Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 07, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week

- Biotech key focus of short sellers this week

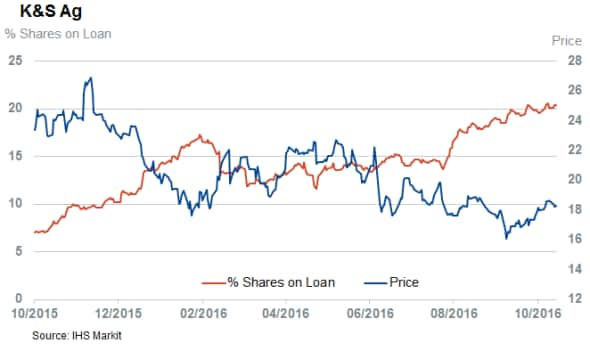

- K&S tops the list of European short targets as potash woes continue

- Noble Group sees a large jump in short interest in last month

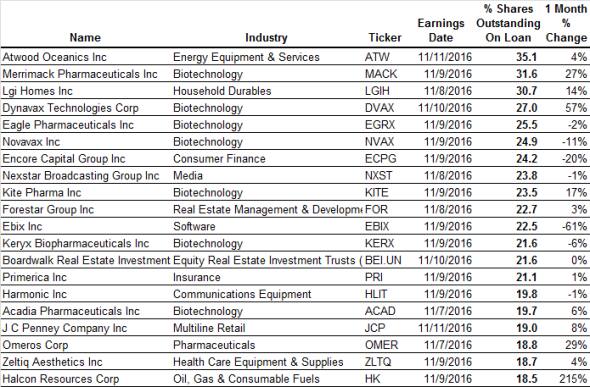

North America

Offshore drilling rig operator Atwood Oceanics sees itself as the most shorted company announcing earnings next week, with 35% of its shares now out on loan to short sellers. While energy shares have seen some sharp covering in recent months, as oil prices have stablised from their lows, Atwood shares have continued to linger in the doldrums. Short sellers have continued to target Atwood as analysts forecast a sharp downturn in revenues as its ongoing contracts roll off.

The second most shorted company in this week’s lot, Merrimack Pharmaceuticals, comes courtesy of the biotech sector, the most heavily represented sector among the heavily shorted companies announcing earnings this week. Merrimack’s current short interest stands at an all-time high as short sellers more than doubled their positions in the last six months to the current all-time high 31.6% of shares outstanding. This new ramp in short interest comes after an initial bear raid on the firm which saw short sellers cover a majority of their positions after Merrimack shares rallied after its ONIVYDE product came to market.

Merrimak’s rapid rise in short interest leading up to earnings is eclipsed by its peer Dynavax Technoligies which has seen its short interest shoot up by over 50% in the month leading up to earnings, Dynavax’s most recent surge in in short interest was triggered back in September after news that the FDA was seeking more information regarding its HEPLISAV-B vaccine application which sent Dynavax shares down sharply.

Looking beyond pharmaceuticals, we see perennial short J C Penney make the heavily shorted list with 17% of the retailer’s shares out on loan. J C Penney’s persistently high short interest comes despite a fairly buoyant set of Q2 earnings which saw the company reaffirm a 3-4% expected revenue gain for the year.

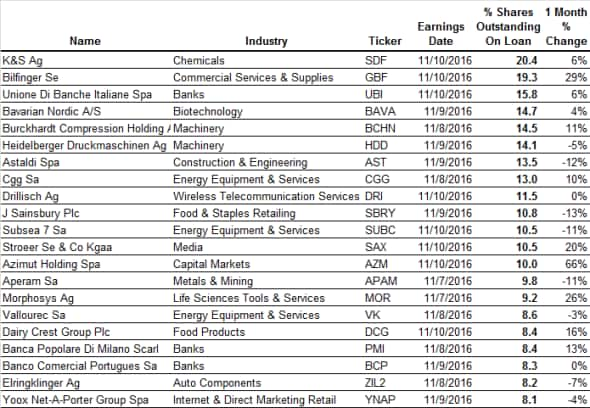

Europe

The key European target for bears among companies announcing earnings this week is German minerals firm K&S which has over 20% of its shares out on loan to short sellers. K&S’s high short interest reflects the ongoing weakness in the Potash Market which has forced its competitors to merge after a sharp fall in profits.

Peripheral European banks are also on the short target list this week as investors fret about the level of bad debt on the balance sheet of these companies. The targets this week include Unione Di Banche Italiane Spa, Banca Popolare Di Milano Scarl and Banco Comercial Portugues Sa, which have all seen a rise in demand to borrow in the month leading up to earnings.

The most shorted UK name announcing this week, grocer Sainsbury’s, has seen a sharp decrease in demand to borrow its shares; dropping to a two year low as the crippling pound sets to kick-start UK inflation which could boost the company’s turnover.

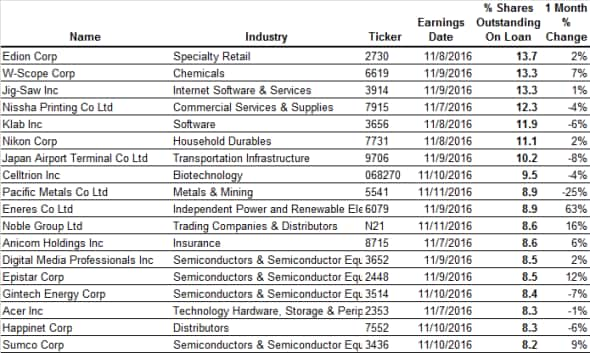

Asia

Household technology retailer Edion leads the Asian short targets announcing earnings this week as 13.7% of its shares out are out on loan. Retailers such as Edion have struggled in the wake of weak Japanese consumer spending figures, which have made retailers some of the most popular short targets in the region.

The largest short target in terms of market cap is Korean biotech Celltrion which has 9.5% of its $10bn plus market cap shorted. It’s worth noting that a part of this heavy demand to borrow could be non-directional, owing to the fact that the firm has a $300m convertible bond issue outstanding.

Commodities trading house Noble also makes the list of heavily shorted stocks ahead of earnings as it has seen a 16% rise in demand to borrow its shares in the last month. This most recent surge in short interest takes the demand to borrow Nobel shares to the highest level since the company closed a rights issue in August.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}