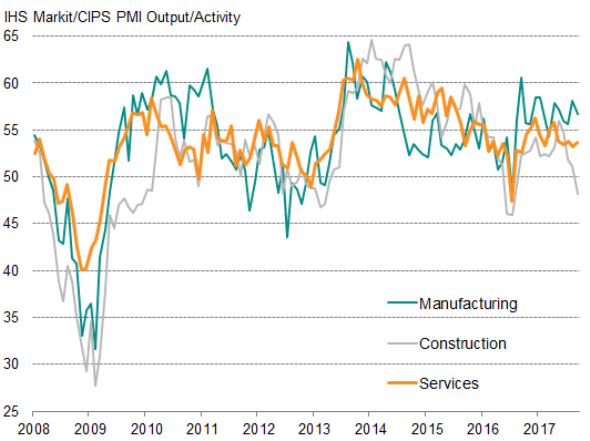

Slower manufacturing output growth and the first drop in construction activity for 13 months were accompanied by on-going weak service sector growth in September. Although output of the service sector grew at a slightly faster rate than August, the pace of expansion for the third quarter as a whole was the worst recorded for a year.

Within services, consumer-facing companies have reported especially weak growth in recent months, leaving reliance on financial services, transport and business services as the main drivers.

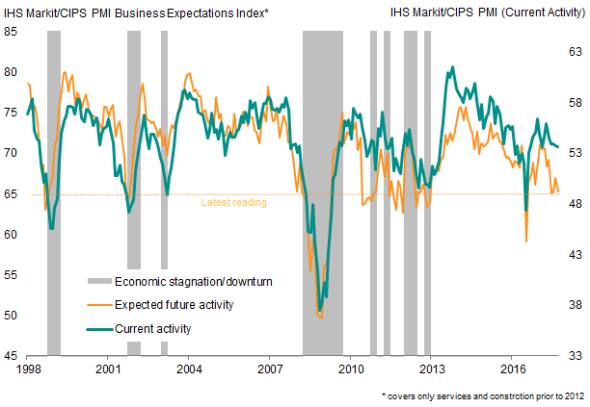

The slow erosion of growth may continue in coming months. Inflows of new business in September were the lowest for 13 months, suggesting demand growth has waned again. Business optimism about the year ahead meanwhile slipped lower again in September, running at a level historically consistent with business activity growth waning further in coming months and the economy slowing towards stagnation at best.

Hiring slowdown amid rising costs

The September surveys also signalled some pull-back in hiring. While August had seen the largest rise in employment since October 2015, September's jobs growth was the weakest since June reflecting slower payroll gains in both manufacturing and services.

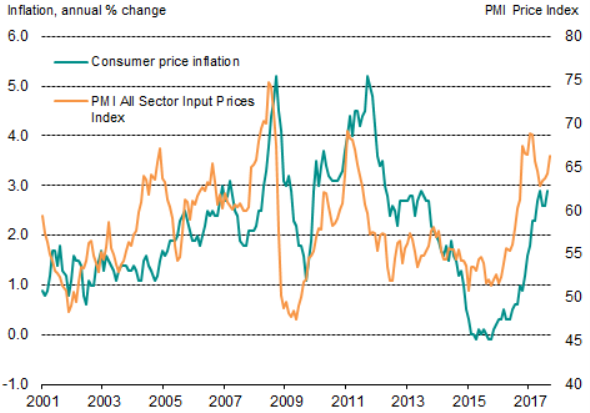

Slower employment growth in part reflected difficulties finding suitable staff, but was also a symptom of a reticence to hire amid worries about future demand and the need to offset higher input costs. Average input cost inflation accelerated in all three sectors, rising as a whole at the steepest rate since February.

Although not matching the highs seen earlier in the year, the rate of input price inflation remained elevated by historical standards, attributed to higher import costs due to sterling's weakness as well as rising global commodity prices, notably for oil.

Higher costs were often passed on to customers, leading to the largest monthly rise in average prices charged for goods and services since April and suggesting consumer price inflation could rise above 3% in coming months.

Policymakers pulled in different directions

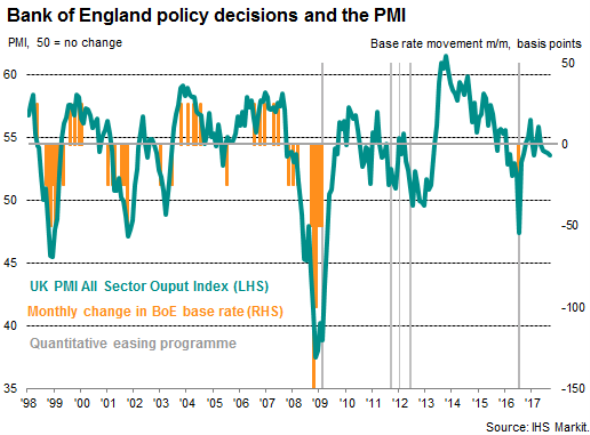

The rise in price pressures will pour further fuel on expectations that the Bank of England will soon follow-up on its increasingly hawkish rhetoric and hike interest rates. However, the decision is likely to be a difficult one, as the waning of the all-sector PMI in September pushes the surveys slightly further into territory that would normally be associated with the central bank loosening rather than tightening policy.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04102017-economics-pmi-surveys-show-uk-economy-struggling-with-slow-growth-and-rising-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04102017-economics-pmi-surveys-show-uk-economy-struggling-with-slow-growth-and-rising-prices.html&text=PMI+surveys+show+UK+economy+struggling+with+slow+growth+and+rising+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04102017-economics-pmi-surveys-show-uk-economy-struggling-with-slow-growth-and-rising-prices.html","enabled":true},{"name":"email","url":"?subject=PMI surveys show UK economy struggling with slow growth and rising prices&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04102017-economics-pmi-surveys-show-uk-economy-struggling-with-slow-growth-and-rising-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+show+UK+economy+struggling+with+slow+growth+and+rising+prices http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04102017-economics-pmi-surveys-show-uk-economy-struggling-with-slow-growth-and-rising-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}