Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 05, 2014

UK PMI surveys signal economic growth slowdown to 16-month low

October's PMI" surveys point to a sharp slowing in UK economic growth at the start of the fourth quarter, with the pace of expansion down to its lowest for almost one-and-a-half years.

The deterioration in the pace of expansion, alongside weakening price pressures, further reduces the prospect of any imminent hike in UK interest rates.

Economic growth slows

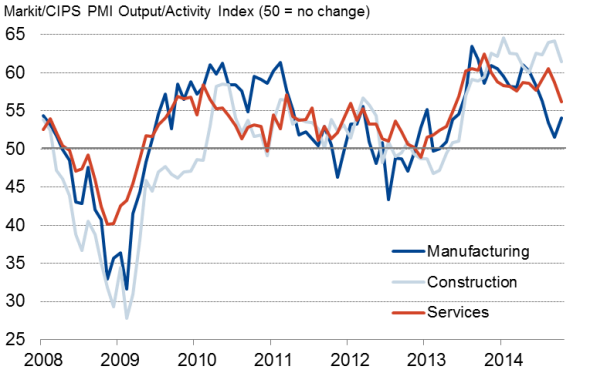

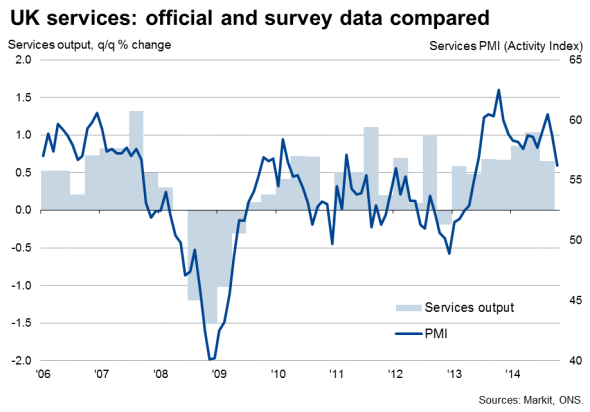

The weighted average of the three Markit/CIPS PMI surveys, which acts as a reliable advance indicator of GDP, fell for a second successive month in October, down from 58.1 in September to 56.4, its lowest since June of last year.

The surveys therefore point to a further moderation in the pace of economic growth as we move towards the end of the year. After GDP growth slowed to 0.7% in the third quarter, a 0.5% expansion is currently being signalled for the final quarter. That would mean the economy grew by 3.0% in 2014, which would be its best year since 2006.

However, with inflows of work across all three sectors combined growing at the slowest rate for 16 months in October, there is clearly a risk that output growth could weaken further in coming months.

Output by sector

Source: Markit.

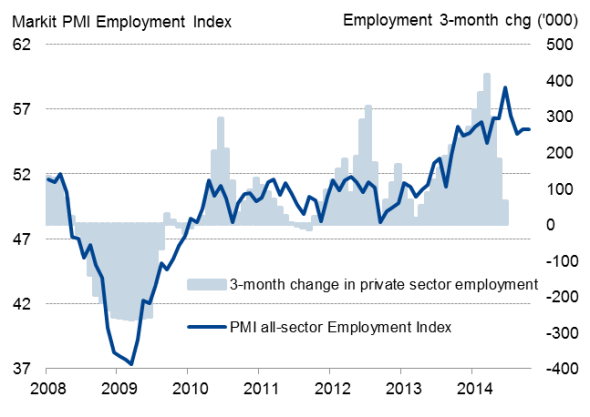

Buoyant job creation unlikely to persist

Some comfort can be sought from the fact that the three surveys showed employment continuing to grow at a historically strong pace in October, broadly consistent with around 250,000 jobs being created every quarter (which would imply a strong pick up in the official employment data). However, given the easing in output and new order growth, such a rapid pace of job creation looks unlikely to be sustained in coming months.

Employment

Sources: Markit, ONS.

Softer inflation outlook

The surveys also point to lower inflation in coming months: average prices charged for goods and services fell, albeit only slightly, for the first time since July 2012. With consumer price inflation already down to a five-year low of 1.2% in September, and looking set to fall further in coming months, the drop in price pressures alongside the slowing pace of economic growth takes some of the heat out of arguments for interest rates to rise.

Hawks on the Bank of England's Monetary Policy Committee are likely to argue that, because the survey suggests that the economy continues to grow at a reasonable rate of 0.5% in the fourth quarter, and that unemployment looks set to drop further as we move towards the end of the year, slack is being rapidly eroded, which will lead to higher inflation in the medium term.

However, the data generally support the view that policymakers will wait to gauge the full extent of any growth slowdown before making any decision on interest rates, effectively pushing out the prospect of an initial hike until the second half of next year.

Broad-based easing

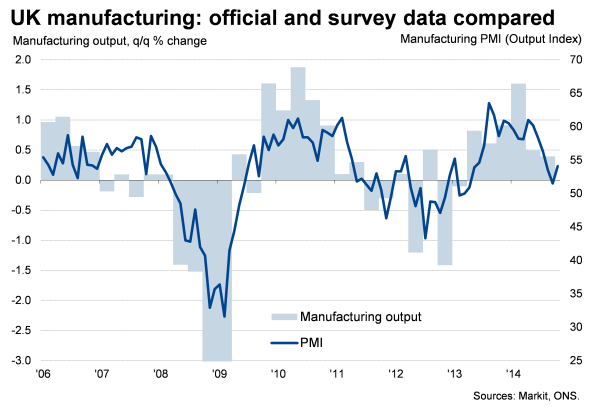

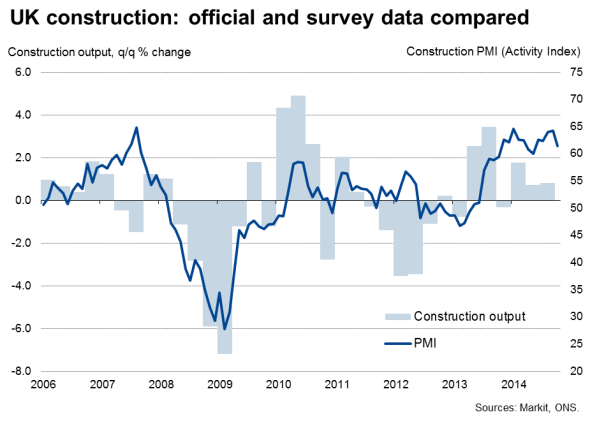

The main cause of the slowdown was a deterioration of service sector activity growth to the weakest since May of last year. Construction sector growth also slowed, down to a five-month low, led by a moderation in the pace of house building, and the goods-producing sector has moved down a gear compared to earlier in the year.

While manufacturing bucked the trend in October, with output rising at the fastest rate for three months, the goods-producing sector had already seen growth weaken considerably over the summer. Despite the uptick in October, the manufacturing sector's pace of expansion remained well below that seen earlier in the year.

Global and domestic factors at play

Part of the reason that growth has slowed is likely to be simply that previous growth rates seen in some sectors, notably house building, were unsustainably strong. A moderation in the pace of expansion to more normal levels by historical standards is therefore perhaps neither surprising nor worrisome.

The slowdown in the domestic housing market, linked to new initiatives to tighten lending criteria, as well as the prospect of higher interest rates next year, has also contributed to some softening of economic growth.

However, an additional factor has once again been the impact of a weakened eurozone. Economic growth in the single-currency area, which typically accounts for around 40% of UK exports, has been especially weak in 2014. Sterling's appreciation against the euro has acted as an additional dampener to exports.

PMI surveys likewise have shown growth in many key emerging markets, notably China, Brazil, Russia and India, to have remained lacklustre at best compared to pre-crisis rates of expansion so far this year. Tensions caused by the situation in Ukraine and the Middle East have meanwhile amplified global economic uncertainty.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-Economics-UK-PMI-surveys-signal-economic-growth-slowdown-to-16-month-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-Economics-UK-PMI-surveys-signal-economic-growth-slowdown-to-16-month-low.html&text=UK+PMI+surveys+signal+economic+growth+slowdown+to+16-month+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-Economics-UK-PMI-surveys-signal-economic-growth-slowdown-to-16-month-low.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys signal economic growth slowdown to 16-month low&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-Economics-UK-PMI-surveys-signal-economic-growth-slowdown-to-16-month-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+signal+economic+growth+slowdown+to+16-month+low http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-Economics-UK-PMI-surveys-signal-economic-growth-slowdown-to-16-month-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}