Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2017

PMI surveys show UK economic growth edging lower in August

The pace of economic growth slipped to its lowest in six months in August, according to PMI survey data, as an improved performance in the manufacturing sector failed to fully offset slower rates of expansion in services and construction.

While robust manufacturing performance suggests the economy may be rebalancing towards goods production, aided by the weaker currency, the slowdowns in services and construction send warning signals about the health of the domestic economy.

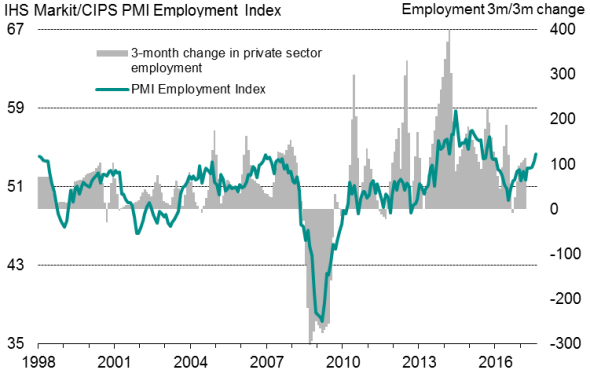

Employment growth struck a 22-month high, though the combination of slower output growth and faster hiring points to lower productivity. Business confidence meanwhile perked up somewhat but remained historically subdued, highlighting ongoing downside risks to the outlook.

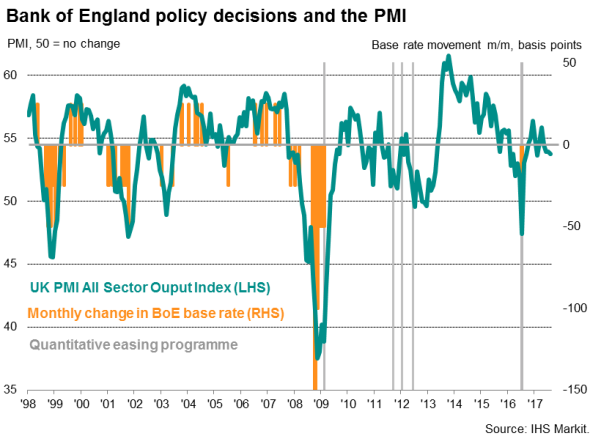

While a rise in price pressures will add to worries that inflation could pick up again in coming months, the overall level of the headline PMI remains more consistent with policymakers erring towards more stimulus rather than hiking interest rates.

Steady but sluggish growth

The latest survey data for August indicate that the economy continued to grow, albeit at a slightly reduced rate. The 'all-sector' IHS Markit/CIPS PMI slipped from 53.9 in July to 53.8 in August, its lowest since February and the second-lowest in 11 months.

The latest two months' data put the economy on course for another 0.3% expansion in the third quarter, though with momentum being gradually lost into August.

Manufacturing-led upturn

A marked manufacturing upturn was countered by slower growth in both services and construction, with the latter showing especial weakness. While manufacturing output growth hit a seven-month high, service sector activity showed the smallest monthly rise since September of last year. The rise in construction output was meanwhile the smallest seen over the past year.

Looking in more detail, the manufacturing expansion was fuelled by both rising export sales and improved domestic demand, with both attributed in part to the weakness of sterling. The drop in sterling since the EU referendum has made exports cheaper and imports more expensive relative to home-produced goods.

In services, the weaker growth trend was most evident in consumer-facing sectors such as hotels & restaurants and other personal services, which includes businesses such as cinemas, gyms and hairdressers. Transport, financial services and business services continued to fare relatively well.

One of the brightest warning signals regarding the underlying health of the economy has appeared in the construction sector. Commercial activity - which includes the building of offices, industrial units and retail and leisure space - has now fallen for two consecutive months, dropping in August at the steepest rate since July of last year and exhibiting one of the sharpest downturns since the global financial crisis.

Improved hiring trend

Some comfort can be drawn from an upturn in employment growth, with the August surveys registering the largest net rise in payroll numbers since October 2015 as companies raised operating capacity to cater for higher demand. Factory jobs growth rose to the highest since June 2014, while a 19-month high was seen in services. In contrast, the construction payroll gain was the second-lowest in over four years.

Employment

Some caution should be used in interpreting the employment trend, as the labour market tends to be a lagging indicator of economic growth. The upturn nevertheless bodes well as it signals that companies have maintained a strong pace of hiring, which should in turn help support consumer confidence in the near-term.

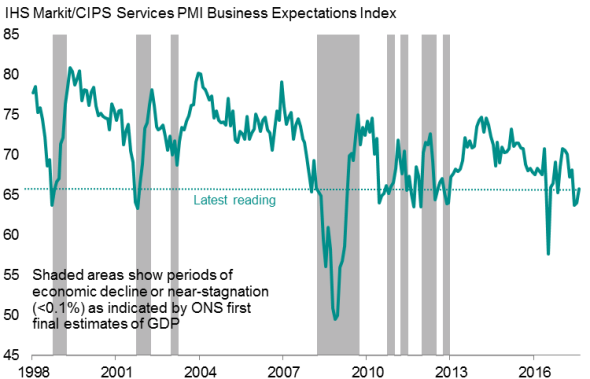

Brighter, but subdued, outlook

Firms' expectations about activity over the coming year picked up somewhat in August, underscoring how hiring often reflected expectations of further order book growth. The overall level of optimism nevertheless remained subdued by historical standards, again mainly linked to Brexit uncertainty, running close to levels that have previously been indicative of the economy stalling or even contracting.

Confidence about business prospects improved in all three sectors.

UK PMI survey future expectations

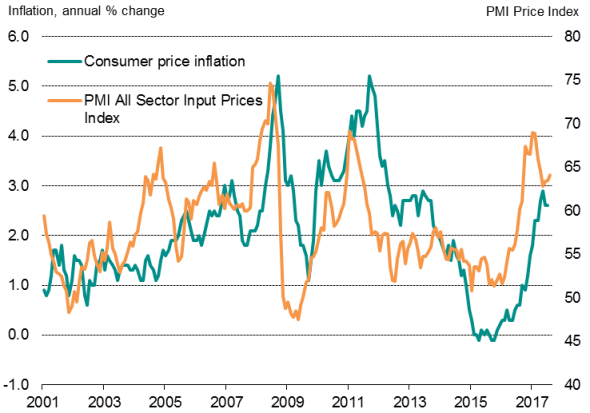

Inflation pressures revive

The surveys also found that price pressures picked up again in August, yet remained below levels seen earlier in the year. Input cost inflation edged up for a third successive month, leading to the largest increase in average prices charged seen for four months. A slight cooling in the rate of inflation for goods prices was offset by an uptick in service sector inflation.

Inflation

The upturn in the surveys' price gauges suggest that consumer price inflation, running at 2.6% in July (down from a recent peak of 2.9% in May) could start to edge higher again in coming months.

Dovish policy bias

While hawkish policymakers at the Bank of England will see the upturn in price pressures, ongoing expansion and improved hiring as grounds for higher interest rates, it's likely that the majority will remain in favour of holding policy steady at least until the pace of expansion lifts higher.

At 53.8, the current reading of the PMI remains historically consistent with a slight easing bias as far as monetary policy is concerned. Since 1998, the Bank of England's Monetary Policy Committee has never hiked interest rates when the most recent 'all-sector' PMI reading has been below 54.3 (with much higher thresholds needing to be breached in more recent years).

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-PMI-surveys-show-UK-economic-growth-edging-lower-in-August.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-PMI-surveys-show-UK-economic-growth-edging-lower-in-August.html&text=PMI+surveys+show+UK+economic+growth+edging+lower+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-PMI-surveys-show-UK-economic-growth-edging-lower-in-August.html","enabled":true},{"name":"email","url":"?subject=PMI surveys show UK economic growth edging lower in August&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-PMI-surveys-show-UK-economic-growth-edging-lower-in-August.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+show+UK+economic+growth+edging+lower+in+August http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-PMI-surveys-show-UK-economic-growth-edging-lower-in-August.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}