Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 06, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

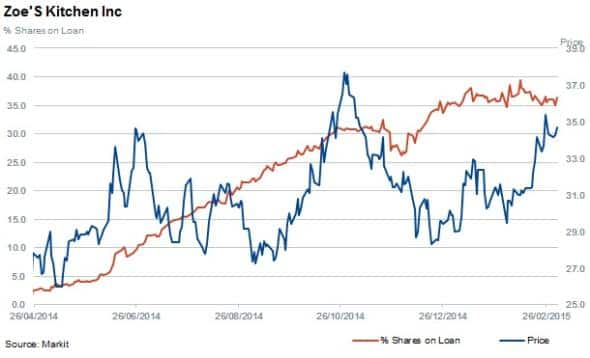

- Short sellers not convinced that Zoe’s Kitchen is the next Chipotle as short interest doubles

- Investors split on Morrisons as shares rally ahead of earnings and dividend cut

- Solar Panel maker CGL attracts short sellers despite posting first profits in three years

North America

Zoe’s Kitchen is the most shorted stock ahead of earnings in North America. Zoe also featured as a heavily shorted company back in October of last year. The stock has witnessed a consistent increase in short bets since then as shares out on loan has nearly doubled to 36%. However Zoe’s shares have held up well in the face of this negative sentiment and have more than doubled from the IPO price.

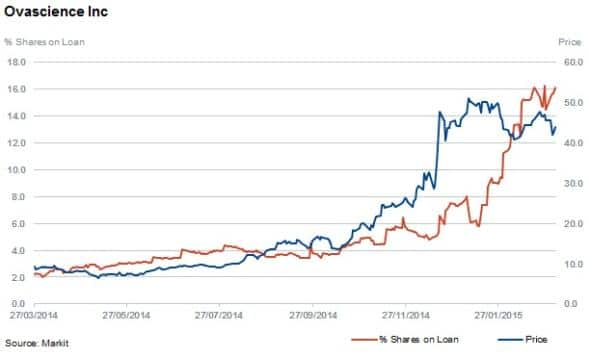

North American biotechnology stocks Ovascience and Spectrum Pharmaceuticals have seen the biggest moves in short sellers’ positions ahead of earnings with 21% and 27% growth in shares out on loan reaching totals of 16% and 14% respectively. Ovascience, founded in 2011, is developing two products to improve female fertility and its share price has increased by 374% over the last 12 months. Spectrum Pharmaceuticals has five oncology/haematology products in late stage development.

Western Europe

Expectations are for Morrisons to increase its dividend for the current fiscal year as promised by management but after profits were guided lower by half, the market expects a drastic cut in the forward dividend. The share has increased in the last few weeks while short sellers have continued to hold onto their positions. This indicates that there may be a divergence of opinion in the market with regards to the company’s future performance and perhaps dividend payments.

Interestingly, Morrisons is the largest holding of the iShares UK Dividend UCITS ETF at 3.6% of AUM, which currently stands at £769m.

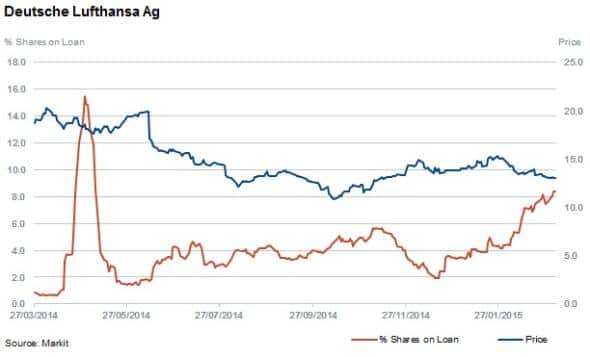

Lufthansa, which recently scrappedtheir dividend for the second time in three years, has seen a 56% increase in shares out on loan in the last month, reaching 8.4%. Despite much lower oil prices lifting the industry due to lower fuel costs, issues plaguing the German carrier include competition from Middle Eastern airlines, low cost carriers and labour strikes.

Lufthansa reported a €732m net loss under local accounting standards on which the decision to cut the dividend was based. Under IFRS the company’s net profits declined from €313m to €55m. The recent 56% increase in shares out on loan indicates that perhaps short sellers expect more turbulence ahead for the carrier.

Asia Pacific

Hong Kong based GCI-Ploy Energy Holdings (GCL) is one of the largest solar photovoltaic (PV) companies in the world supplying PV materials. Even though the firm announced that it expects profits for the first time in three years the company is the most shorted in Apac this week ahead of earnings. The firm’s share price is up by 17% year to date, but shorts have stayed the course as demand to borrow shares is up by 16% year to date to 7.9% of shares outstanding.

GCL expects industry demand to grow by 20% to 30% a year but the market is nervous as the last supply glut sent prices for polysilicon plummeting from $80 per kg to under $20 per kg in 2011 which was the main factor for the company’s prior year losses.

Relte Stephen Schutte | Analyst, IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}