Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 06, 2017

Steady global growth masks worsening emerging market performance

The global economy enjoyed further steady growth in June, according to the latest PMI data, finishing off a solid second quarter. Both new orders inflows and hiring grew at marginally faster rates while business optimism about the outlook also improved, suggesting the upturn has further to run. Cost pressures meanwhile showed signs of continuing to ease.

However, the surveys also showed the divergence between the developed and emerging markets widening, amid slower growth in the latter.

Steady global growth

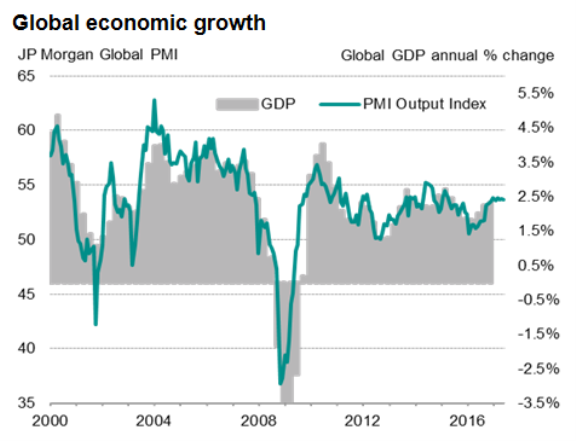

The headline JPMorgan PMI, compiled by IHS Markit, edged down from 53.8 in May to 53.7 in June, but still completed a solid second quarter. At 53.7, the second quarter average was unchanged on that seen in the first quarter, which had in turn been the best performance for two years. The surveys have therefore been signalling global GDP growth of approximately 2.5% per annum over the course of the first half of 2017.

The survey's sub-indices suggest this pace of growth is likely to be at least maintained as we move into the third quarter. Inflows of new business showed one of the largest gains seen for almost three years, and employment growth picked up slightly to a two-year high, suggesting firms are braced for further expansion to meet rising demand.

Companies' expectations of their own output levels in a year's time meanwhile inched higher to signal the second-most positive outlook for just over two years.

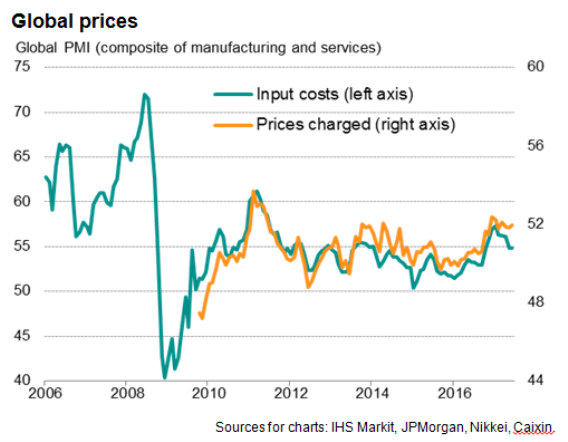

Although average prices charged for goods and services rose at a slightly increased rate, companies' costs grew at the slowest pace for eight months, suggesting some pressure will come off selling prices in coming months.

Widening divergence

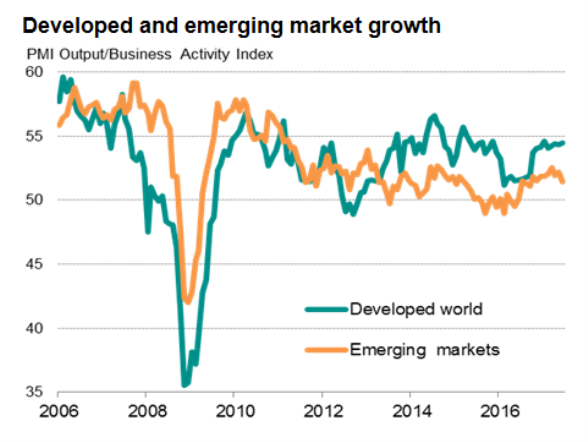

The steady headline PMI masked regional variations, notably a slippage in emerging market growth.

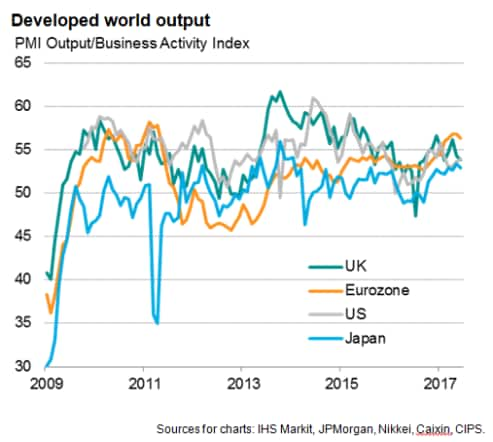

The developed world PMI rose from 54.4 to 54.5 in June, signalling a marginal improvement in the rate of output growth to the second-fastest in just over one-and-a-half years. In contrast, the emerging markets PMI fell from 52.2 to 51.5, its lowest since last November. The underperformance of the emerging market PMI compared to the developed world equivalent consequently rose to the widest since January 2016.

The divergence may well persist or even intensify in coming months: while future expectations in the developed world hit a five-month high in June, optimism slipped to a five-month low in the emerging markets.

India bucks wider EM slowdown

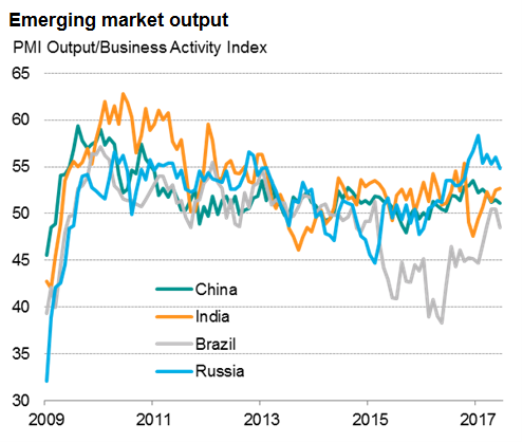

Of the four largest emerging markets, only India saw business activity grow at an increased rate in June. However, India is still playing catch-up after the economy was hit by the government's withdrawal of high denomination bank notes late last year. Even with the latest rise, the composite Nikkei PMI for India is still just below the average seen in the months leading up to the currency change.

Weaker service sector growth and a near-stagnant manufacturing economy meanwhile pushed the headline Caixin PMI for China down to a one-year low, suggesting not only that second quarter GDP growth will have weakened compared to the first quarter, but also that momentum is being lost as the economy moves into the second half of the year.

Brazil's economy also took a step backwards after its return to growth earlier in the year. The composite PMI fell back below 50 to signal a renewed downturn after two months of modest growth.

Russia continued to outperform relative to the other large emerging markets, but nonetheless saw growth slacken to an eight-month low amid slower expansion of both manufacturing and services activity.

Eurozone leads developed world growth

Developed world growth was meanwhile once again led by the eurozone. Although the Eurozone PMI signalled slightly softer growth in June, the region outperformed its peers for the fifth straight month.

The June Eurozone PMI in fact rounded off the best quarter for the region for over six years, with broad-based and robust growth seen in all four major euro members. Historical comparisons suggest the second quarter PMI readings are broadly consistent with euro area GDP rising by almost 0.7%.

Steady growth meanwhile continued to be seen in the US, with the final PMI readings beating earlier flash numbers to indicate an upturn in growth momentum at the end of the second quarter. However, the recent readings remains relatively subdued, especially in manufacturing, and point to the economy growing at an underlying annualised rate of around 2% (though official GDP data may well show a sharper upturn compared to the weak first quarter).

While US growth accelerated in June, it was a different story in the UK, where the surveys indicated the weakest expansion for four months. Although the PMI data point to 0.4% GDP growth in the second quarter (double the lacklustre 0.2% rise in the opening three months of the year), the June surveys point to an economy that's losing momentum. The weakest growth was seen in the service sector, which is being hit as consumers struggle against low wages and rising prices. Business confidence also slumped in June, linked mainly to political worries, dropping to its lowest since last year's Brexit vote.

Japan's economy likewise lost a little growth momentum in June, but the Nikkei PMI surveys still rounded off the best quarter for over three years. Moreover, jobs growth accelerated to the fastest for nearly a decade, underscoring the reviving health of corporate Japan.

Further insights into worldwide business expectations, including analysis of business trends in the major developed and emerging markets, will be released in the July edition of the tri-annual IHS Markit Business Outlook Survey on July 17th.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-economics-steady-global-growth-masks-worsening-emerging-market-performance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-economics-steady-global-growth-masks-worsening-emerging-market-performance.html&text=Steady+global+growth+masks+worsening+emerging+market+performance","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-economics-steady-global-growth-masks-worsening-emerging-market-performance.html","enabled":true},{"name":"email","url":"?subject=Steady global growth masks worsening emerging market performance&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-economics-steady-global-growth-masks-worsening-emerging-market-performance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Steady+global+growth+masks+worsening+emerging+market+performance http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-economics-steady-global-growth-masks-worsening-emerging-market-performance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}