Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 05, 2016

Worldwide PMI surveys show few signs of malaise lifting at end of third quarter

PMI survey data point to ongoing sluggish global economic growth at the end of the third quarter, with worldwide job creation also remaining subdued amid weak global demand and uncertainty about the outlook, in many cases linked to political factors.

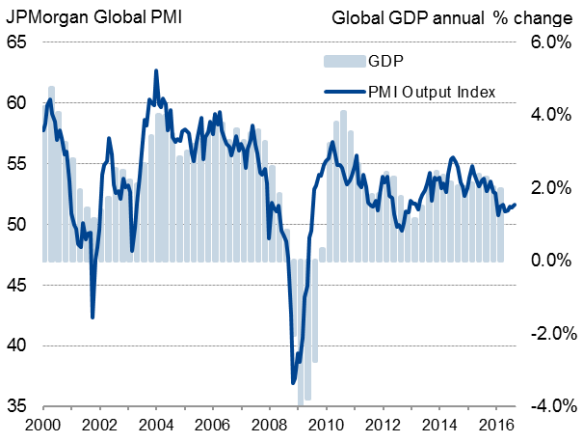

Global economic growth

The JPMorgan Global PMI, compiled by IHS Markit from its various national surveys, edged up to an eight-month high in September, rising from 51.4 in August to 51.7. However, although rising, the PMI points to annual global GDP growth (at market prices) of just less than 2% in the third quarter, which would be the slowest quarter of growth for just over three years.

With inflows of new business ticking lower in September, the surveys suggest business activity growth could remain subdued in October, and possibly even weaken.

Employment also remained under pressure, with the rate of job creation globally running at its slowest since early-2013. Payroll growth remained at a three-year low in the developed world and net job losses continued to be signalled across the emerging markets.

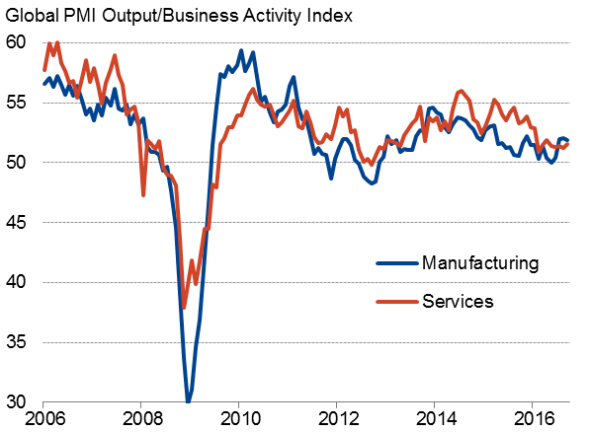

Global manufacturing v services PMI (output)

Developed world

The downshifting of global growth which took place earlier in the year, which had been caused by slower developed market expansion, showed only tentative signs of easing. At 51.9, the developed world PMI rose to a five-month high, but the current level still looks weak when compared to the average of 54.5 seen in 2015.

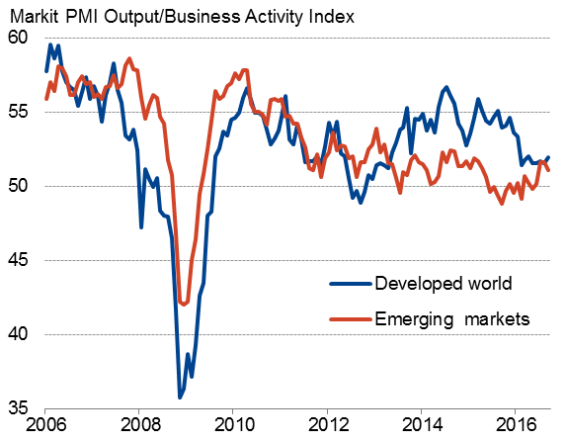

Developed v emerging market PMI (output)

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin.

Note: China Services data only updated to August.

US growth picked up to a five-month high, the Markit composite PMI having lifted to 52.3 in September, but the still-weak reading suggests the US remains locked in a slow growth phase.

Over the third quarter as a whole, the US surveys are signalling annualised growth of only around 1%, with the rate of job creation slowing to the weakest for nearly six-and-a-half years. Uncertainty regarding the looming presidential election was widely reported to have subdued spending and hiring.

Uncertainty about Brexit meanwhile continued to keep business optimism about future activity low in the UK, but current business activity growth picked up to an eight-month high, suggesting short-term worries about leaving the EU were being shrugged off. The weaker currency also helped, lifting UK manufacturing to the top of the global PMI export rankings in September. Recent UK PMI readings are nevertheless only consistent with 0.3% GDP growth (with even weaker growth signalled for the third quarter as a whole).

Political uncertainty appeared to be more of a constraint on current growth in the Eurozone, where the PMI fell to a 20-month low of 52.6 in September. GDP growth of 0.3% is being signalled for the region as a whole in the third quarter, with similar rates of expansion being recorded in both Germany and France. Spain remains the stand-out performer, with 0.6% growth indicated for Q3, while Italy looks the biggest worry of the major euro economies. The PMI for Italy signals just 0.1% GDP growth in the third quarter.

Japan added to the sense of developed world malaise, once again being the worst performer of the largest 'rich-world' economies. At 48.9, the Nikkei composite PMI was the joint-lowest since the imposition of the sales tax hike in 2014 and has now been in contraction territory in six of the past seven months.

Emerging markets

Emerging market growth meanwhile lost a little momentum, the PMI slipping from 51.6 in July and August to 51.1. Although still managing to end the third quarter with the strongest average quarterly gain for one-and-a-half years, the rate of growth in emerging markets continues to run far weaker than seen prior to the global financial crisis, highlighting the ongoing drag from the developing world relative to pre-crisis years.

Emerging market growth was led by Russia and India. Over the third quarter, Russia saw the strongest expansion since the first quarter of 2013 (the PMI gaining further ground to 53.1 in September), while India's expansion was the largest since the first quarter of last year (despite the Nikkei composite PMI losing ground in September, dipping from 54.6 in August to 52.4).

China saw its manufacturing sector near-stagnate again in September, but the improvement in the survey suggests the economy is enjoying its best quarter for two years. The Caixin Manufacturing PMI registered 50.1.

Once again, Brazil was the worst performing major economy globally, highlighting the impact of ongoing political unrest and lacklustre commodity demand, but at least saw the rate of contraction ease in Q3 to the weakest since the opening quarter of last year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102016-economics-worldwide-pmi-surveys-show-few-signs-of-malaise-lifting-at-end-of-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102016-economics-worldwide-pmi-surveys-show-few-signs-of-malaise-lifting-at-end-of-third-quarter.html&text=Worldwide+PMI+surveys+show+few+signs+of+malaise+lifting+at+end+of+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102016-economics-worldwide-pmi-surveys-show-few-signs-of-malaise-lifting-at-end-of-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Worldwide PMI surveys show few signs of malaise lifting at end of third quarter&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102016-economics-worldwide-pmi-surveys-show-few-signs-of-malaise-lifting-at-end-of-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+PMI+surveys+show+few+signs+of+malaise+lifting+at+end+of+third+quarter http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102016-economics-worldwide-pmi-surveys-show-few-signs-of-malaise-lifting-at-end-of-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}