Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 07, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

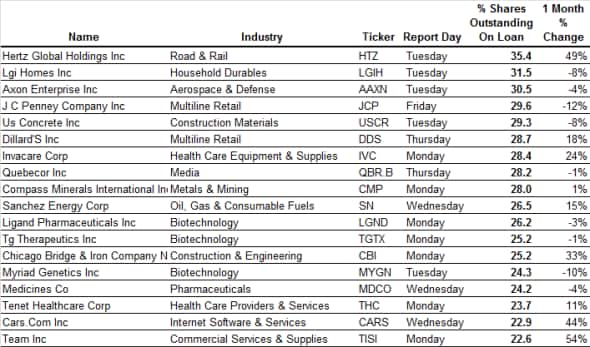

- In North America, Hertz short interest is at an all-time high

- Europe's Basilea Pharmaceutica sees shorts cover in the lead-up to earnings

- Japanese shorts target Klab as its shares lose momentum

The big short play leading up to earnings is car rental firm Hertz - over the last four weeks, Hertz had a massive 50% increase in the demand to borrow its shares. This sent the firm to an all-time high of 35% of shares on loan.

The high demand to borrow Hertz demonstrates that short sellers are still wary of the ongoing weakness in the rental market and the firm's exposure to cratering secondhand car values. Hertz shares rallied in the last few weeks, but short sellers continued their bear raid undeterred. Short sellers aren't the only ones to have a bearish view of the car rental service: more than a quarter of analysts that cover Hertz have a sell or underweight rating.

Short sellers targeting woes in the secondhand car market have also targeted Cars.com since the company was spun off from online conglomerate Tegna back in June. The firm's first earnings announcement as an independent company promise to produce fireworks, as just under 23% of its shares are out on loan.

Two retail firms are also on the list of high conviction short targets announcing earnings this week. The most shorted of the pair is perennial short JC Penney, which has just under 30% of its shares out on loan. Surprisingly, JC Penney's current short interest represents a slight improvement in investor sentiment, as demand to borrow its shares was a fifth higher back in September.

Dillard's, the other high conviction retail play, hasn't seen such an improvement in sentiment. The demand to borrow its shares has climbed by a fifth in the last four weeks to a multi-year high of 28% of outstanding shares. This rise in short interest has come despite the fact that Dillard shares have rallied by over a quarter in the last three months; analysts covering the company boosted their revenue expectations for the upcoming quarter.

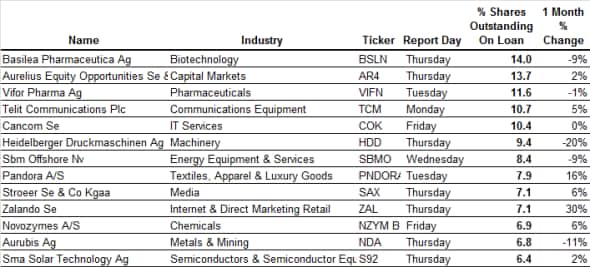

Europe

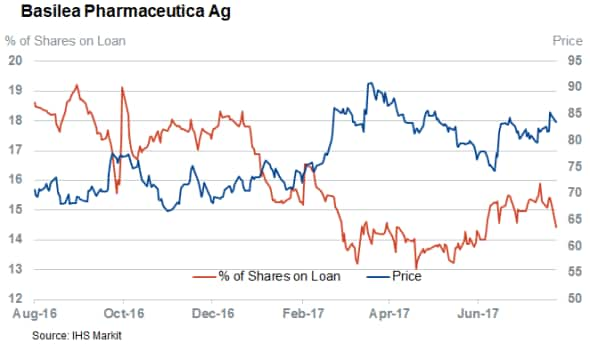

Swiss biotech firm Basilea is the most shorted European company announcing earnings in the coming week. Basilea has been on short sellers' radars for the last couple of years, although they have been paring back their positions in the run-up to earnings, and demand to borrow its shares fell by 9% in the last month.

This improvement in investor sentiment comes in the wake of the firm announcing a licensing deal with Pfizer to market an antifungal drug in Europe. Since the announcement, Basilea shares have rallied by over 10%. It's also worth noting that a portion of Basilea's short interest may be driven by the company relying on convertible bonds for funding.

Fellow biotech peers Vifor and Novozymes also join Basilea on this week's list of heavily shorted companies in the lead-up to earnings.

Online retailer Zalando will be another key focus for short sellers next week. Shorting activity in the company's shares has increased by 30% in the last month to 7% of shares outstanding. The latest surge in short interest means that investors are now as bearish in Zalando as they have been at any-time since the firm listed two and a half years ago.

Short sellers will have to watch out, however, as Zalando competitor and fellow short target Yoox reported better than expected earnings last week, which sent its shares up sharply.

The other firm seeing a significant increase in short interest is jewelry retailer Pandora, which has seen a 16% increase in demand to borrow its shares this last month. This increase in shorting activity comes despite a rally in Pandora shares, and most recent shorts are now standing on a paper loss.

Asia

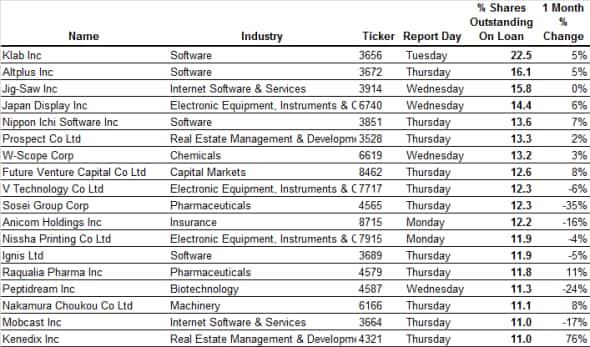

Japanese mobile apps developer Klab is this week's high conviction Asian short with more than 22% of its shares out on loan. Although its shares have nearly tripled in value year-to-date, short sellers remain unconvinced, and Klab's short interest has nearly doubled over the same period. This willingness to double down is starting to pay off: Klab shares have fallen by over fifth from the highs posted in early July.

The shorting momentum has also been profitable for sceptics of the recent Altplus rally. Altplus is the second most shorted firm of Asian companies announcing earnings, and has seen its shares fall by more than a third since highs posted in June. This reversal of fortunes has played into the hands of short sellers, and they have been actively shorting the company over the last six months.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}