Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 07, 2015

QE pays off for inflation investors

Investors of inflation linked bonds have benefited from the ECB's QE program as these bonds saw their breakeven inflation surge after the bank loosened monetary policy.

- Inflation linked bonds are trading with five times the breakeven inflation seen in January

- Inflation bond ETFs outperformed their conventional peers as inflation expectations rose

- Euro inflation linked bond ETFs saw their largest ever quarterly inflows in Q1

The threat of seeing the eurozone slide into a deflation driven downward spiral was the final straw which spurred the ECB to loosen monetary policy. While it's still too early to judge whether the program was a success, policy makers will take comfort from the March Markit Eurozone Composite PMI which indicated that the region's manufacturing and service industries boosted output at the fastest pace in four years.

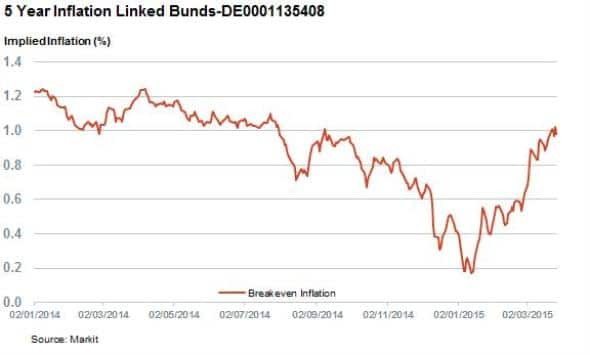

The spectre of deflation, as gauged by the breakeven inflation priced into bonds which offer investors protection against inflation, has also receded in the wake of QE's implementation.

Inflation expectations surge

German five year inflation linked bonds traded with less than 20bps of annualised breakeven inflation in the days just prior to the QE program's onset. Inflation expectations tripled as the bank set out the details of the QE program in the second half of January.

This trend gathered pace in the subsequent two months and the breakeven inflation priced into five years German Bunds is now over 1%, the highest level in over eight months.

This surge in breakeven inflation priced into eurozone inflation linked bond ETFs is not limited to Bund inflation linked issuances as a similar dated Italian inflation linked bond listing has seen its implied inflation more than triple from the January lows.

ETF investors benefit from the trend

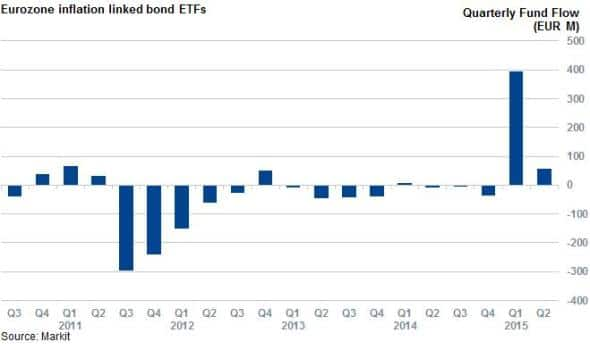

This surge in breakeven inflation has played into the hands of ETF investors as the largest eurozone inflation linked bond ETF, the iShares Euro Inflation Linked Government Bond UCITS ETF, has outperformed its closest non-inflation linked peer, the iShares Euro Inflation Linked Government bond UCITS ETF, by 1.2% since the start of the year.

Investors have been eager to play this trend as eurozone inflation linked bond ETFs have seen net inflows for every week since the end of January. These strong consistent inflows made the Q1 the best ever quarter in terms of inflow for the six inflation linked eurozone ETFs which managed to attract €395m of new assets over that period. These inflows represent a staggering 42% of the assets managed by these products at the start of the year which has made the asset class the most popular eurozone bond ETF strategy of the first quarter.

Investors have been keen to continue to add to their exposure to future inflation jumps in the region, as these six funds have managed to attract €56m of inflows in the opening seven days of April.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-credit-qe-pays-off-for-inflation-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-credit-qe-pays-off-for-inflation-investors.html&text=QE+pays+off+for+inflation+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-credit-qe-pays-off-for-inflation-investors.html","enabled":true},{"name":"email","url":"?subject=QE pays off for inflation investors&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-credit-qe-pays-off-for-inflation-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=QE+pays+off+for+inflation+investors http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-credit-qe-pays-off-for-inflation-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}