Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 06, 2017

UK Retail Shorts Emboldened by Article 50

UK retailers are facing a new wave of bearish investor sentiment as the UK kick-starts the process that will see it leave the European Union.

- Short sellers increase bets in UK retailers to the highest in over two years

- Supermarkets most shorted although demand to borrow has been steady ytd

- Non staples retailers have been driving the recent surge in short interest

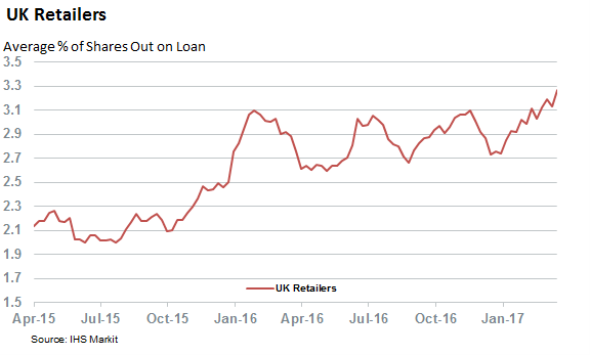

Investors keen to hedge against Brexit uncertainty have been placing bets against UK stocks with a heavy domestic revenue profile since the middle of last year. The triggering of Article 50 has seen this trend kick into overdrive as evidenced by the fact that UK retailers, many of which derive the entirety of their earnings from within the British Isle, have seen shorting activity surge over the last few weeks. These bets, which stand to pay off in the advent of a "hard" Brexit, now represent 3.3% of all shares outstanding, the highest average for the sector in over two years.

If last week's spat over Gibraltar is any indication, the two year process promises to be anything but plain sailing as the list of parties that need to be placated grows ever larger. This raises the prospects of a "hard" Brexit that could leave retailers paying more for imported goods, owing to both tariffs and a falling pound, while potentially limiting their access to the foreign staff who play an important role in the UK's service industry.

Grocers lead the way

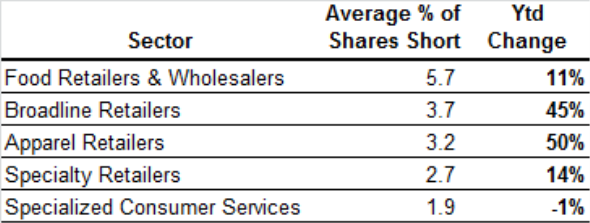

Grocery firms, both physical and online, have been focus of the largest amount of shorting activity as grocers hold the top three spots on the list of UK retailers that see the largest proportion of shares out on loan. The sector, which has been reeling from an ongoing war of attrition with German discounters, has had to contend with the post referendum inflation brought along by the falling pound.

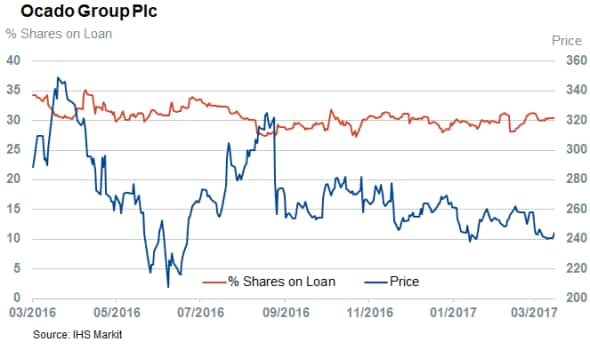

Ocado's, the most shorted firm in the sector, may also be spurred on by the feeling that its customers' mood may have been negatively impacted by the referendum as they were the least likely to have backed Brexit, according to polling organisation YouGov.

While significant, it's worth mentioning that the shorting activity in Ocado and its two heavily shorted peers, Morrison's and Sainsbury's, has remained relatively flat over the last three months.

Shorts target non-essential spending

Non-staples retailers, whose wears include less essential goods as clothing and sportswear, have been the driving force behind the recent surge in retail short interest. Such a steep rise in bearish investor sentiment among these firms indicates that the market is positioning for a slowdown in non-essential spending, something which was already glimpsed in a recent survey by the British Retail Consortium.

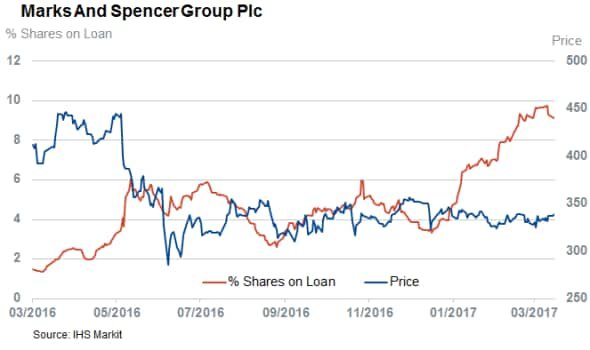

High street stalwart Marks and Spencer has been singled out by this trend as its short interest has more than doubled year to date to 9% of shares outstanding.

Two other retailers which have seen a material rise in shorting activity since the start of the year are Sports Direct and Pets at Home which have both seen their short interest climb by over a third since the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Equities-UK-Retail-Shorts-Emboldened-by-Article-50.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Equities-UK-Retail-Shorts-Emboldened-by-Article-50.html&text=UK+Retail+Shorts+Emboldened+by+Article+50","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Equities-UK-Retail-Shorts-Emboldened-by-Article-50.html","enabled":true},{"name":"email","url":"?subject=UK Retail Shorts Emboldened by Article 50&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Equities-UK-Retail-Shorts-Emboldened-by-Article-50.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Retail+Shorts+Emboldened+by+Article+50 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Equities-UK-Retail-Shorts-Emboldened-by-Article-50.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}