Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 06, 2017

Global manufacturing PMI hits highest since March 2011

The global manufacturing PMI rose to its highest for over six-and-a-half years in November, with output, new orders and employment growth all strengthening. Even better news came on the broadening out of the upturn: for the first time in over a decade, no country reported a deterioration in manufacturing conditions.

Improved output, orders and employment

The headline JPMorgan Manufacturing PMI, compiled by IHS Markit, hit 54.0 in November, its highest since March 2011. The PMI has indicated that manufacturing has now gained growth momentum for five successive months, with both output and new orders rising at increased rates in November.

New export orders showed the largest monthly gain for nearly seven years, highlighting an upturn in global trade flows.

With orders and trade continuing to pick up, factories added to their headcounts at the fastest rate for six-and-a-half years.

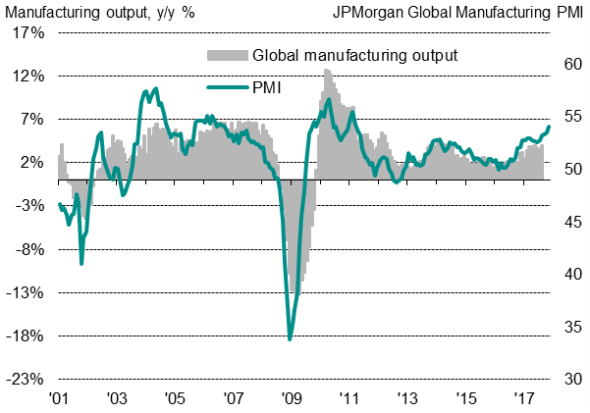

High Correlation

The survey data correlate closely with official data on manufacturing production from statistics offices around the world, with the survey providing an advance indication of official data. Over the past two decades, the PMI shows an 86% correlation (acting with a four-month lead) on the official manufacturing output data. The latest surveys are running at a pace broadly consistent with global factory production rising at a robust annual rate of approximately 6%.

Global manufacturing output

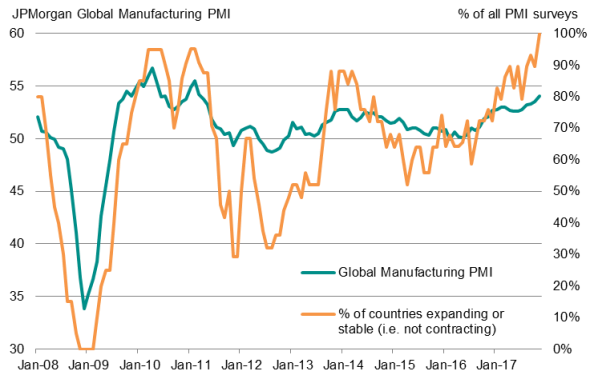

Full-house of 50 or higher

The increasing broad-based nature of the expansion is also encouraging. All of the 29 countries covered by IHS Markit's manufacturing PMI surveys reported an improvement in business conditions in November with the exception of Thailand, where the index signalled no change at 50.0. This was the first time in at least a decade whereby all countries covered by the surveys have reported either an expansion or stabilisation of manufacturing.

<<p>Global manufacturing PMI surveys

European countries continued to dominate, once again holding all top eight places in the global manufacturing rankings. Central European countries also again fared especially well, with the upturn led by Germany, followed by the Netherlands, Austria and the Czech Republic.

Australia recorded the fastest growing manufacturing sector outside of Europe, followed by Taiwan, the latter seeing the highest PMI reading since April 2011.

Taiwan's strong performance stood in contrast to many other Asian countries, including China, which occupied the bottom five spots in the global rankings as business conditions either stagnated or showed only very modest growth.

Manufacturing PMI rankings

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin,

Commonwealth Bank, Investec, Istanbul Chamber of Industry.

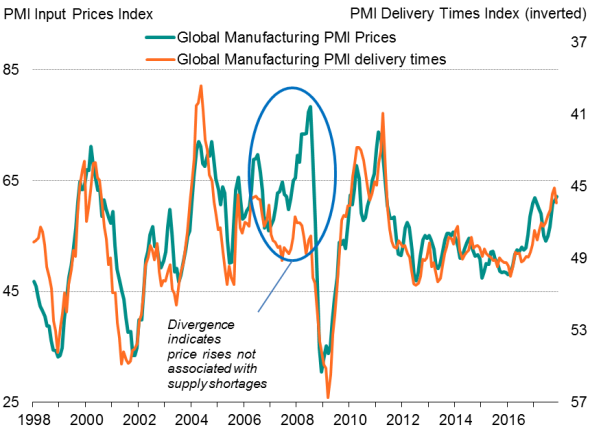

>Analysing price pressures

The upturn was accompanied by a further rise in price pressures. Average factory selling prices showed the largest monthly rise since May 2011, often as a result of firms needing to pass higher costs on to customers. Average input prices also showed the largest increase since May 2011.

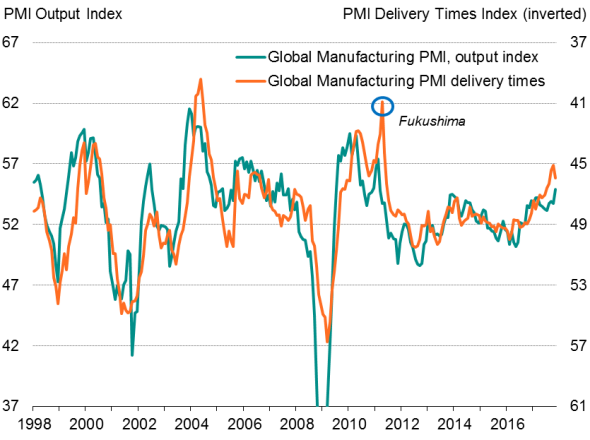

However, many price hikes were again associated with suppliers being busier, and therefore enjoying a sellers' market as demand often outstripped supply. Average suppliers' delivery times have been lengthening to the greatest extent since 2011 in recent months, albeit with some reduction in the number of delays in November.

While longer delivery times have in part been the result of hurricane disruption in the US in recent months meaning delivery times are in effect lengthening more than current output growth would normally suggest would be expected, November brought signs that global input cost inflation may be increasingly driven by demand outpacing supply.

Price pressures

Global supply delays and prices

Global supply delays and output

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin,

Commonwealth Bank, Investec, Istanbul Chamber of Industry.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122017-Economics-Global-manufacturing-PMI-hits-highest-since-March-2011.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122017-Economics-Global-manufacturing-PMI-hits-highest-since-March-2011.html&text=Global+manufacturing+PMI+hits+highest+since+March+2011","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122017-Economics-Global-manufacturing-PMI-hits-highest-since-March-2011.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI hits highest since March 2011&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122017-Economics-Global-manufacturing-PMI-hits-highest-since-March-2011.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+hits+highest+since+March+2011 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122017-Economics-Global-manufacturing-PMI-hits-highest-since-March-2011.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}