Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 08, 2016

Week Ahead Economic Overview

With markets still unsettled following the UK's EU referendum, the Bank of England announces whether or not it will introduce fresh stimulus in an attempt to help shore up confidence. Analysts will meanwhile also be watching US industrial production and inflation figures for guidance on the Fed's next move. Moreover, a raft of economic data, including second quarter GDP numbers is released in China.

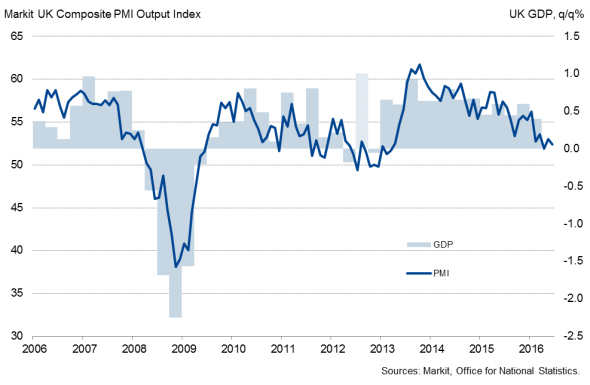

With sterling falling to a 31-year low, economic uncertainty rising and PMI data signalling that the UK economy came to a near-standstill in June, there are clearly some arguments for the Bank of England to cut interest rates from their historic low of 0.5%, when they meet on Thursday. The Bank has already warned that "Brexit risks have begun to crystallise" and that "the current outlook for UK financial stability is challenging".

UK GDP and the PMI

Over in the US, latest minutes from the Fed confirmed that the central bank remained in a wait-and-see position in June, with uncertainty regarding the Brexit vote and an unexpectedly sharp slowdown in job gains in May (the first estimate of a 38k rise was revised down to just 11k) putting any further rate hikes on hold. Over the second quarter as a whole, the average monthly rate of job creation was the weakest since the second quarter of 2012.

Although the Fed stated that it expects to see continued progress towards its inflation target, it is likely that the bank will carefully monitor the data flow in coming months for signs that the US economy is strengthening, before rushing into a next rate hike. Consumer price numbers for June are published by the US Bureau of Labor Statistics on Friday and are predicted to show an uptick to 0.3% (from 0.2% in May).

More information on US consumer and industry trends will be provided by industrial production and retail sales data. Markit's PMI data are signalling meagre GDP growth of around 1% for the second quarter as a whole and analysts will get a clearer picture of economic growth trends when the official data are published on Friday.

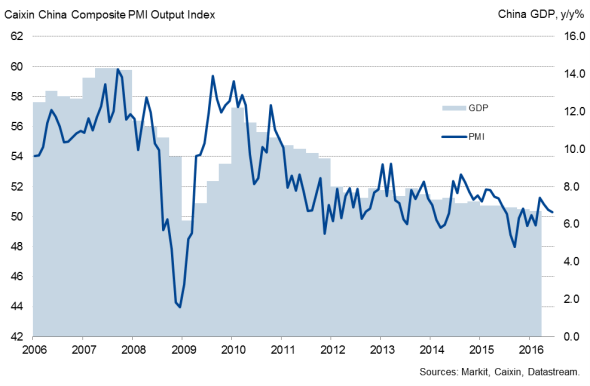

There will be a big focus on China during the week, with inflation, industrial production, retail sales and second quarter GDP numbers released. Markets are expecting GDP growth to have slowed further from the 6.7% in the first quarter to 6.6%. It would be the weakest rise since the financial crisis and add to arguments for more stimulus. Caixin PMI data suggest that while the service sector is growing, industry is struggling under a combination of falling demand, stagnating selling prices and a broad-based downturn in production volumes.

Chinese GDP and the PMI

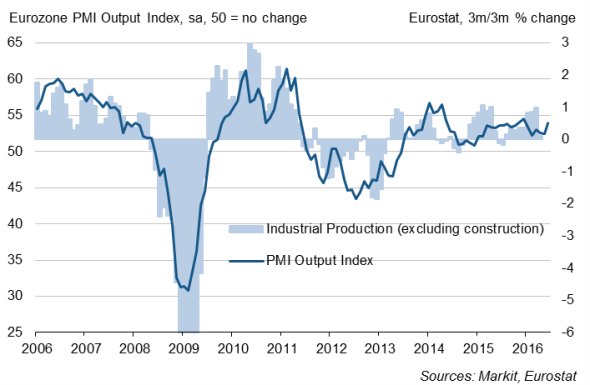

Eurozone policy makers will meanwhile keep an eye on industrial production and trade numbers after latest PMI results pointed to steady though disappointingly lacklustre economic growth in the region. Industrial production rose 1.1% in April, but is expected to decline 0.6% in May. The industrial sector looks like it will struggle to match the first quarter's impressive performance, with national data for Germany already pointing to a marked slowdown. Eurostat releases updated figures on Wednesday.

Eurozone industrial production and the PMI

Monday 11 July

Mortgage lending data are released in Australia.

In India, trade numbers are published.

Industrial production figures are meanwhile updated in Greece and Italy.

UK regional PMI results are published.

Canada sees the release of housing starts numbers.

Tuesday 12 July

In Australia, NAB business confidence data are published.

Corporate goods price numbers are released in Japan.

Industrial output and inflation figures are meanwhile out in India.

Russia sees the publication of trade data.

Manufacturing production numbers are out in South Africa.

Inflation figures are updated in Germany.

The British Retail Consortium releases retail sales data. Moreover, the latest UK Commercial Development Activity Reports is out.

Retail sales figures are also published in Brazil.

In the US, the latest NFIB Index is issued alongside wholesale inventory figures.

Wednesday 13 July

Consumer sentiment data are issued by the Faculty of Economics and Commerce Melbourne Institute in Australia.

Japan sees the release of industrial production figures, while trade numbers are out in China.

Meanwhile, retail sales data are issued in South Africa.

Eurostat releases updated industrial production numbers for the eurozone.

In France, Italy and Spain, inflation figures are published.

The Bank of Canada announces its latest monetary policy decision.

Mortgage data and import price numbers are out in the US.

Thursday 14 July

Australia sees the release of labour market data.

In India, wholesale price numbers are published.

Mining production figures are out in South Africa.

The Bank of England announces its latest monetary policy decision. Moreover, the latest IPA UK Bellwether Report is released.

Economic activity data are published in Brazil.

House price numbers are out in Canada.

In the US, initial jobless claims and producer price figures are released.

Friday 15 July

Second quarter GDP results, industrial output numbers and retail sales figures are all released in China.

In Russia, industrial production data are out.

Eurostat issues inflation and trade numbers for the currency union.

The Office for National Statistics releases updated construction output figures.

Meanwhile, manufacturing sales data are out in Canada.

Industrial production and inflation figures are issued in the US. Moreover, the latest Reuters/Michigan Consumer Sentiment Index is released.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}