Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2015

Japan PMI surveys signal acceleration in economic growth at year-end

The pace of economic growth picked up in Japan at the end of 2014, providing the government with much-needed welcome news that the country is pulling out of recession.

However, the fall in the yen is pushing up companies' costs to the greatest extent since late-2008, in turn causing companies to curtail recruitment. Although new stimulus measures may help foster stronger economic growth in 2015, the impact may be offset by a lack of labour market improvements and weak global demand.

Growth accelerates at year-end

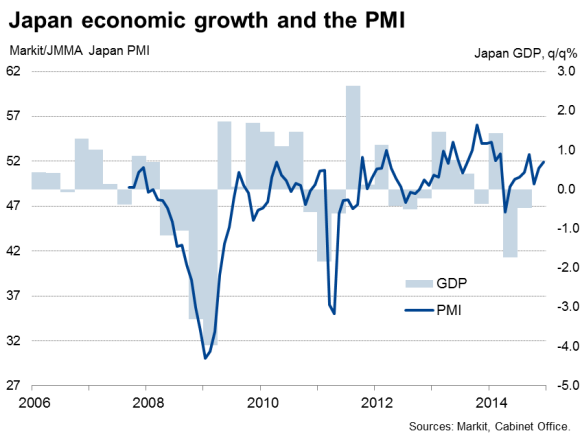

At 51.9, the PMI" survey measure of business activity across the manufacturing and service sectors rose from 51.2 in November to indicate a second successive month of growth and an acceleration in the pace of expansion.

GDP rose 1.4% in the first quarter, before falling 1.7% and 0.5% in the second and third quarters respectively, pushing Japan into its fourth recession since the global financial crisis. However, recent PMI data indicate that the economy will have risen from recession in the fourth quarter, enjoying reasonably robust growth of domestic business activity by historical standards. The fourth quarter average PMI reading of 50.9 compares with a survey long-run average of just 47.8.

Brighter outlook?

The headline PMI data therefore provide encouraging news for the beleaguered Japanese economy. The latest recession prompted Prime Minister Shinzo Abe to call a snap election held in December, his success in which paved the way to pass through new stimulus measures worth Yen3.5 trillion ($29 billion). The government expects the stimulus to boost GDP by 0.7%. Roughly half of the spending is directed at subsidies to households, small firms and struggling regions, intended to boost consumption. The other half is directed at rebuilding areas hit by the 2011 tsunami.

Lower oil prices should also help boost the Japanese economy, especially as the country is reliant on energy imports. Oil prices have halved over the past six months in US dollar terms.

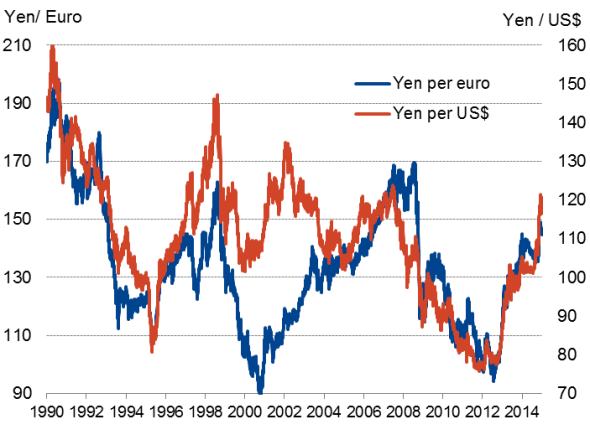

However, the impact of lower oil prices is being offset by the recent depreciation of the yen, which has fallen to its lowest against the US dollar since 2007, down nearly 20% over the past six months and raising the cost of imports. The PMI surveys registered the steepest rise in companies' input costs since September 2008 as a result.

Unfortunately, the survey data also suggest that exporters are not benefitting from the falling yen, with manufacturers reporting a near-stalling of new export orders in December. While the lower yen makes Japanese goods cheaper in overseas markets, global economic growth remains stubbornly subdued, with demand especially weak in Asia, and particularly in China.

Worryingly, overall new orders for goods and services rose only marginally in December, contrasting with solid growth in the prior six months.

Exchange rate

Profit margin squeeze hits recruitment

Weak demand meant firms were often unable to pass higher costs onto customers. Average prices charged for goods and services barely rose in December, registering the smallest increase since March.

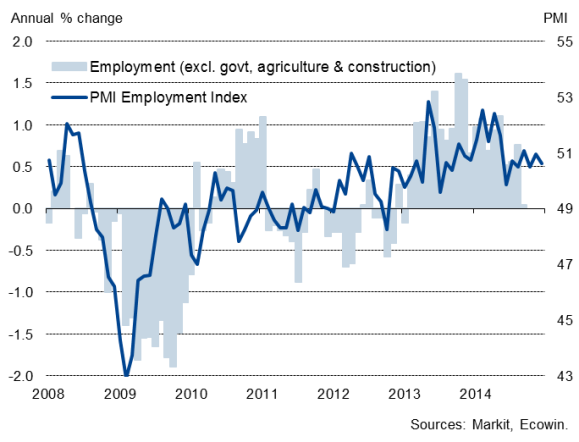

The resulting profit margin squeeze indicated by the rise in costs alongside stagnant selling prices continued to hit companies' appetite to recruit staff, with firms preferring instead to focus on keeping staff costs down. Employment consequently barely rose in both manufacturing and services in December. However, even the near-stagnant hiring picture represents an improvement on the trend of downsizing seen in the years prior to the introduction of "Abenomics'.

Employment

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-Japan-PMI-surveys-signal-acceleration-in-economic-growth-at-year-end.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-Japan-PMI-surveys-signal-acceleration-in-economic-growth-at-year-end.html&text=Japan+PMI+surveys+signal+acceleration+in+economic+growth+at+year-end","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-Japan-PMI-surveys-signal-acceleration-in-economic-growth-at-year-end.html","enabled":true},{"name":"email","url":"?subject=Japan PMI surveys signal acceleration in economic growth at year-end&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-Japan-PMI-surveys-signal-acceleration-in-economic-growth-at-year-end.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+surveys+signal+acceleration+in+economic+growth+at+year-end http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-Japan-PMI-surveys-signal-acceleration-in-economic-growth-at-year-end.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}