Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 07, 2015

Global ETFs pass the $3trn mark

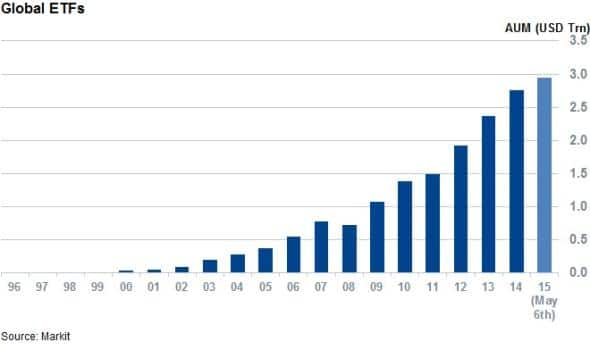

The aggregate value of assets managed by ETFs has surpassed the $3 trillion mark, driven by an increasingly sophisticated user base and growing international penetration.

- 2015 ETF inflows are on track to match last year's $300bn record

- The two funds leading inflows this year have seen assets grow over 600fold since 2012

- Funds listed outside of North America have seen over $100bn of inflows in the last 29 months

Since the launch of the SPDR S&P 500 in 1993, ETFs have proved to be one of the standout growth stories in financial services. The asset class has grown by leaps and bounds and over 6,200 products are now tracked by the Markit ETF Encyclopaedia, covering just about every asset class imaginable. The funds' relatively low cost (33bps weighted aggregate fee) and ease of use has resonated with investors, with the AUM tracked by Markit surpassing the $3trn AUM milestone on April 24th.

The aggregate AUM figure has since receded to $2.94trn in the wake of recent market volatility. But the current value of all ETFs outstanding is still around $200bn higher than at the start of the year due to a combination of strong inflows (over $100bn) in the first four months of the year and rising NAVs. In fact, inflows for the year are on track to match last year's record total when ETFs attracted over $320bn of new assets.

Milestone reached in record time

The growing popularity of the asset class is highlighted by the fact that the third trillion in AUM came less than three years after ETFs passed the $2trn milestone.

ETFs took over 13 years to gather their first trillion of AUM after the first product launched. The second milestone trillion only took three years and two months to be reached after the $1trn mark.

Larger toolset

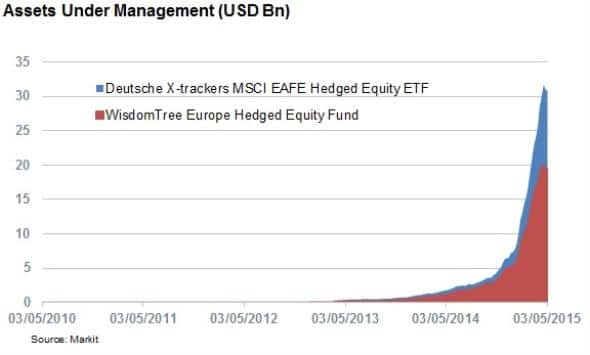

The products that have seen the largest inflows in the run-up to the recent milestone have been more unconventional when compared to the funds that proved most popular with investors the last time ETFs reached $2trn.

Inflows in the year leading up to the $2trn mark were led by core flagship products such as the SPY, the Vanguard FTSE Emerging Market ETF and the MSCI Emerging Market ETF. All these products offered plain unhedged exposure to equities.

The funds leading inflows so far this year are led by two hedged products, WisdomTree Europe Hedged Equity Fund and the Deutsche X-trackers MSCI EAFE Hedged Equity ETF. These funds have proved popular with US investors looking to protect against currency swings, and gathered over $22.3bn to date from a low base this January.

Both these funds had a combined AUM of ?$40mm the last time the industry crossed a billion milestone in 212. The fact that they have been able to grow their assets by over 600fold since then highlights the growing sophistication of ETF investors.

International markets growing

The growing popularity of ETFs outside of the core North American market has also provided impetus for the industry. In the two and a half years since ETFs reached the $2trillon mark, funds listed in Europe, Asia and Mena have seen over $100bn of inflows; helping grow their AUM base to over $700bn.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Equities-Global-ETFs-pass-the-3trn-mark.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Equities-Global-ETFs-pass-the-3trn-mark.html&text=Global+ETFs+pass+the+%243trn+mark","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Equities-Global-ETFs-pass-the-3trn-mark.html","enabled":true},{"name":"email","url":"?subject=Global ETFs pass the $3trn mark&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Equities-Global-ETFs-pass-the-3trn-mark.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+ETFs+pass+the+%243trn+mark http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Equities-Global-ETFs-pass-the-3trn-mark.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}