Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 06, 2015

Emerging market downturn contrasts with robust developed world growth

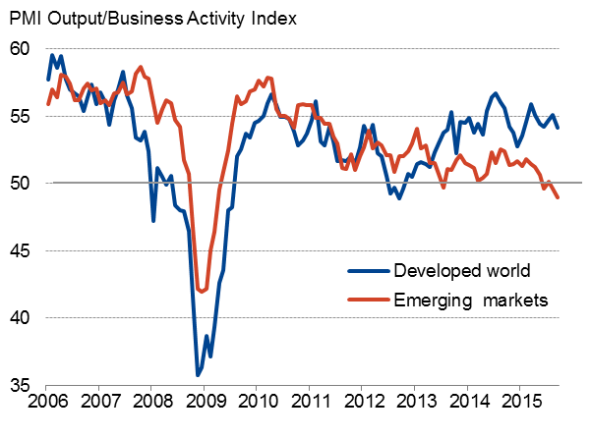

A deepening emerging market downturn led global economic growth lower in September, according to worldwide PMI survey data.

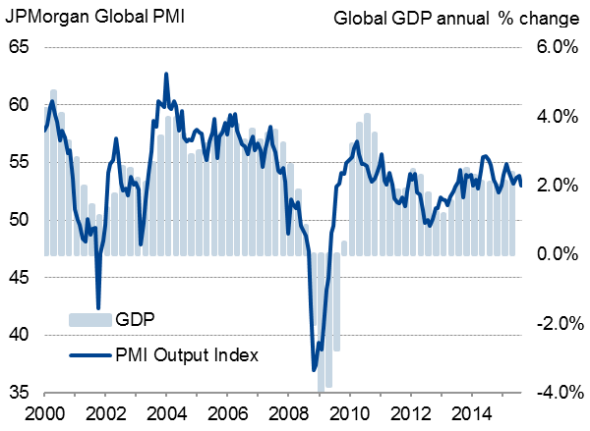

Global economic growth

The JPMorgan Global PMI, compiled by Markit, fell from 53.9 in August to 52.8 in September, its weakest for nine months and signalling a rate of worldwide GDP growth of just 2% per annum.

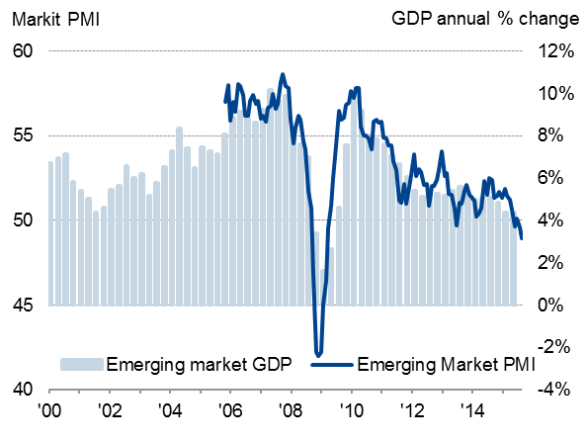

The divergence between developed and emerging markets widened to the greatest on record over the third quarter. At 49.0 in September, the emerging market PMI fell to its lowest since March 2009, indicating a deterioration in business conditions across manufacturing and services for the third time in the past four months.

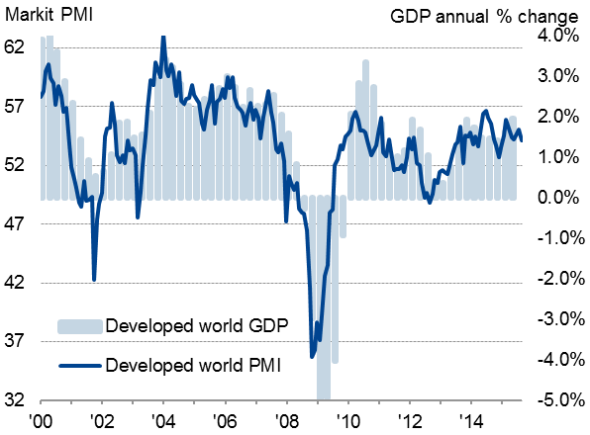

The developed world PMI meanwhile also fell but, at 54.0 (down from 55.1 in August), remained in expansion territory.

The developed world PMI is signalling a 1.5% annual GDP expansion, while the emerging market equivalent is broadly consistent with just 3% growth.

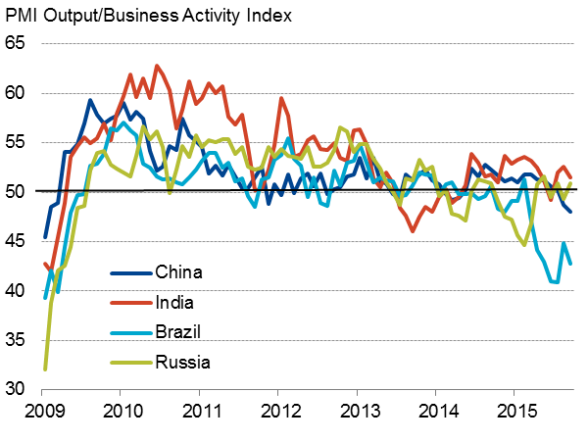

Emerging market downturn deepens

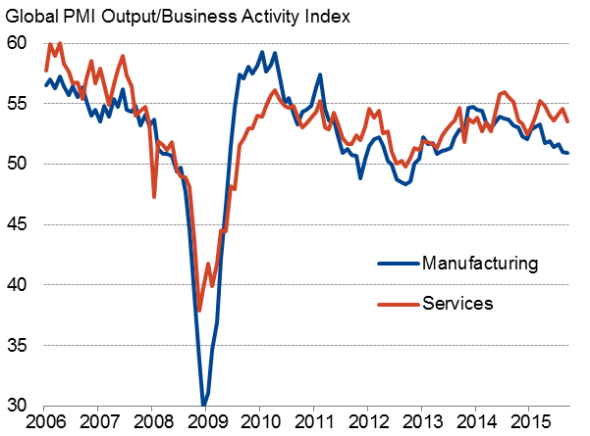

The emerging market downturn was led by manufacturing, where the PMI has signalled contraction for five successive months, with the rate of decline accelerating in September. However, services also slipped into contraction, suggesting the industrial malaise is spreading to other parts of the emerging market economies.

Emerging markets

The steepest downturn was seen in Brazil, where a further fall in the PMI suggests the economy is set to suffer a third quarterly decline of a similar magnitude to the 1.9% GDP slump seen in second quarter.

The Markit-compiled Caixin PMI data meanwhile fell to the lowest since January 2009 to signal a further slowdown in the annual rate of GDP growth in China. An accelerating downturn in China's manufacturing sector was accompanied by a near-stagnation of services activity.

Signs of China's weakness spreading across Asia were again evident in other Nikkei manufacturing PMI surveys, with ongoing downturns recorded in Taiwan, South Korea, Malaysia and Indonesia, while Vietnam slipped into decline for the first time in over two years.

Growth continued to be recorded in India, though slowed to a three-month low. Near-stagnation was meanwhile seen in Russia, albeit the modest expansion representing an improvement on the decline seen in August.

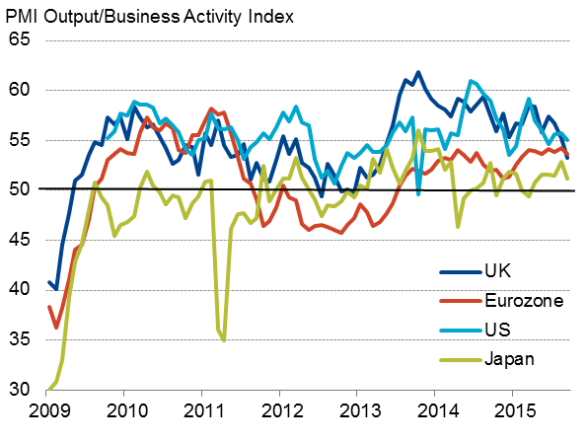

Developed world

Broad-based developed world slowdown

The developed world upturn was largely driven by the United States, despite the September PMI surveys signalling the second-slowest pace of expansion since January. The survey data are consistent with US GDP growing at a 2.2% annualised rate in the third quarter, down markedly from 3.9% in the second quarter.

Global manufacturing and services

Growth also slowed in the United Kingdom, with the PMI surveys indicating the weakest expansion for two-and-a-half years, running at a level consistent with just a 0.3% (1.2% annualised) GDP growth rate in September.

The downturns in the US and UK PMI surveys reduced the odds of the Federal Reserve and Bank of England hiking interest rates.

Meanwhile, PMI data fell in both the Eurozone and Japan, raising concerns that ongoing quantitative easing programmes in both economies are failing to drive strong and sustainable upturns.

The Markit Eurozone PMI remained in expansion territory, rounding off the best quarter for four years (signalling a 0.4% upturn in GDP). However, the index fell to a four-month low, pointing to a loss of momentum going into the fourth quarter. Worrying indications of slower grow in Italy and Spain offset signs of renewed life in France.

The Nikkei Japan PMI surveys meanwhile pointed to the slowest expansion for five months. Adding to the list of concerns was the first drop in average prices charged in almost two years.

Developed world

Emerging markets

Developed and emerging markets PMI

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-Economics-Emerging-market-downturn-contrasts-with-robust-developed-world-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-Economics-Emerging-market-downturn-contrasts-with-robust-developed-world-growth.html&text=Emerging+market+downturn+contrasts+with+robust+developed+world+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-Economics-Emerging-market-downturn-contrasts-with-robust-developed-world-growth.html","enabled":true},{"name":"email","url":"?subject=Emerging market downturn contrasts with robust developed world growth&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-Economics-Emerging-market-downturn-contrasts-with-robust-developed-world-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+downturn+contrasts+with+robust+developed+world+growth http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-Economics-Emerging-market-downturn-contrasts-with-robust-developed-world-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}