Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 05, 2016

UK PMI points to first quarter slowdown and gloomy outlook despite upturn in March

Survey data indicate a slowing in UK economic growth in the first quarter, with the suggestion that the pace is more likely to ease further rather than recover in coming months as business confidence remains unsettled by worries at home and abroad.

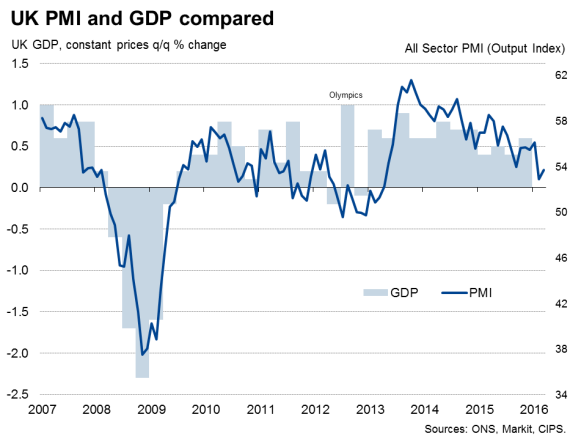

The latest Markit/CIPS PMI business surveys recorded a slight upturn in the pace of business activity growth in March, but the improvement was insufficient to prevent the data from indicating a slowdown in economic growth in the first quarter.

At 53.7, the weighted average output index from the three surveys was up from 52.9 in February, when the index sank to the greatest extent for four-and-a-half years. The resulting first quarter average PMI reading is consequently the lowest since the second quarter of 2013.

The surveys point to a 0.4% increase in gross domestic product, down from 0.6% in the closing quarter of last year. Even this weaker pace of expansion was only achieved thanks to a strong January. The February and March surveys were at levels consistent with just 0.3% growth.

Across the three main sectors of the economy, firms reported the smallest increase in demand for just over three years, which in turn fed through to a reluctance to take on new staff. March saw the weakest rate of job creation for over two-and-a-half years.

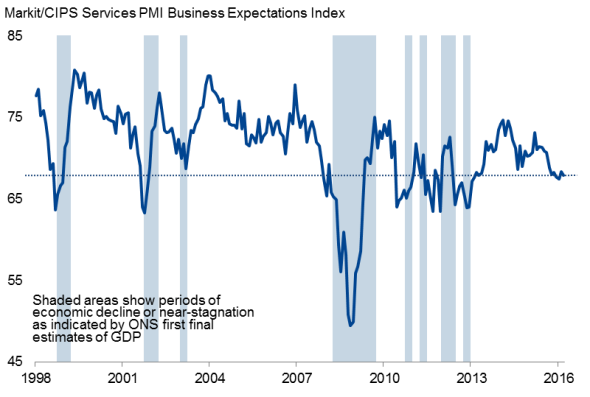

Business confidence remains in the doldrums as concerns about the global economy continue to be exacerbated by uncertainty at home, with nerves unsettled by issues such as Brexit and the prospect of further government spending cuts announced in the Budget.

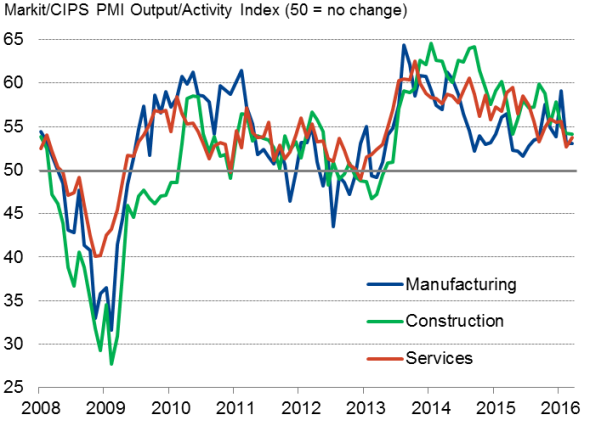

Broad-based slowdown

Growth slowed in all three sectors in the first quarter. Despite seeing a pick-up in the pace of expansion in March, the vast service sector suffered its worst quarter since the opening three months of 2013. Unchanged rates of expansion in construction and manufacturing meanwhile left the two sectors enduring their worst three-month spells since the second quarter of 2013 and the third quarter of last year respectively.

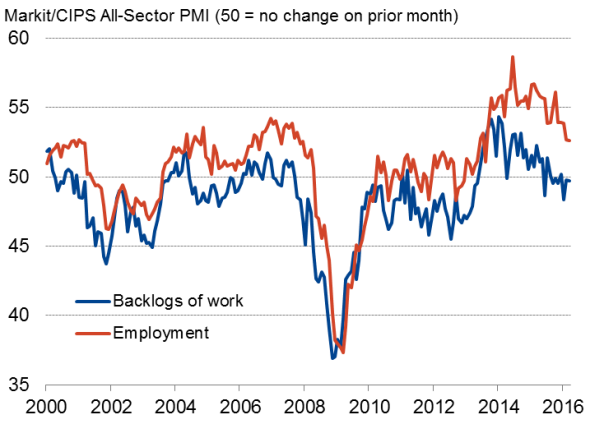

The slowdown was reflected in trends in employment. Manufacturing job losses accelerated, while net job creation fell to its lowest since June 2013 in the construction sector and one of the weakest seen over the past two-and-a-half years in services.

Broad-based slowdown in first quarter

Inflation subdued

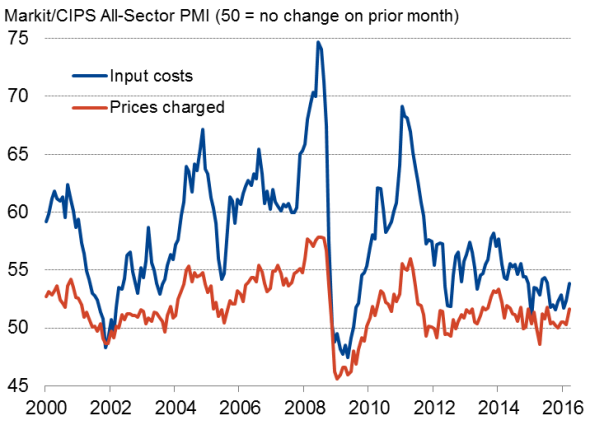

Inflationary pressures meanwhile picked up, but remained modest. Average input costs measured across the three surveys and average prices charged for goods and services showed the largest increases since July of last year. However, both series remained below their long-run averages, suggesting historically weak inflationary pressures.

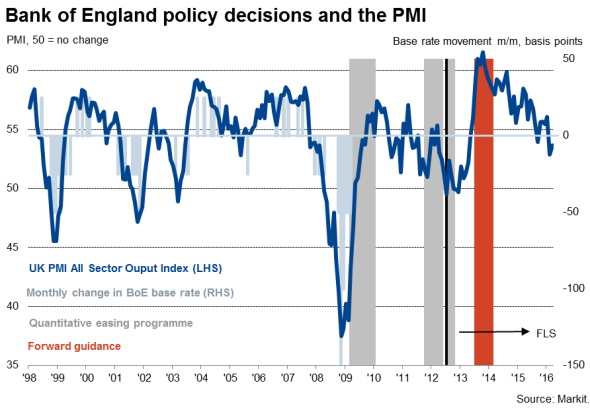

It therefore seems unlikely that March's upturn in the pace of growth represents the start of a longer term upswing. In contrast, the data suggest growth could weaken further in the second quarter. With the PMI already in territory traditionally associated with the Bank of England choosing to loosen policy, interest rate hikes seem a long way off.

Future expectations

Backlogs of work and employment

Price pressures

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042016-economics-uk-pmi-points-to-first-quarter-slowdown-and-gloomy-outlook-despite-upturn-in-march.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042016-economics-uk-pmi-points-to-first-quarter-slowdown-and-gloomy-outlook-despite-upturn-in-march.html&text=UK+PMI+points+to+first+quarter+slowdown+and+gloomy+outlook+despite+upturn+in+March","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042016-economics-uk-pmi-points-to-first-quarter-slowdown-and-gloomy-outlook-despite-upturn-in-march.html","enabled":true},{"name":"email","url":"?subject=UK PMI points to first quarter slowdown and gloomy outlook despite upturn in March&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042016-economics-uk-pmi-points-to-first-quarter-slowdown-and-gloomy-outlook-despite-upturn-in-march.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+points+to+first+quarter+slowdown+and+gloomy+outlook+despite+upturn+in+March http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042016-economics-uk-pmi-points-to-first-quarter-slowdown-and-gloomy-outlook-despite-upturn-in-march.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}