Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 08, 2015

Investor sentiment favours Eurozone despite 'Grexit' fears

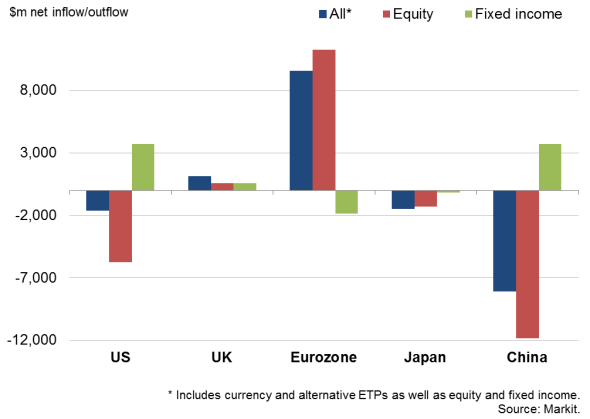

Investors clamoured for greater exposure to euro area equities in the second quarter, according to exchange traded fund (ETF) data from Markit, shunning the US, China and Japan.

Sentiment favours Eurozone

Eurozone equity ETFs saw net inflows of $11.3bn in the second quarter, taking the total for the year to date to some $38.7bn. Fixed income funds for the region have likewise seen net inflows in the year to date, but record inflows of $6.9bn in the first quarter have been offset by a $1.8bn outflow in the second quarter.

The influx of investment funds into the eurozone so far this year represents a combination of signs that the region is at last seeing a sustainable-looking economic upturn, as well of course as the instigation of quantitative easing by the ECB. The latter is likely to have led to a surge in inflows into bond markets earlier in the year which, amid signs of deflation not taking hold to an extent that many, including the ECB, had feared, then led to a pull-back in the second quarter.

Eurozone equity and fixed income ETFS are enjoying further net inflows in July so far, with sentiment buoyed by survey data showing economic growth to have reached a four-year high, as well as - at the time of writing - few signs of the Greek crisis spreading to other 'peripheral' countries.

Not only did Markit's Eurozone PMI data for June signal the strongest expansion for four years, the survey also showed job creation running at a four-year high, boding well for the sustainability of the upturn and a reduction in the region's double-digit unemployment rate. GDP therefore looks set to rise at a robust pace again in the second quarter, after having increased by 0.4% in the first quarter.

Exchange traded fund flows, Q2 2015

UK funds see further net outflows

The UK has likewise seen net inflows in both the first and second quarters of this year, with equity funds seeing inflows of $1.4bn and fixed income funds attracting a net $1.0bn over the first six months of the year. July has seen ongoing inflows into both equities and bonds. The UK continues to appeal to investors due to signs that the economy looks set to grow by perhaps 2.5% this year, but policy is unlikely to be tightened any time soon.

US growth jitters lead to volatile fund flows

ETFs exposed to US equites meanwhile saw net outflows for a second consecutive quarter in the three months to June, albeit the $17.8bn withdrawal so far this year is still dwarfed by the $103bn inflow seen in the final quarter of last year. The outflows coincided with a deterioration in the US economy's performance, with GDP having declined slightly in the first quarter. However, recent weeks have seen net inflows resume into US equity funds (June in fact saw $10.3bn inflows and the positive trend has continued into July) as investors have soaked up brighter news on the economy, including signs that GDP is likely to have rebounded convincingly in the second quarter and employment growth remains impressive.

However, signs of US growth fading again, linked to earnings being hit by the strong dollar, may soon mean the inflows are reversed again if indications of slower growth are sustained in coming month.

China market suffers sell-off

Investors have also taken a wary approach to Chinese equity-exposed EFTs, which have seen net outflows totalling $11.8bn in the second quarter, building on a $9.0bn outflow in the first three months of the year. The withdrawals most likely reflect the combination of concerns about equity markets being overvalued and weak economic growth. PMI survey data point to a further deterioration in the manufacturing sector's performance in June, raising the possibility of GDP growth slowing further from the already-disappointing 7.0% annual pace seen in the first quarter.

Struggling Japanese economy deters investors

Japanese equity EFTS have also seen a net outflow so far this year, with a $0.4bn loss in the first quarter followed by a further $1.3bn in the three months to June. Investors have become worried that the economic recovery lacks sufficient momentum to sustain itself, let alone reignite inflationary forces. Survey data indicated only modest growth again in June, with manufacturing struggling despite the weakened yen, and set for a renewed decline in the second quarter. The data suggest policymakers may need to do more to reinvigorate the recovery, which is potentially one of the factors behind a movement into fixed income ETFS in the second quarter, as investors front-run further quantitative easing.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-economics-investor-sentiment-favours-eurozone-despite-grexit-fears.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-economics-investor-sentiment-favours-eurozone-despite-grexit-fears.html&text=Investor+sentiment+favours+Eurozone+despite+%27Grexit%27+fears","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-economics-investor-sentiment-favours-eurozone-despite-grexit-fears.html","enabled":true},{"name":"email","url":"?subject=Investor sentiment favours Eurozone despite 'Grexit' fears&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-economics-investor-sentiment-favours-eurozone-despite-grexit-fears.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investor+sentiment+favours+Eurozone+despite+%27Grexit%27+fears http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-economics-investor-sentiment-favours-eurozone-despite-grexit-fears.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}