Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 07, 2015

Week Ahead Economic Overview

Second quarter GDP numbers are expected to show further eurozone economic growth despite a steep Greek downturn. Industrial output numbers are also released for the euro area, as well as for the US, China, Japan and India, providing important overviews of global industrial trends. Retail sales data will give clues as to the extent to which consumers are helping drive sustained growth in the US and UK. The UK also updates its labour market data.

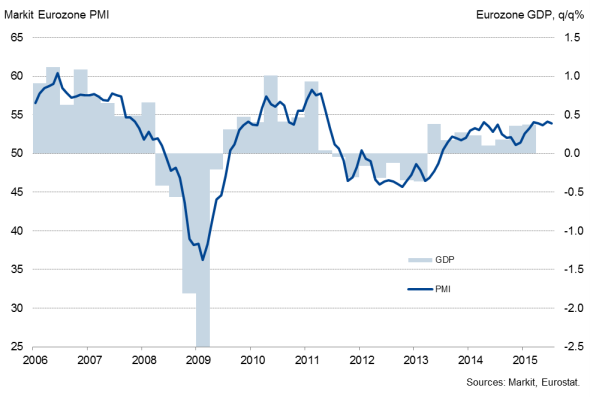

In the eurozone, data watchers are eagerly awaiting the release of second quarter GDP numbers to gauge the damage that the Greek crisis may have done to the real economy, and whether the ECB may be inclined to 'front load' its asset purchases to engender a stronger recovery. PMI survey data point to little impact, with the eurozone expanding by around 0.4% in the second quarter, despite the Greek economy contracting in the second quarter and the PMI dropping to a record-low in July amid bank closures as the debt crisis came to head.

Eurozone GDP and the PMI

The currency union also sees the release of industrial output numbers. PMI data signal that eurozone manufacturers showed resilience despite the situation Greece, suggesting industrial output will have rebounded after falling 0.4% in May.

Fed chair Janet Yellen has sought to prepare the markets for the US policy normalisation process to start later this year, but with the decision to hike rates "data dependent", all eyes will be on the release of industrial production and retail sales data. US manufacturing remained in the doldrums in June, with factory output stagnating for a second straight month, according to official data. PMI survey data for July signalled only a slight gain of momentum.

Retail sales numbers are likely to be more supportive of the case for higher rates. Despite falling unexpectedly in June, retail sales rose 1.5% in the second quarter as a whole, helping the US economy to expand by 2.3% in Q2. Low prices, especially for fuel, look to be driving consumer spending higher.

US manufacturing output and the PMI

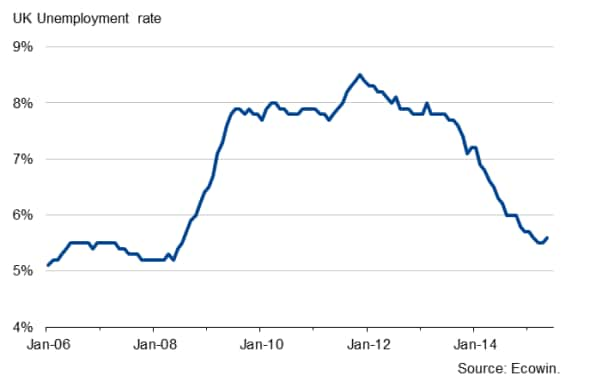

In the UK, labour market and retail sales data are updated. Last month's data presented a mixed bag of news on the health of the UK labour market. While wage growth continued to accelerate, employment fell in the three months to May and unemployment nudged higher. This could lead to hesitation in starting the monetary policy normalisation process. Moreover, latest business survey data signalled that employment growth fell sharply to the lowest since September 2013.

As with the US, UK retail sales are expected to rebound after dipping in June, painting a picture of consumer-led economic growth, fuelled in turn by low prices and steady wage growth.

UK unemployment

Construction output numbers are also updated in the UK. PMI data indicate that the building industry has seen growth slow considerably over the past year, though the survey numbers paint a much rosier picture than the stagnation signalled by official data. The official data are often heavily revised and it is therefore difficult to use them as a reliable source of the sector's performance. The data are nevertheless important to watch as they are included in the GDP calculations.

Industrial production and retail sales numbers are released in China, which will help determine the economy's strength at the start of the third quarter. PMI data for July suggested that global manufacturing was stuck in low gear amid emerging market downturn. China saw the largest drop in manufacturing activity for two years, with weak demand acting as a major drag on Asian economic growth. The weak data add to signs that China may struggle to meet its economic growth target of 7.0% this year.

Industrial production numbers are also released in India and Japan. Japan's goods-producing sector meanwhile showed tentative signs of stirring back into life at the start of the third quarter after its worst performance for a year in the second quarter. Over in India, the business survey data suggest that the manufacturing economy gained some traction in July.

Monday 10 August

The UK regional PMI survey results are published.

Current account data are released in Japan.

The eurozone Sentix Index is updated.

In Greece, industrial output numbers are out.

Employment trends data are published in the US.

Tuesday 11 August

In Australia, business confidence data are issued.

Russia sees the release of second quarter GDP and trade numbers.

Manufacturing production figures are meanwhile published in South Africa.

ZEW economic sentiment data and wholesale price numbers are issued in Germany.

Consumer price figures are updated in Italy.

Retail sales information are out in the UK.

In Canada, housing starts data are published.

The NFIB Business Optimism Index and productivity data are released in the US.

Wednesday 12 August

Consumer sentiment numbers and wage inflation data are out in Australia.

Industrial output figures are meanwhile updated in China, India, Japan and the eurozone with the former also seeing the publication of retail sales data.

In France, current account data are released.

Italy sees the publication of trade figures.

A labour market update and the latest UK Commercial Development Activity Report are released in the UK.

Retail sales numbers are issued in Brazil.

Thursday 13 August

Germany and Spain see the release of inflation numbers.

Second quarter GDP data are meanwhile published in Greece.

RICS publishes results from its latest housing survey.

Canada sees the release of the latest New Housing Price Index.

Initial jobless claims, retail sales and business inventories data are out in the US.

Friday 14 August

Wholesale price numbers are out in India.

Second quarter GDP numbers and inflation data are updated in the eurozone.

France sees the release of non-farm payrolls.

The Office for National Statistics issues construction output numbers for the UK.

Manufacturing sales figures are out in Canada.

Industrial production numbers and producer price data are meanwhile published in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}