Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 05, 2015

Looking forward pays dividends

High trailing dividend yields can lure investors towards stocks that are seemingly paying above the norm. But selection based on forward yields, utilising detailed forecast changes to dividends, provides greater clarity and superior returns.

- Since Q3 2011, using forecasted versus lagging yields has outperformed by 38%

- The same strategy has outperformed the S&P High Yield Dividend Aristocrats index by 24%

- Price returns vital to the outperformance, indicating a key benefit of forecasted yields

To receive the full report or to find out more, please contact us.

Dividends are currently more volatile than ever with major payment suspensions from Deutsche Bank, Standard Chartered and Glencore, meaning that 2015 is proving to be an annus horribilis for dividend focused investors.

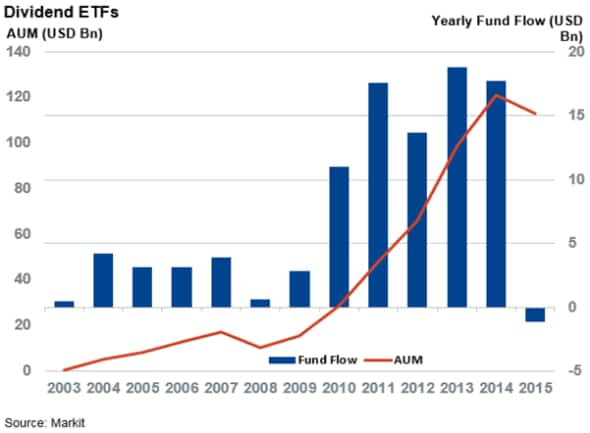

It is not surprising that dividend focused ETFs have suffered as a result. These funds invest in companies with high yielding shares, and have this year seen outflows for the first time since their genesis in 2003.

Markit Dividend Forecasting highlighted back in March that the continued upheaval in historically strong dividend paying sectors, such as energy and telecoms, could leave investors who piled into dividend ETFs disappointed. This is due to almost all dividend ETFs relying on trailing dividend yields as the main factor for selecting the highest yielding stocks.

By focusing on historical dividend yields, investors are enticed into "yield traps" which upon dividend curtailments, trigger negative share price reactions and returns that are prone to suffer.

Dividend forecasts add value

It is against this backdrop that Markit has undertaken a study on the advantages of using dividend forecasts for income portfolios for higher returns. The research attempts to quantify the value of using forecasted yields rather than the na"ve trailing yield model. The goal was to see if using forecast yield was a more effective value indicator, not to use forecasts to capture maximum dividends in a quarter.

Methodology-lite

Using the Russell 3000 index as an investment universe, Markit's proprietary forecast dataset was tested against two alternatives; a historical trailing yield, and a popular incumbent dividend index, the S&P High Yield Dividend Aristocrats (SPDA). According to factor ranks, the top 10% of names were selected to create a high forward dividend yield portfolio (HFDY) and a high trailing dividend yield portfolio (HTDY). Compositions were recalculated quarterly, using dividend forecasts looking a year ahead.

Sector capping boosts returns

Raw performance results were positive, showing total returns for the HFDY portfolio that outperformed the HTDY by 34% and the SPDA by 21%. To remove a heavy bias towards the financial sector, and to remove micro-caps and illiquid stocks, the basket was adjusted to add basic constraints and apply sector capping. This resulted in an increased level of outperformance.

Total returns for HFDY outperformed the HTDY by 38% in the sample period, and total returns using Markit forecasts outperformed the SPDA by 24%. Sector capping was the underlying driver for the enhanced returns as it removed stocks with a lower relative yield compared to their direct competitors within the high yield sector, which underperformed later in the next period.

Single stocks with high dividend yields on a historic basis, which would be typical results of high yield screening but excluded when applying a forward yield methodology, include 13 high yielding names at the beginning of Q3 2015. These names on average have posted a 5% price decline to date.

The worst performing out of this group is Freeport-Mcmoran whose shares have plummeted 49% year to date. Shares are down 35% since the beginning of the third quarter. The company slashed its dividend by 84% in March to shore up its balance sheet as commodity prices weakened.

The gulf between the company's historical and forward yields highlights the importance for dividend forecasts to investors to form yield expectations.

Investors can avoid being yield moths

Backward looking indicators can "trap" investors towards companies with high trailing yields, which risk falling share prices when companies announce a cut in payouts. This research shows that investors should pay attention to dividend forecasts to form their views, not the dividend past.

The benefits of using forecasts could be even more pronounced in Europe and Asia where dividend payments are more variable in use and frequency. This means negative dividend surprises might be greater which could potentially have greater impact on share price

Thomas Matheson | Dividend Analyst, Markit

Tel: +44 207 260 2247

thomas.matheson@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-Equities-Looking-forward-pays-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-Equities-Looking-forward-pays-dividends.html&text=Looking+forward+pays+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-Equities-Looking-forward-pays-dividends.html","enabled":true},{"name":"email","url":"?subject=Looking forward pays dividends&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-Equities-Looking-forward-pays-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Looking+forward+pays+dividends http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-Equities-Looking-forward-pays-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}