Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 08, 2017

French merger mania stirs up dividend pot

French dividends are set to continue to grow despite the furious pace of recent merger activity

- Every firm engaged in merger activity year-to-date expected to stick to dividends

- Danone forecasted to increase its dividend despite paying $12.5bn for competitor WhiteWave

- Rights issues used to fund deals will raise the aggregate amount paid to investors

Please contact press@markit.com to receive a copy of the full French merger dividend report.

In the last four months of this year, French companies produced their most prolific M&A haul in more than a decade. While this newfound swagger is encouraging for France, the country's income focused investors may have less to cheer about. These deals have the potential to disrupt 8% of the aggregate dividends paid by SBF 120 companies.

The complexity and uncertainty surrounding mergers offers management teams the perfect opportunity to rethink dividend policies, and focus on new corporate priorities, such as building up cash reserves, or paying down debt. This shift in priorities could throw a spanner in the works for yield focused investors, as formerly reliable dividend payers put capital redistribution on hold. Dividend disruptions will also potentially impact investors in the acquired companies - particularly those with management teams that favor other uses for excess cash, like share buybacks or further acquisitions.

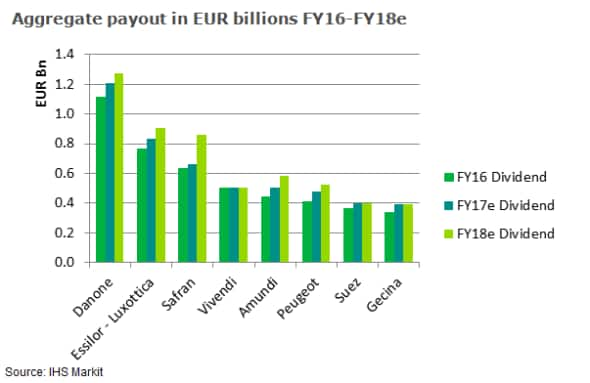

While the flurry of French takeover activity has offered plenty of the aforementioned opportunities, the IHS Markit dividend forecasting team does not expect any of the participants to backtrack on prior dividend commitments. In fact, all but two of the French companies involved in major strategic mergers this year are forecasted to raise their dividend payments over FY17.

Companies sticking to their guns

Danone's acquisition of US competitor WhiteWave back in April has been the most potentially disruptive acquisition to year-to-date. The $12.5bn deal, which was financed entirely by debt, impacted 2% of the total SBF 120 dividends paid. Despite the large sums of cash involved in the deal, Danone kept its commitment of a "constant or growing" dividend. The company is forecasted to grow its dividend by 8% in FY17 and an additional 6% in FY18. The acquisition had some impact on Danone's dividend policy, however, and the company offered investors the opportunity to receive dividends in the form of stock through a scrip option. This option will enable the company to deleverage as it conserves cash.

Mergers, such Technip-FMC and Essilor-Luxottica have the most uncertainty around dividend payments; both offer a clean slate for management to rethink dividend policies. Despite the high potential for dividend surprises, the recent mergers between Ahold and Delhaize, and Lafarge and Holcim, have resulted in "business as usual" policies in terms of dividends.

To this end, the forecast for TechnipFCM's shareholder distribution includes a dividend payout around 20% of net earnings, starting with an initial $0.075 per share payment in Q4 2017.

The pro forma forecast for the Essilor-Luxotica merger is for the merged entity to pay "834m of dividends over FY17. This dividend forecast represents a significant 9% increase on the payments made by each legacy firm in the previous fiscal year.

The rights offerings used to finance REIT Gecina and utility Suez are also set to impact dividend policies going forward. These deals have increased outstanding shares, which means that both companies will have to pay larger sums of cash to keep payments flat. The forecast is that both firms will do so - effectively hiding a respective 15% and 10% increase in aggregate payments based on the increased number of shares.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082017-Equities-French-merger-mania-stirs-up-dividend-pot.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082017-Equities-French-merger-mania-stirs-up-dividend-pot.html&text=French+merger+mania+stirs+up+dividend+pot","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082017-Equities-French-merger-mania-stirs-up-dividend-pot.html","enabled":true},{"name":"email","url":"?subject=French merger mania stirs up dividend pot&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082017-Equities-French-merger-mania-stirs-up-dividend-pot.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=French+merger+mania+stirs+up+dividend+pot http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082017-Equities-French-merger-mania-stirs-up-dividend-pot.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}