Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 08, 2013

M&A news provides diversion

Trans-Atlantic M&A activity shifted attention away from the political impasse in the US, though the diversion is likely to be temporary.

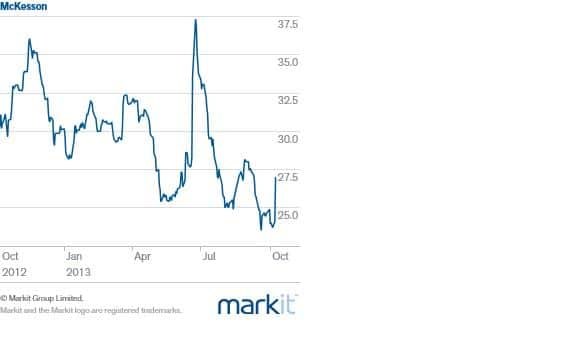

US pharmaceutical distributor McKesson is reported to be in advanced talks to acquire German rival Celesio in a deal potentially worth $5bn. The news received a positive welcome in the equity markets, with Celesio’s shares up 20% and the US firm’s stock up 4.5%.

However, the credit markets were less keen – McKesson’s CDS spreads widened 3bps to 27bps. We don’t know how the deal will be financed - if and when it occurs – so it is difficult to assess how it will affect McKesson’s credit standing.

But, if some of the US firm’s cash is used, along with equity, then the buyout will inevitably raise leverage. The potential balance sheet deterioration will depend on the cash/equity mix, but it should be underlined that McKesson is a strong credit and trades with an AA implied rating, according to Markit data.

In the broader market, spreads continued to drift wider as the deadlock in the US Congress showed no sign of breaking. The Markit iTraxx Europe was 1.5bps wider at 100bps, while the Markit CDX.NA.IG was trading at 83bps, just 0.5bps wider.

The IMF trimmed its global growth forecasts and the European Stability Mechanism issued its inaugural bond – which was oversubscribed – but neither had a significant impact on the market. Perhaps Alcoa ‘s results after the US close will provide a catalyst for spread direction.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102013122624M-A-news-provides-diversion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102013122624M-A-news-provides-diversion.html&text=M%26A+news+provides+diversion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102013122624M-A-news-provides-diversion.html","enabled":true},{"name":"email","url":"?subject=M&A news provides diversion&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102013122624M-A-news-provides-diversion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=M%26A+news+provides+diversion http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102013122624M-A-news-provides-diversion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}