Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 04, 2014

Bank of England holds policy amid growth risks and falling inflation

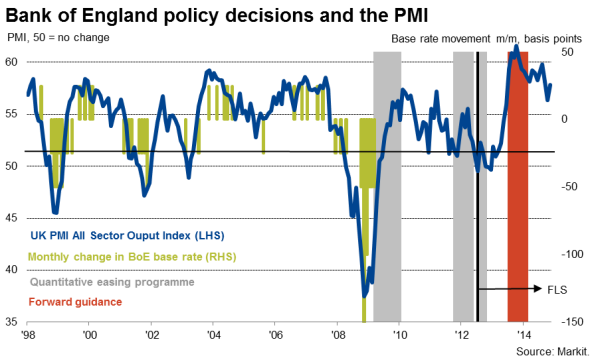

The Bank of England's Monetary Policy Committee left interest rates on hold at their final meeting of the year, but it's likely that the nine members remained split on the economic outlook and the appropriate course for policy.

It's expected that two MPC members, Martin Weale and Ian McCafferty, again voted to hike interest rates by 0.25% from their current record low of 0.5%, as they have done continually since August.

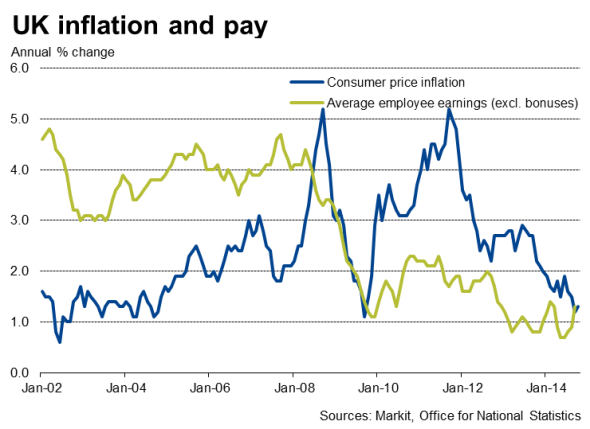

But with the Bank forecasting inflation to fall below 1.0% in coming months, forcing the governor to write an open letter of explanation to the Chancellor, it is likely that the majority of members remain of the opinion that there is no rush to tighten policy.

However, there is a chance that others may be veering towards joining the hawkish camp. There is an argument that inflation is currently low only because of the stronger exchange rate and lower global commodity prices, notably oil. Importantly, these are factors the MPC should "look through', or ignore, as they have previously done when they have driven inflation higher in the past.

Wage growth worries

Weale and McCafferty are worried that underlying price pressures could pick up sharply due to a lack of spare capacity in the economy. In particular, wage growth may accelerate as unemployment continues to fall. The jobless rate has dropped from 7.2% at the start of 2014 to 6.0% in the third quarter, with survey data suggesting a further decline is likely in the fourth quarter. There is some evidence that wages are indeed starting to pick up, with private sector pay growth moving higher from a recent low of 0.9% in the second quarter to 1.6% in the third quarter.

On the other hand, wage growth clearly remains weak by historical standards, and well below rates that would normally trigger alarm bells about a feed-through to higher inflation. With global oil prices plummeting, the inflation outlook has also improved.

Growth risks intensify

What's more, the pace of economic growth looks to have moderated in recent months. The PMI surveys are signalling GDP growth of 0.6% in the fourth quarter, down from 0.7% in the third quarter.

Downside risks to the economic outlook have also intensified. The eurozone is edging closer towards another downturn, with the Eurozone PMI sinking to a 16-month low in November, and worries about the crisis with Russia and the impact of sanctions have hit business confidence. Closer to home, the forthcoming General Election next year has the potential to destabilise the economy.

With these risks abounding, it can be argued that now is not the time to be starting to normalise policy, even gradually, as this will introduce one more worry to households and businesses. Higher rates would also of course push up the exchange rate, hitting already-lacklustre export performance.

It's likely, therefore, that the doves will continue to outnumber the hawks for some time to come, meaning it is likely that any hike in interest rates will be delayed until the second half of next year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122014-economics-bank-of-england-holds-policy-amid-growth-risks-and-falling-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122014-economics-bank-of-england-holds-policy-amid-growth-risks-and-falling-inflation.html&text=Bank+of+England+holds+policy+amid+growth+risks+and+falling+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122014-economics-bank-of-england-holds-policy-amid-growth-risks-and-falling-inflation.html","enabled":true},{"name":"email","url":"?subject=Bank of England holds policy amid growth risks and falling inflation&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122014-economics-bank-of-england-holds-policy-amid-growth-risks-and-falling-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+holds+policy+amid+growth+risks+and+falling+inflation http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122014-economics-bank-of-england-holds-policy-amid-growth-risks-and-falling-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}