Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 08, 2017

Bank bulls continue unchecked

Banks on both sides of the Atlantic have been at the vanguard of the recent bull market and investors are betting that the trend will continue.

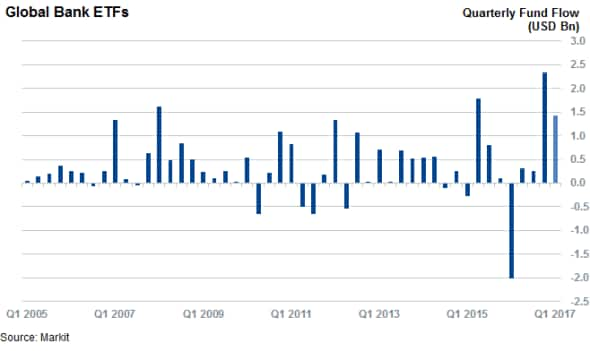

- Banks ETFs continue see strong inflows after registering largest quarterly inflow in Q4 2016

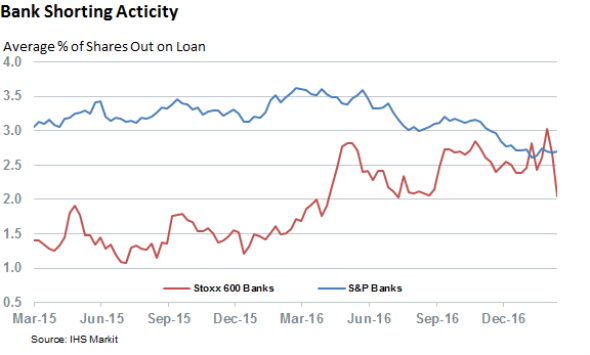

- Short sellers have covered heavily in both US and European financials

- Growing portion of shorting activity driven by corporate actions

US and European financials have been some of the biggest beneficiaries of the recent market rally and investors have been eager to grab a piece of the action. Bank ETFs, which experienced their largest quarterly on inflow on record over Q4 of last year, have continued to see strong inflows on the other side of the New Year as investors have ploughed $1.4bn into the 64 ETFs that track banks globally. While it's still too early to tell, the current quarter's inflows could match the record $2.3bn set last quarter which would further extend what is already a record breaking streak for global bank ETFs.

These strong inflows haven't occurred in a vacuum as banks, which have had a torrid last decade, have seen their shares surge over the last five months as global growth picked up pace. In fact the largest US and European bank ETFs, the SPDR S&P Bank ETF and the iShares EURO STOXX Banks have outperformed their wider domestic market peers by 26% and 21% respectively since the end of September.

Central banks, which have hurt banking profitability thanks to a decade of ultra-low interest rates, have also played their roles in this rally as the hawkish tone set by the Fed has seen US investors rush to bank shares in anticipation that interest rate normalization would lift bank profits. European banks have been boosted by the region's growing economic momentum and receding threat of deflation which has taken the prospects of further monetary easing off the agenda.

Bullish investor sentiment towards the banking sector is further evidenced by the fact that the four funds which have attracted the largest inflows so far this year invest in regional and community banks. These banks tend to relatively smaller players which disproportionally benefit from a lift in operating conditions.

More room to run?

In a theme that has been repeated throughout recent months, both European and US short sellers have shown no appetite to call the top of this runaway bank bull run as shorting activity in across both groups of shares has atrophied in recent months. US banks which make up the S&P Bank index have seen a 17% fall in average shorting activity since the end of September and now have the lowest average demand to borrow out of any period in over two years. Short covering among their European peers has been even more drastic as these firms have seen their average shorting activity fall by over a quarter in the last five months.

The decreasing appetite to sell the sector short is arguably driven by disparaged bears some of the highest conviction short plays in the sector have also been caught up in the bull stampede. One such name is People's United Financials, which was the target of the most fervent demand to borrow its shares at the start of the bull rally. Its shares have rallied by over a quarter to the highest level since before the financial crisis which has prompted short sellers to trim their positions by over a quarter.

The compositions of short sellers has also likely changed in the wake of several mergers in the sector which means that a growing portions of the demand to borrow bank shares is not likely to be directionally driven. This is definitely the case in the second and third most shorted banks, United Bankshares Inc and F.N.B. Corp which are currently in the process of acquiring firms though all share transactions which attract the most arbitrage activity.

Arbitrageurs have also been active in Europe where Unicredit's capital raising efforts meant that over 20% of its shares were out on loan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Bank-bulls-continue-unchecked.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Bank-bulls-continue-unchecked.html&text=Bank+bulls+continue+unchecked","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Bank-bulls-continue-unchecked.html","enabled":true},{"name":"email","url":"?subject=Bank bulls continue unchecked&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Bank-bulls-continue-unchecked.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+bulls+continue+unchecked http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Bank-bulls-continue-unchecked.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}