Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 05, 2015

Eurozone markets get a boost as ECB announces start of QE

The European Central Bank announced that it will start its €60 billion per month asset purchase programme on 9th March, and that it expects the new stimulus to help boost economic growth by around 0.5% in each of the next two years.

Investors are likewise betting on the increased likelihood of the eurozone reviving amid looser central bank policy just as policymakers in the US start to raise interest rates. The euro has hit an 11-year low against the greenback as a result, and ETFs are seeing record outflows from US equity exposures and record inflows into Eurozone-exposed funds.

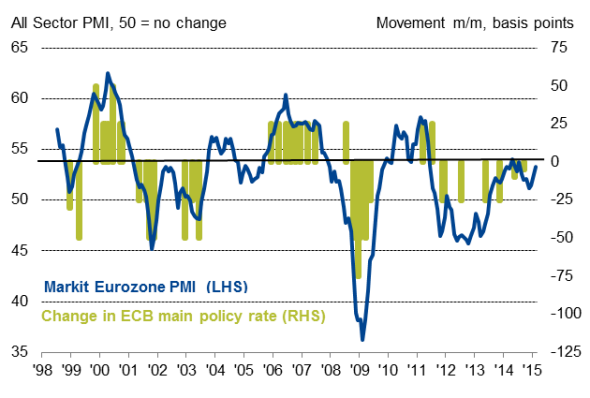

QE comes at a time when the economy is reviving"

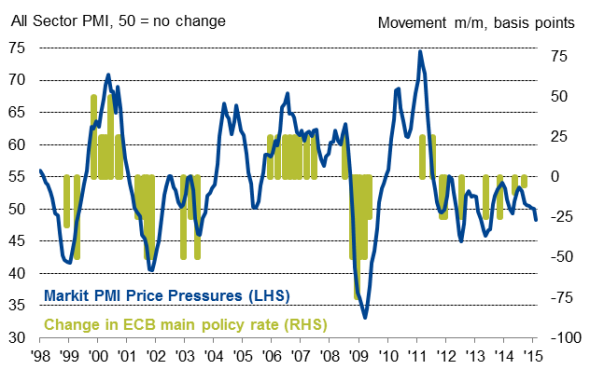

"but inflationary pressures have weakened

Sources: Markit, ECB.

Full-scale QE at the ECB

At the monthly Governing Council meeting, President Mario Draghi announced the ECB's commencement of its buying of euro-denominated government debt in the secondary market in addition to the purchases of asset-backed securities and covered bonds, which commenced last year (full transcript available here).

This move to "full-scale quantitative easing' is in fact open ended. While the ECB envisages that they will need to continue these purchases until September 2016, there is a more subjective caveat that QE will need to persist until policymakers "see a sustained adjustment in the path of inflation" consistent with a return to the target of below, but close to, 2%. Inflation is projected to rise to just 1.5% in 2016 and 1.8% in 2017, according to updated ECB forecasts.

The ECB also raised its growth projections, in part based on the beneficial impact of QE. The single currency area's GDP is now expected to grow 1.5% this year and 1.9% in 2016, with 2.1% growth pencilled-in for 2017. This year's and next year's growth projections have therefore been revised up by 0.5% and 0.4% respectively since December.

Mr Draghi saw that even January's announcement of the QE programme was already having a positive impact, notably by reducing borrowing costs, which is something February's PMI surveys have signalled may already be filtering through to the real economy. The Eurozone PMI hit a seven-month high in February, buoyed in particular by rising service sector activity.

However, Draghi also took the opportunity to continue to hammer home the message that national governments needed to continue to focus on structural reforms to boost productivity and ensure nascent growth becomes sustainable. Such reforms are vital to achieve a successful manufacturing recovery in particular.

One of the benefits of QE that the ECB will be reluctant to highlight will be the resulting fall in the euro, down to an 11-year low against the dollar as the loosening of policy in the euro area occurs at a time when US policymakers look increasingly likely to start hiking interest rates.

It's not just currency traders that are positioning themselves for the policy divergence. Investors have moved out of US equity exposed exchange-traded funds into eurozone equities. While tighter policy and a rising dollar look set to hurt US corporate performance, a weaker euro and central bank stimulus should boost corporate performance in the single-currency area.

US-exposed equity ETFs have seen a $16.8bn outpouring so far this year, which puts these funds on course for their largest quarterly decline since the first quarter of 2009. Eurozone ETFs have meanwhile seen a $19.3bn inflow, which far exceeds the prior record of $11.4bn in the first quarter of 2008.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Economics-Eurozone-markets-get-a-boost-as-ECB-announces-start-of-QE.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Economics-Eurozone-markets-get-a-boost-as-ECB-announces-start-of-QE.html&text=Eurozone+markets+get+a+boost+as+ECB+announces+start+of+QE","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Economics-Eurozone-markets-get-a-boost-as-ECB-announces-start-of-QE.html","enabled":true},{"name":"email","url":"?subject=Eurozone markets get a boost as ECB announces start of QE&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Economics-Eurozone-markets-get-a-boost-as-ECB-announces-start-of-QE.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+markets+get+a+boost+as+ECB+announces+start+of+QE http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Economics-Eurozone-markets-get-a-boost-as-ECB-announces-start-of-QE.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}