Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 05, 2018

Japan PMI points to stronger fourth quarter growth and higher prices

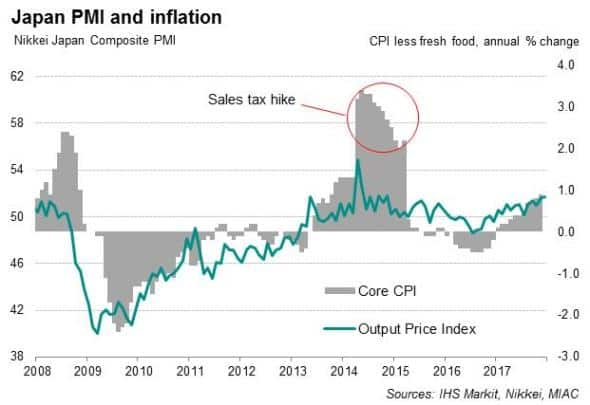

Nikkei PMI data showed Japanese economic growth maintaining solid momentum at the end of 2017. Price pressures meanwhile remained firm, with an encouraging trend of steadily rising selling prices.

Stronger fourth quarter growth

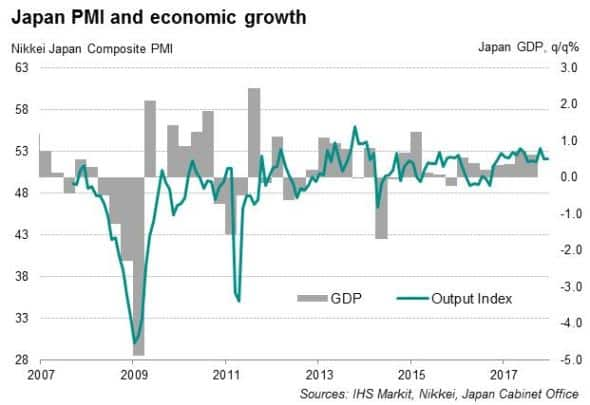

The Nikkei Composite PMI™ Output Index held steady at 52.2 in December, signalling a positive end to the year for Japan's economy. The latest reading brought the fourth quarter average to 52.6, up from the third quarter.

Official statistics from Japan's Cabinet Office showed that third quarter GDP was revised up from 0.3% in earlier estimates to 0.6%. Historical comparisons suggest the survey data are consistent with the economy expanding at a quarterly rate of 0.7% in the closing quarter of 2017, suggesting upside risk to many forecasts (IHS Markit's current prediction is for 0.3% growth).

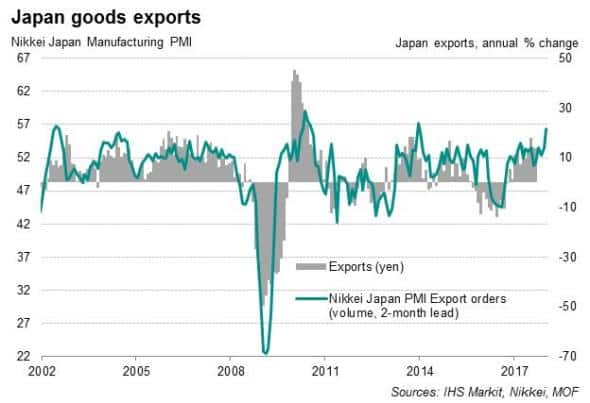

The goods-producing sector picked up momentum to show the fastest growth in nearly four years during December. Manufacturing activity has been buoyed in particular by solid export gains. The expansion of foreign sales was the strongest since late-2013.

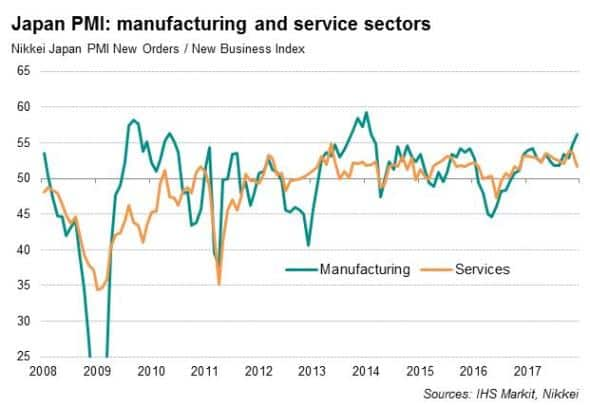

In contrast, the service sector maintained a modest rate of increase, though business conditions in the sector were noticeably better in 2017 compared with the previous year.

Softer domestic demand

Exports remained a major driver of economic growth, which has been most evident in the manufacturing sector. However, there is a clear risk of slower GDP growth if the export momentum eases.

A broadening of growth drivers, especially the domestic market, can mitigate this risk. While the service sector, commonly used as a barometer for domestic demand, has recorded higher business activity since October 2016, the rate of growth has generally been below that of manufacturing output. Furthermore, the December survey brought further signs of services activity lagging behind. The second half of 2017 saw slower growth in business activity on average compared with the first half of the year. This suggests waning domestic demand.

Forward-looking indicators in the service sector hint at a further slowing. Inflows of new business showed the smallest monthly rise since September 2016. Backlogs of work fell for the first time in over a year, reflecting a lack of capacity pressure.

Rising price pressures

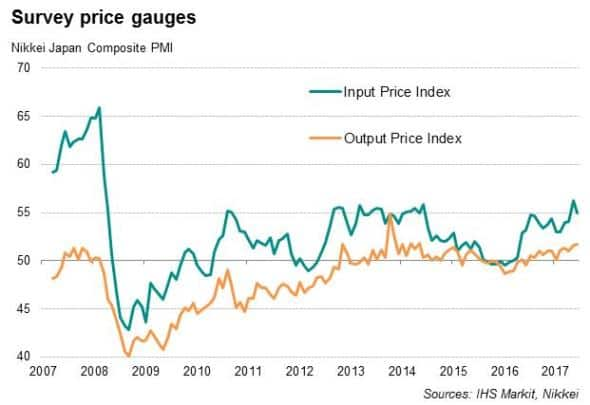

Signs of increasing price pressures should bring comfort to the Bank of Japan, where low inflation has been a worrying issue despite aggressive monetary stimulus. Average prices charged for goods and services increased at the fastest rate for over three years as companies sought to pass on higher costs to their customers. Input price inflation was the second-highest since 2014, cooling slightly from November's peak.

Further signs of improvement in economic activity and rising prices will add to expectations of a tightening in monetary policy, especially given concerns about the extent to which prolonged easing and negative interest rate have hurt banks' profitability. At the December policy meeting, one voting member suggested that a rate hike may become appropriate if growth and inflation continue to strengthen.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-economics-japan-pmi-points-to-stronger-fourth-quarter-growth-and-higher-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-economics-japan-pmi-points-to-stronger-fourth-quarter-growth-and-higher-prices.html&text=Japan+PMI+points+to+stronger+fourth+quarter+growth+and+higher+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-economics-japan-pmi-points-to-stronger-fourth-quarter-growth-and-higher-prices.html","enabled":true},{"name":"email","url":"?subject=Japan PMI points to stronger fourth quarter growth and higher prices&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-economics-japan-pmi-points-to-stronger-fourth-quarter-growth-and-higher-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+points+to+stronger+fourth+quarter+growth+and+higher+prices http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-economics-japan-pmi-points-to-stronger-fourth-quarter-growth-and-higher-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}